Get the free Unemployment for Self-Employed - TN.gov

Show details

PRPUA1A

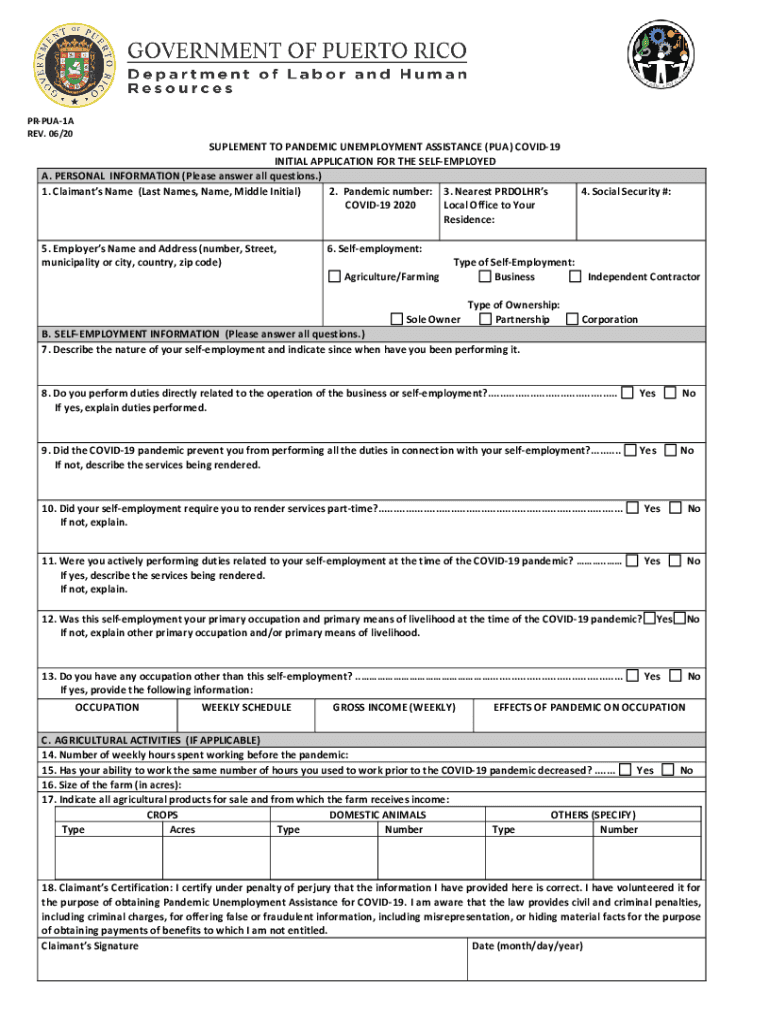

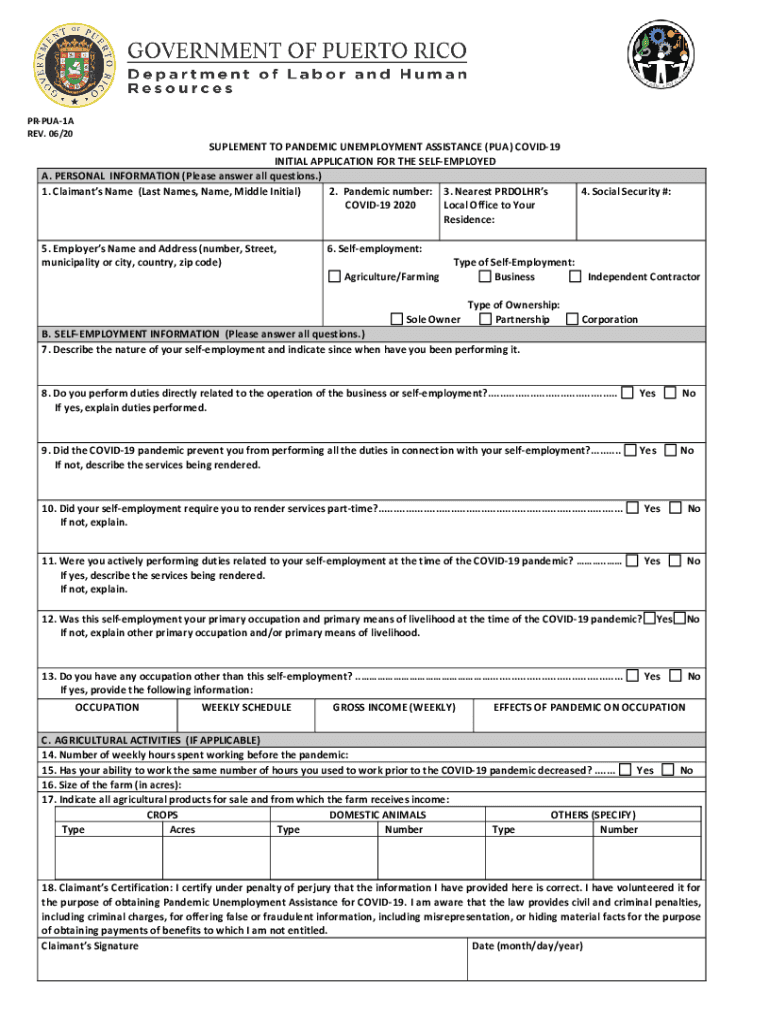

REV. 06/20SUPLEMENT TO PANDEMIC UNEMPLOYMENT ASSISTANCE (PUA) COVID-19

INITIAL APPLICATION FOR THE REEMPLOYED

A. PERSONAL INFORMATION (Please answer all questions.)

1. Claimants Name (Last

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unemployment for self-employed

Edit your unemployment for self-employed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unemployment for self-employed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing unemployment for self-employed online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit unemployment for self-employed. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out unemployment for self-employed

How to fill out unemployment for self-employed

01

Gather all the necessary information and documents, such as your social security number, proof of self-employment income, and tax returns.

02

Visit the website of your state's unemployment agency or the Department of Labor and find the section specifically for self-employed individuals.

03

Create an account or log in to your existing account on the website.

04

Follow the instructions provided to submit an application for unemployment benefits as a self-employed individual.

05

Fill out the application form carefully, providing accurate and detailed information about your self-employment activities, income, and any other required details.

06

Upload and attach any supporting documents requested, such as tax forms, invoices, or proof of business closure, if applicable.

07

Double-check all the information entered before submitting the application.

08

Submit the application and wait for a confirmation or acknowledgment from the unemployment agency.

09

Follow up with any additional information or documentation requested by the agency and promptly respond to any communication regarding your application.

10

Keep track of the progress of your application and any updates provided by the agency.

11

If approved, carefully review the terms and conditions of the benefits offered and any required ongoing reporting or certification requirements.

12

Comply with all the necessary reporting and certification requirements to continue receiving unemployment benefits as a self-employed individual.

13

Keep records of all communication, paperwork, and payments related to your unemployment benefits for future reference and potential audits.

14

If your application is denied, you may have the option to appeal the decision. Follow the instructions provided by the agency to initiate an appeal, if applicable.

Who needs unemployment for self-employed?

01

Self-employed individuals who have lost their source of income and meet the eligibility criteria for unemployment benefits.

02

Those who have been forced to close their self-employed business or have experienced a significant reduction in income due to circumstances beyond their control.

03

