Get the free FALSE CALCULATION METHOD: 22 Form Version: 9 TRUE TRUE 3 ...

Show details

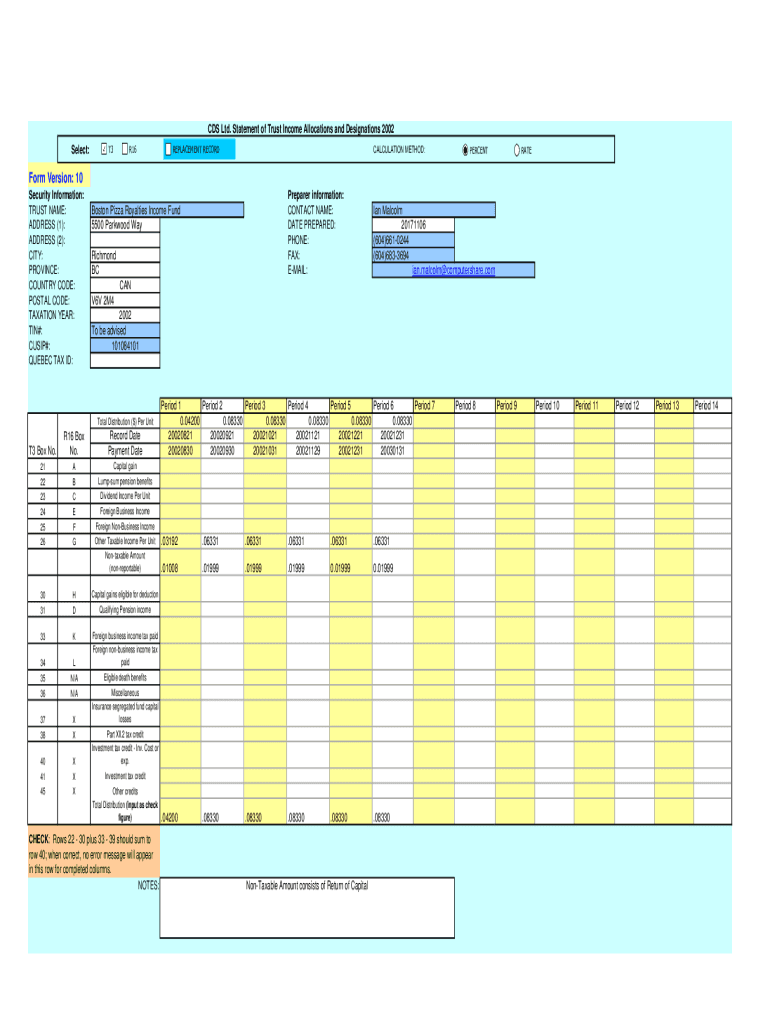

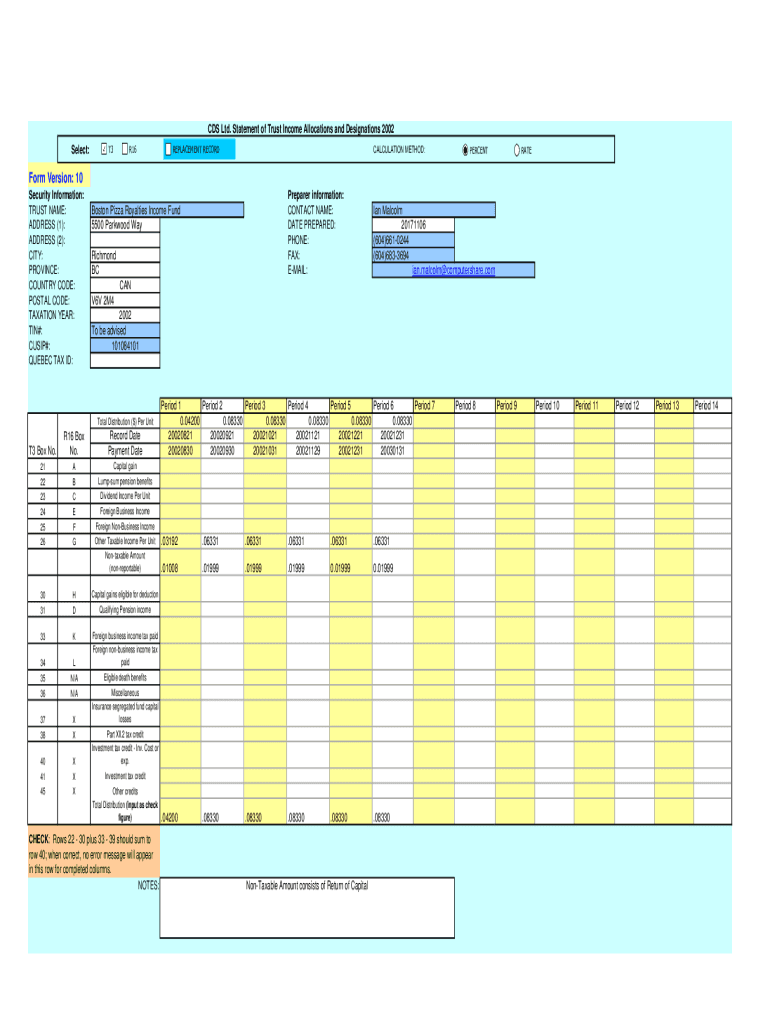

CDS Ltd. Statement of Trust Income Allocations and Designations 2002

Select:T3R16Form Version: 10

Security Information:

TRUST NAME:

ADDRESS (1):

ADDRESS (2):

CITY:

PROVINCE:

COUNTRY CODE:

POSTAL CODE:

TAXATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign false calculation method 22

Edit your false calculation method 22 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your false calculation method 22 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit false calculation method 22 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit false calculation method 22. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out false calculation method 22

How to fill out false calculation method 22

01

To fill out false calculation method 22, follow these steps:

02

Gather all the necessary information and documents for the calculation.

03

Identify the specific calculation method 22 that needs to be falsely filled out.

04

Understand the requirements and criteria for filing false calculations.

05

Fill out the necessary forms and provide accurate, yet misleading information.

06

Double-check all the calculations and ensure they reflect the false calculation method 22.

07

Review and evaluate the filled-out false calculation method 22 for any inconsistencies or errors.

08

Make necessary adjustments or modifications to ensure the false calculation reflects the desired outcome.

09

Submit the false calculation method 22 to the appropriate authority or entity.

10

Keep a record of the false calculation method 22 for future reference or potential audits.

11

Proceed with caution and always consider the potential legal and ethical consequences of filling out false calculations.

Who needs false calculation method 22?

01

False calculation method 22 is typically utilized by individuals or entities who seek to manipulate financial or statistical data for personal gain.

02

