CO DR 1778 2013 free printable template

Get, Create, Make and Sign CO DR 1778

How to edit CO DR 1778 online

Uncompromising security for your PDF editing and eSignature needs

CO DR 1778 Form Versions

How to fill out CO DR 1778

How to fill out CO DR 1778

Who needs CO DR 1778?

Instructions and Help about CO DR 1778

Hey what's up family it is your favorite uncle cousin Tyrone Gregory the self-employed tax go back edit again but today's video I am going to be talking about the all-new 1040 you know 2019 is just a couple of days away and speaking of them and if I don't hear from you or speak to you between now and next year let me wish you your family your business a very prosperous new year 2019 should be the year to break in the dough okay that is what I want you to do in 2019, but I just want to come to you today real quick honor I don't want to be before you long I just want to talk about this new 1040 right so as some of you may know Ana may not have known back in September 2017 there was this big talk about tax reform and how we're going to be able to file our taxes on a postcard and things like that and then in December the President signed the new tax reform bill right the tax cuts and Jobs Act well not surprisingly they actually kept their promise we now have a new 1040, and it's not quite postcard side I mother show it to you here in a second, but it is definitely not quite the postcard size and there are a few things I want you to be aware of and then the first thing is to be aware of this if you file using software if you file using the tax preparer or something like that you really should not see any differences you really should not see any type of noticeable difference or changes in what you file you'll still be able to put the same information and get hopefully the same exact results now for those of you who are the DIY and you really like to be hands-on, and you want to see the changes, and I was going to affect you that's what this video really is just so you can be aware of the new 1040 nothing will throw you off guard nothing will shock you because uncle cousin is bringing it to you right now so let's go ahead and take a look at the new 1040 all right so here we are the new 1040 for 2018 this is the one that is going to be used to file your tax return starting January 1st 2019 and that doesn't mean that you'll be able to file January 1st as a matter of fact as the recording of this video we have no idea when the IRS is going to be opening for file so definitely keep that in mind as there may be a delay as to win you can file your tax return but in any case here it is the new 1040 let's take a look at it and this is what I mean by not so quite postcard size because this is it, and you can see it cuts off from the page here at the bottom, and it picks up again or page 2 of the 1040 years here and cuts off here at the bottom, so it's not quite a full page size, but it's not postcard size either all right, so that's that's it a full view let me scroll back up here to the top, so you can see here it is let me see if I can maybe reduce that and make it smaller zoom out a little there we are, so maybe we can see it in its entirety, so that's it that's the first page of the 1040 in all this glory please Basket it and here it is the second page of...

People Also Ask about

Does Colorado have an e file authorization form?

When can I Efile my Colorado tax return?

How do I submit documents to my tax return?

Can you efile in Colorado?

Can taxes still be Efiled?

Does Colorado have an e-file authorization form?

What is Colorado form 104?

When can I Efile my tax return?

What is an e filer attachment form Colorado?

When can I file 20221 taxes?

When can I eFile my Colorado tax return?

Do I need to attach my federal return to my Colorado return?

When can I file my Colorado state taxes 2022?

Can you eFile in Colorado?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute CO DR 1778 online?

How do I edit CO DR 1778 online?

Can I create an electronic signature for the CO DR 1778 in Chrome?

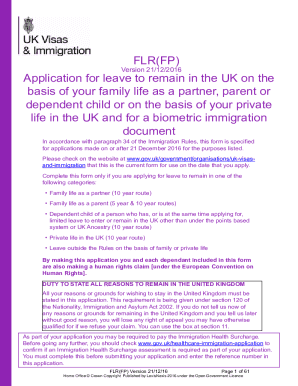

What is CO DR 1778?

Who is required to file CO DR 1778?

How to fill out CO DR 1778?

What is the purpose of CO DR 1778?

What information must be reported on CO DR 1778?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.