Individuals who have paid into the unemployment insurance system through self-employment taxes and meet the specific requirements set by their state's unemployment agency.

04

Self-employed individuals who have registered with the appropriate government agencies as self-employed or business owners.

05

Certain self-employed individuals who are eligible for the Pandemic Unemployment Assistance (PUA) program, which provides unemployment benefits during the COVID-19 pandemic.

06

It is advised to check the specific requirements and eligibility criteria of your state's unemployment agency to determine if you qualify for unemployment benefits as a self-employed individual.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit unemployment for self-employed from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your unemployment for self-employed into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send unemployment for self-employed to be eSigned by others?

When you're ready to share your unemployment for self-employed, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete unemployment for self-employed online?

pdfFiller makes it easy to finish and sign unemployment for self-employed online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

What is unemployment for self-employed?

Unemployment for self-employed individuals refers to the financial assistance provided to those who are self-employed and have lost their income due to circumstances like economic downturns or unforeseen events, allowing them to receive benefits similar to traditional unemployment insurance.

Who is required to file unemployment for self-employed?

Self-employed individuals who have been negatively impacted by a significant loss of work or income may be required to file for unemployment benefits, particularly if they qualify under programs like the Pandemic Unemployment Assistance (PUA) or similar state initiatives.

How to fill out unemployment for self-employed?

To fill out unemployment for self-employed, individuals typically need to gather necessary documentation such as proof of income, business records, and identification, and then complete the application form provided by their state’s unemployment office, detailing their work history and reasons for income loss.

What is the purpose of unemployment for self-employed?

The purpose of unemployment for self-employed individuals is to provide financial support during periods of economic distress or personal hardship, enabling them to cover essential living expenses while they search for new income opportunities.

What information must be reported on unemployment for self-employed?

Self-employed individuals must report their business income, expenses, any work they have undertaken since their income loss, and relevant financial documentation that verifies their eligibility for benefits.

Fill out your unemployment for self-employed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unemployment For Self-Employed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.