Get the free Fiscal Year: Definition, Federal Budget ExamplesFINANCIAL SUMMARY TABLES - U.S. Depa...

Show details

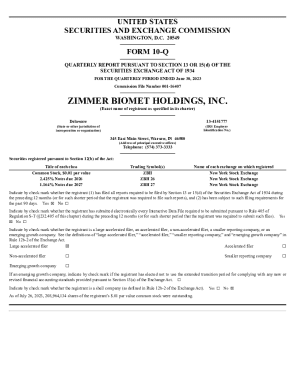

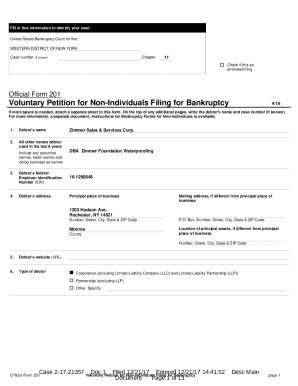

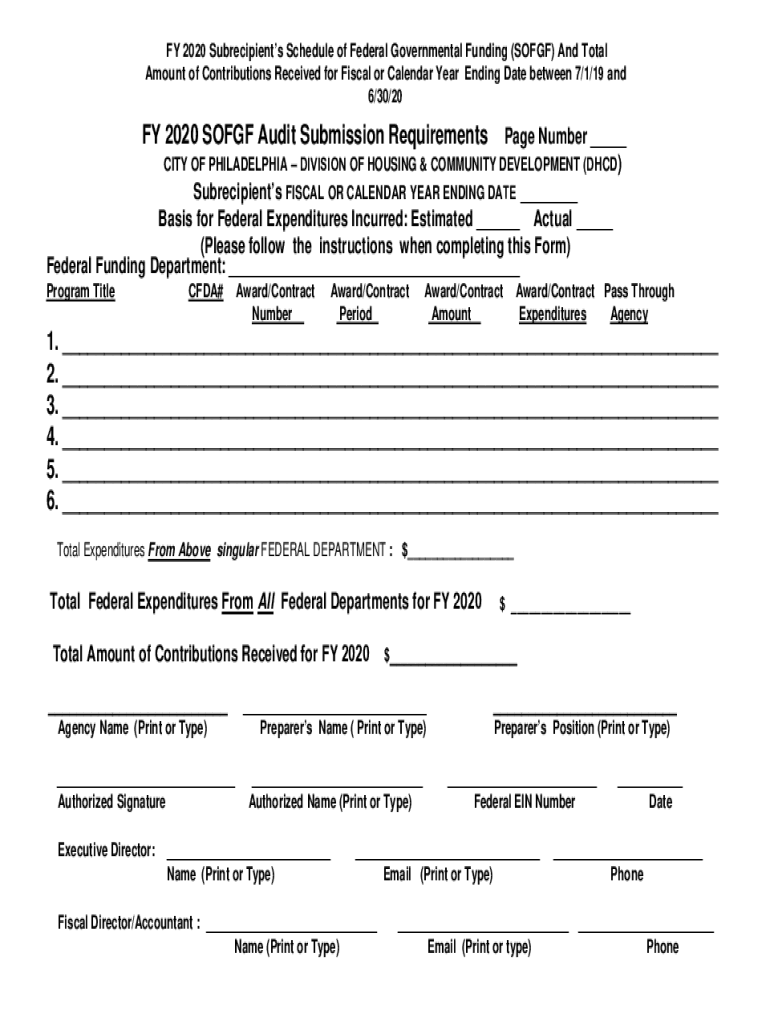

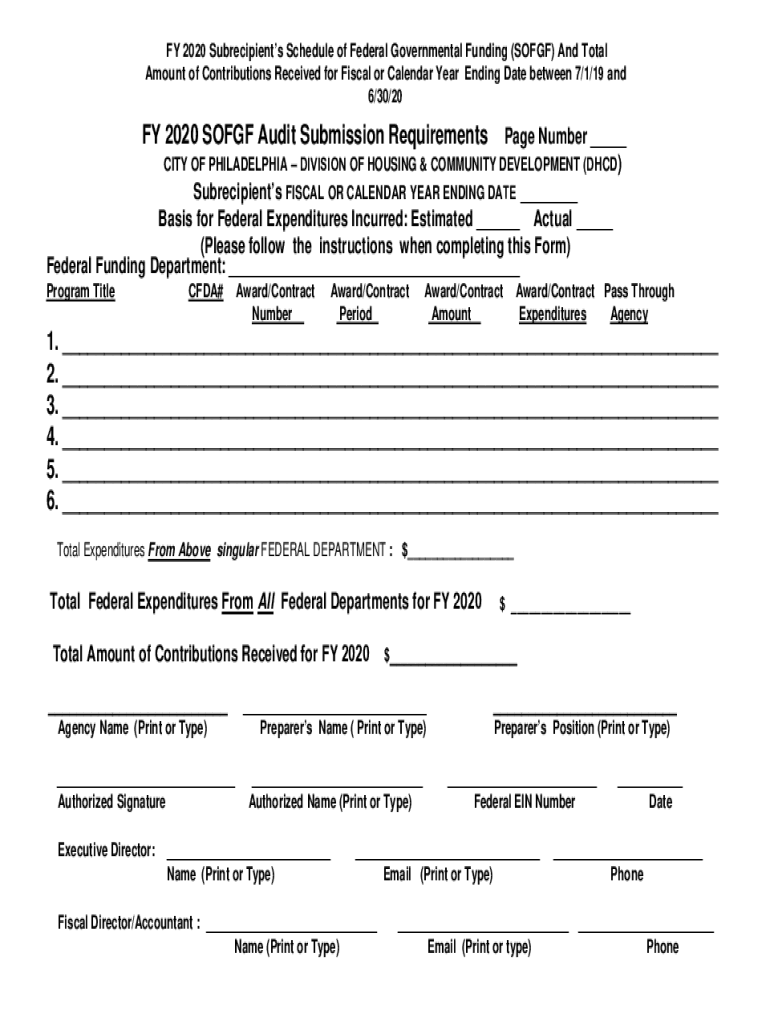

FY 2020 Subrecipients Schedule of Federal Governmental Funding (SO FGF) And Total Amount of Contributions Received for Fiscal or Calendar Year Ending Date between 7/1/19 and 6/30/20FY 2020 SO FGF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal year definition federal

Edit your fiscal year definition federal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal year definition federal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fiscal year definition federal online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fiscal year definition federal. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal year definition federal

How to fill out fiscal year definition federal

01

- Determine the start date and end date of your fiscal year.

02

- Consult the Internal Revenue Service (IRS) guidelines for your specific type of entity (e.g., individual, corporation, partnership) to know the requirements for filling out the fiscal year definition.

03

- Use the appropriate form or online platform provided by the IRS to provide the necessary information about your fiscal year definition.

04

- Enter the start date and end date of your fiscal year as required.

05

- Provide any additional information or explanations required by the IRS.

06

- Review the completed form or online submission for accuracy and compliance with IRS guidelines.

07

- Submit the completed form or online submission to the IRS by the specified deadline.

Who needs fiscal year definition federal?

01

Any individual, corporation, partnership, or other type of entity that is required to file federal taxes in the United States needs to define their fiscal year in accordance with the federal tax regulations.

02

Businesses of all sizes, including small businesses and large corporations, need to define their fiscal year to establish their tax reporting period.

03

Non-profit organizations and tax-exempt entities also need to determine their fiscal year for tax and financial reporting purposes.

04

Individual taxpayers may also need to define their fiscal year if they have specific circumstances that require a non-calendar year reporting period.

05