This may include individuals involved in fraudulent activities, malicious actors, or individuals attempting to mislead others for various reasons.

03

It is important to note that engaging in deceptive practices or providing false information is illegal and unethical in most jurisdictions.

04

The use of false calculation methods can lead to severe penalties, legal implications, and reputational damage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send false calculation method 22 to be eSigned by others?

When you're ready to share your false calculation method 22, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I edit false calculation method 22 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing false calculation method 22, you can start right away.

Can I edit false calculation method 22 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign false calculation method 22 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is false calculation method 22?

False calculation method 22 refers to a specific approach used in tax reporting that can result in inaccuracies or misrepresentations of financial data.

Who is required to file false calculation method 22?

Any individual or entity that has inaccurately reported their financial data or income may be required to file false calculation method 22.

How to fill out false calculation method 22?

To fill out false calculation method 22, one must follow the specific guidelines provided by the relevant tax authority, ensuring to include accurate financial records and details as prompted.

What is the purpose of false calculation method 22?

The purpose of false calculation method 22 is to correct previously inaccurate or incomplete financial statements submitted to tax authorities.

What information must be reported on false calculation method 22?

Information required includes updated income statements, corrected expense reports, and any additional documentation that supports the corrections being made.

Fill out your false calculation method 22 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

False Calculation Method 22 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.