Get the free Employer Owned Life Insurance - Ash Brokerage

Show details

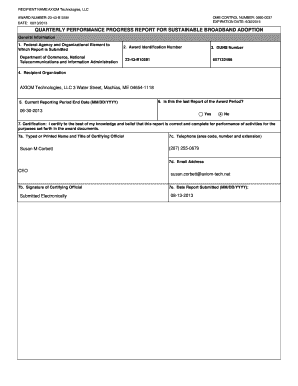

Advisor Guide to IRC 101(j) Compliance AV OI D I N G P O T E N T IA L TA X AT I ON OF EM PLAYER- OW NED LI FE I NS URA N C E Employer Owned Life Insurance Compliance with IRC Sections 101(j) and 6039I

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer owned life insurance

Edit your employer owned life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer owned life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employer owned life insurance online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit employer owned life insurance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer owned life insurance

How to fill out employer owned life insurance:

01

Research your employer's policy: Start by reviewing the details of your employer's life insurance policy. This may include understanding the coverage amount, beneficiaries, and any specific requirements or exclusions.

02

Complete the application form: Obtain the application form for employer-owned life insurance from your HR department or insurance provider. Carefully fill out all the required fields, ensuring accuracy and providing all necessary information.

03

Provide personal details: The application will typically require your personal information, including your full name, date of birth, social security number, and contact details. Make sure to provide accurate and up-to-date information.

04

Specify the coverage amount: Indicate the desired coverage amount based on your needs and your employer's options. This could be a predefined amount or a multiple of your salary.

05

Nominate beneficiaries: State the individuals or entities that you want to receive the death benefit in the event of your passing. You may need to provide their full names, relationship to you, and their contact information.

06

Consent and authorization: Depending on the policy and regulations, you may need to sign forms consenting to the coverage, authorizing your employer to deduct premiums from your paycheck, or allowing any necessary medical examinations.

07

Review and submit: Before submitting the application, carefully review all the information provided to ensure its accuracy. Take note of any required supporting documents, such as proof of age or medical records. Once everything is in order, submit the completed application to the designated HR representative or insurance provider.

Who needs employer owned life insurance?

01

Business owners: Employer owned life insurance can be beneficial for business owners who want to protect their company in case a key employee, such as a founder or high-level executive, passes away. It can provide financial stability to the business during a challenging transition period.

02

Key employees: Employees who play vital roles within a company, such as those with specialized skills or expertise, may be covered under employer owned life insurance. This ensures that the company can withstand the financial impact of their loss and potentially recruit a suitable replacement.

03

Employers offering employee benefits: Employers who provide life insurance as part of their employee benefits package may opt for employer owned life insurance policies. This helps cover the costs associated with providing life insurance to their employees and can provide additional financial security to the company.

04

Large corporations: Larger corporations with a significant number of employees may choose employer owned life insurance to manage the risks associated with death benefits and ensure their financial stability in the event of multiple employee deaths.

05

Businesses with debt obligations: Employer owned life insurance can be used as collateral to secure business loans or manage debt obligations. It acts as a safety net that protects lenders or stakeholders from financial loss if a key employee or business owner passes away.

Overall, the need for employer owned life insurance varies depending on the specific circumstances and goals of the employer. Consulting with a financial advisor or insurance specialist can help determine the suitability and benefits of such coverage for a particular business or individual.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is employer owned life insurance?

Employer owned life insurance is a policy purchased by a company on the life of an employee.

Who is required to file employer owned life insurance?

Employers who have taken out life insurance policies on their employees are required to file employer owned life insurance.

How to fill out employer owned life insurance?

Employers can fill out employer owned life insurance by providing details about the policy, the insured employee, and the beneficiary.

What is the purpose of employer owned life insurance?

The purpose of employer owned life insurance is to provide financial protection to the employer in case of the death of an employee.

What information must be reported on employer owned life insurance?

Employers must report details about the policy, the insured employee, and the beneficiary on employer owned life insurance.

How do I modify my employer owned life insurance in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign employer owned life insurance and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I execute employer owned life insurance online?

With pdfFiller, you may easily complete and sign employer owned life insurance online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out the employer owned life insurance form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign employer owned life insurance and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your employer owned life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Owned Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.