In summary, anyone subject to federal tax regulations and reporting requirements needs to define their fiscal year as specified by the federal government.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute fiscal year definition federal online?

Easy online fiscal year definition federal completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for signing my fiscal year definition federal in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your fiscal year definition federal directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out fiscal year definition federal using my mobile device?

Use the pdfFiller mobile app to fill out and sign fiscal year definition federal on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is fiscal year definition federal?

A fiscal year in a federal context refers to a one-year period used for accounting and budgeting purposes by the government, which determines the financial cycle for reporting and allocating resources. For the federal government, the fiscal year runs from October 1 to September 30.

Who is required to file fiscal year definition federal?

Organizations, businesses, and entities that operate on a fiscal year basis and need to report their financial activities to the federal government are required to file. This typically includes corporations, non-profits, and government agencies.

How to fill out fiscal year definition federal?

To fill out fiscal year reports, entities must compile financial statements that accurately reflect their income, expenses, and financial position for the period. They must adhere to federal forms and guidelines specific to their type of entity and ensure that all documentation is accurate and submitted on time.

What is the purpose of fiscal year definition federal?

The purpose of a fiscal year is to create a structured timeline for accounting and budgeting, allowing for consistent financial reporting, resource allocation, and strategic planning. It helps in assessing the financial health and performance of entities and aids in governmental oversight.

What information must be reported on fiscal year definition federal?

Required information typically includes detailed income statements, balance sheets, cash flow statements, and any pertinent tax documents. Entities must disclose relevant financial information and any changes in accounting methods or financial conditions.

Fill out your fiscal year definition federal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Year Definition Federal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.