Get the free COMMUNITY FOUNDATION INC

Show details

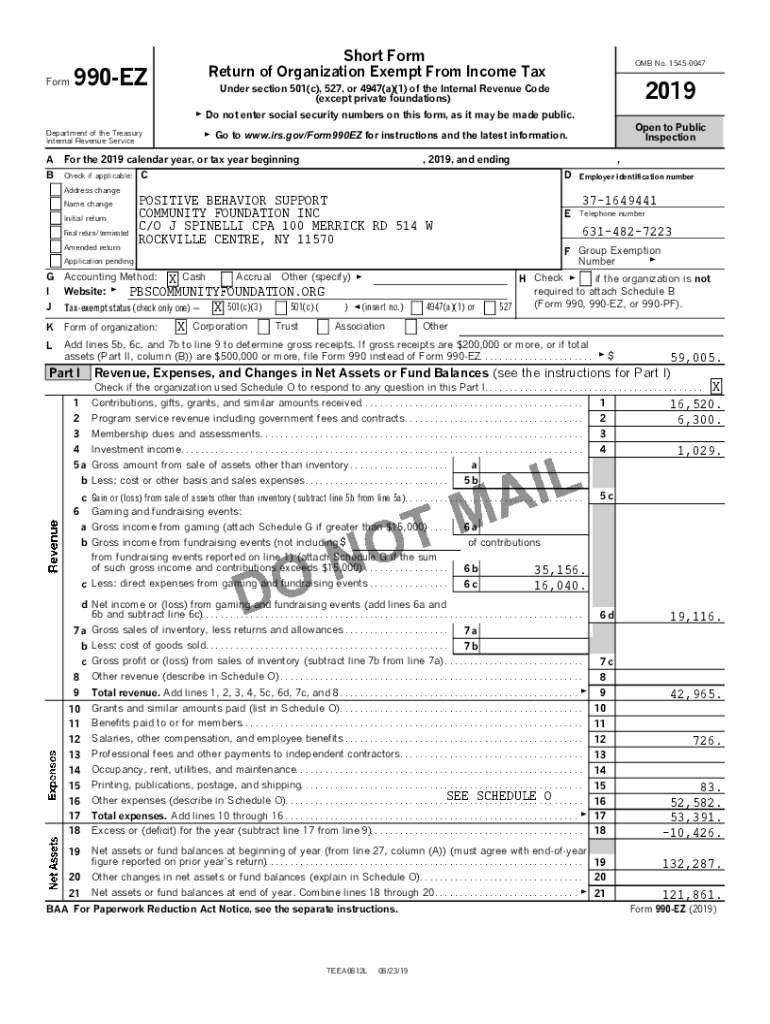

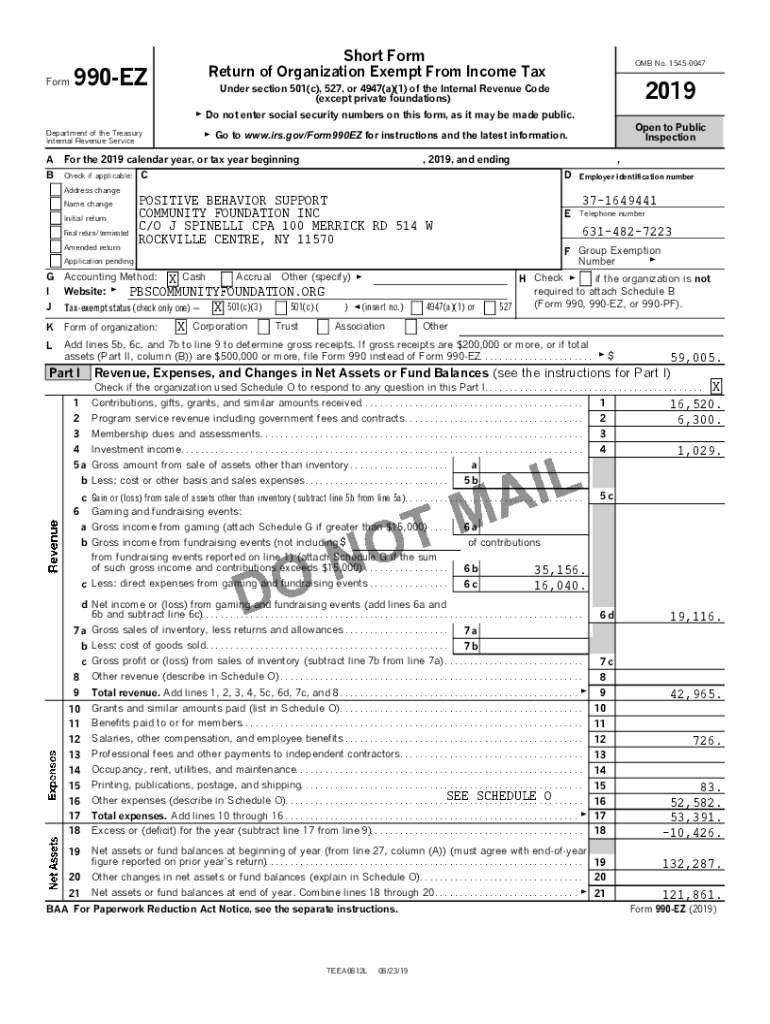

Form990EZShort Form

Return of Organization Exempt From Income Tax OMB No. 154500472019Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code

(except private foundations)

G Do not enter

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign community foundation inc

Edit your community foundation inc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your community foundation inc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit community foundation inc online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit community foundation inc. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out community foundation inc

How to fill out community foundation inc

01

To fill out Community Foundation Inc, follow these steps:

02

Begin by opening the application form for Community Foundation Inc.

03

Fill out the required personal information such as name, address, contact details, and social security number.

04

Provide relevant documentation or content to support your application, such as financial statements, project proposals, or proof of eligibility.

05

Clearly state your goals and objectives for seeking assistance from the Community Foundation Inc.

06

Answer any specific questions or sections in the application form related to your project or funding requirements.

07

Make sure to review your filled application form for accuracy and completeness before submitting it.

08

Submit the filled application form to the designated address or online portal specified by the Community Foundation Inc.

09

Wait for the foundation to review your application and notify you about the next steps.

10

If selected, you may need to provide additional information or attend an interview to further discuss your application.

11

Once approved, follow the instructions provided by the Community Foundation Inc. on how to utilize the granted funds or assistance.

Who needs community foundation inc?

01

Community Foundation Inc can be of great help to various individuals and organizations, including:

02

- Non-profit organizations or charities in need of financial support to carry out their projects or initiatives for the betterment of society.

03

- Individuals or families facing financial hardships and require assistance for essential needs such as education, healthcare, or housing.

04

