Get the free U.S. Independent Consultant Consultant Number

Show details

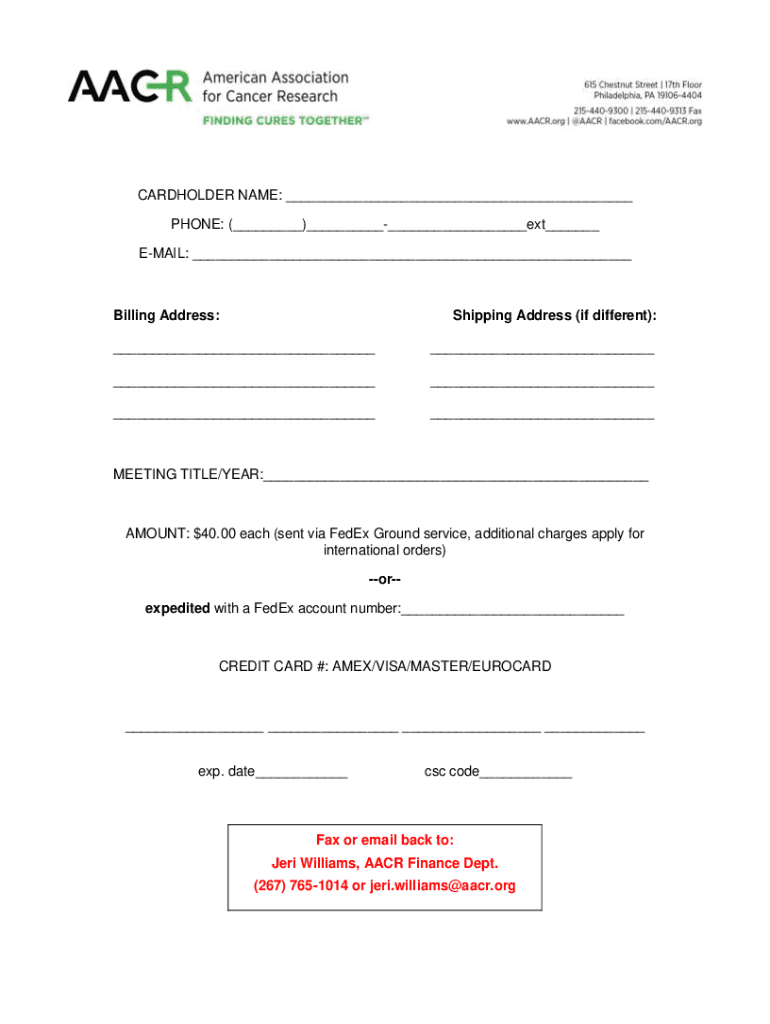

CARDHOLDER NAME: PHONE: () ext EMAIL: Billing Address:Shipping Address (if different): MEETING TITLE/YEAR: AMOUNT: $40.00 each (sent via FedEx Ground service, additional charges apply for international

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us independent consultant consultant

Edit your us independent consultant consultant form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us independent consultant consultant form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit us independent consultant consultant online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit us independent consultant consultant. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us independent consultant consultant

How to fill out us independent consultant consultant

01

Gather all necessary documentation such as identification, tax forms, and business registration documents.

02

Research and understand the requirements and regulations for becoming an independent consultant in the US. This may include obtaining licenses or certifications.

03

Determine your niche or area of expertise as a consultant. This will help you target your services and market yourself effectively.

04

Develop a business plan outlining your goals, target audience, pricing structure, and marketing strategies.

05

Choose a business name and register it with the appropriate authorities.

06

Set up a professional website and create marketing materials to promote your services.

07

Network with other professionals in your industry and attend industry events to build connections and find potential clients.

08

Establish client contracts and agreements to protect both parties involved.

09

Maintain accurate financial records and consult with a tax professional to ensure compliance with tax laws.

10

Continuously update your skills and knowledge in your field to stay competitive and provide valuable expertise to your clients.

Who needs us independent consultant consultant?

01

Individuals or businesses seeking specialized expertise or guidance in a specific field.

02

Startups or small businesses in need of strategic advice or assistance with various aspects of their operations.

03

Companies undergoing organizational changes or restructuring, requiring independent consultants to provide objective insights and recommendations.

04

Government agencies or non-profit organizations seeking outside perspectives and expertise to address specific social or economic challenges.

05

Executives or individuals looking for personal coaching or mentorship to enhance their professional development and decision-making skills.

06

Organizations requiring temporary or project-based support for specific initiatives, such as market research, financial analysis, or process improvement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute us independent consultant consultant online?

With pdfFiller, you may easily complete and sign us independent consultant consultant online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the us independent consultant consultant in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your us independent consultant consultant in seconds.

How can I edit us independent consultant consultant on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing us independent consultant consultant, you need to install and log in to the app.

What is us independent consultant consultant?

A US independent consultant is typically a self-employed individual or a freelancer who provides professional services to clients without being committed to a long-term contract.

Who is required to file us independent consultant consultant?

Independent consultants in the US who earn income from their consulting services are required to file taxes and report their earnings.

How to fill out us independent consultant consultant?

To fill out the tax forms required for independent consulting, individuals must report their income, deduct eligible business expenses, and utilize appropriate schedule forms such as Schedule C or Schedule SE.

What is the purpose of us independent consultant consultant?

The purpose of filing tax forms as an independent consultant is to accurately report income earned, claim potential deductions, and comply with federal and state tax regulations.

What information must be reported on us independent consultant consultant?

Consultants must report total income, business expenses, net profit or loss, and any applicable deductions on the appropriate tax forms.

Fill out your us independent consultant consultant online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Independent Consultant Consultant is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.