- Students seeking scholarships or grants to pursue higher education or skill development.

05

- Artists, musicians, or performers looking for funding to support their creative endeavors or career development.

06

- Community development projects or initiatives aiming to improve the quality of life in a specific locality or region.

07

- Social entrepreneurs with innovative ideas and initiatives that require financial support to bring about positive change.

08

- Environmental organizations or initiatives focusing on conservation, sustainable practices, or climate change mitigation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send community foundation inc to be eSigned by others?

When your community foundation inc is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I edit community foundation inc on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit community foundation inc.

Can I edit community foundation inc on an iOS device?

Use the pdfFiller mobile app to create, edit, and share community foundation inc from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is community foundation inc?

Community Foundation Inc. is a nonprofit organization that provides financial and advisory support to charitable initiatives within a specific community, pooling resources from donors to make a greater impact.

Who is required to file community foundation inc?

Community foundations, as nonprofit entities, are generally required to file tax returns with the IRS and any applicable state regulatory bodies, depending on their operational jurisdiction.

How to fill out community foundation inc?

To fill out the forms for Community Foundation Inc., gather the necessary financial data, complete the required forms as per IRS guidelines, ensuring accurate reporting of income, expenses, and charitable distributions.

What is the purpose of community foundation inc?

The purpose of Community Foundation Inc. is to facilitate charitable giving, support various local projects, and enhance the quality of life within the community through grants and funding.

What information must be reported on community foundation inc?

Information that must be reported includes financial statements, details of donations received, amounts granted to charitable causes, and administrative expenses.

Fill out your community foundation inc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Community Foundation Inc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.