Get the free Mortgage Lending Made Easy: 4 Steps to Originating a ... - up mcul

Show details

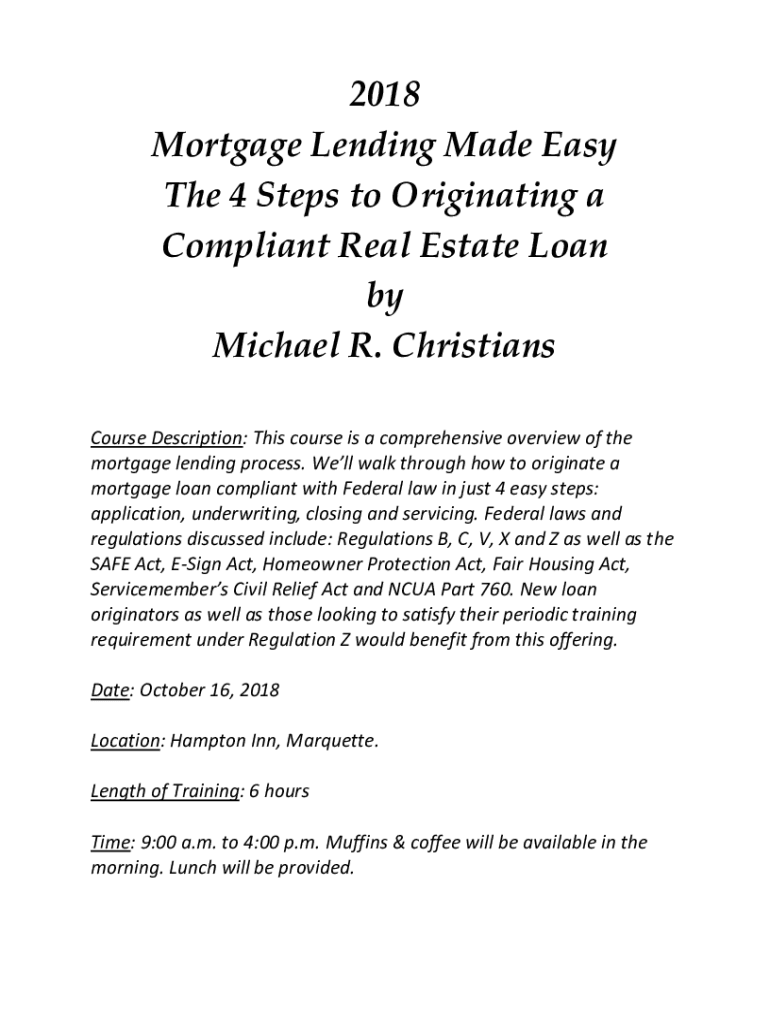

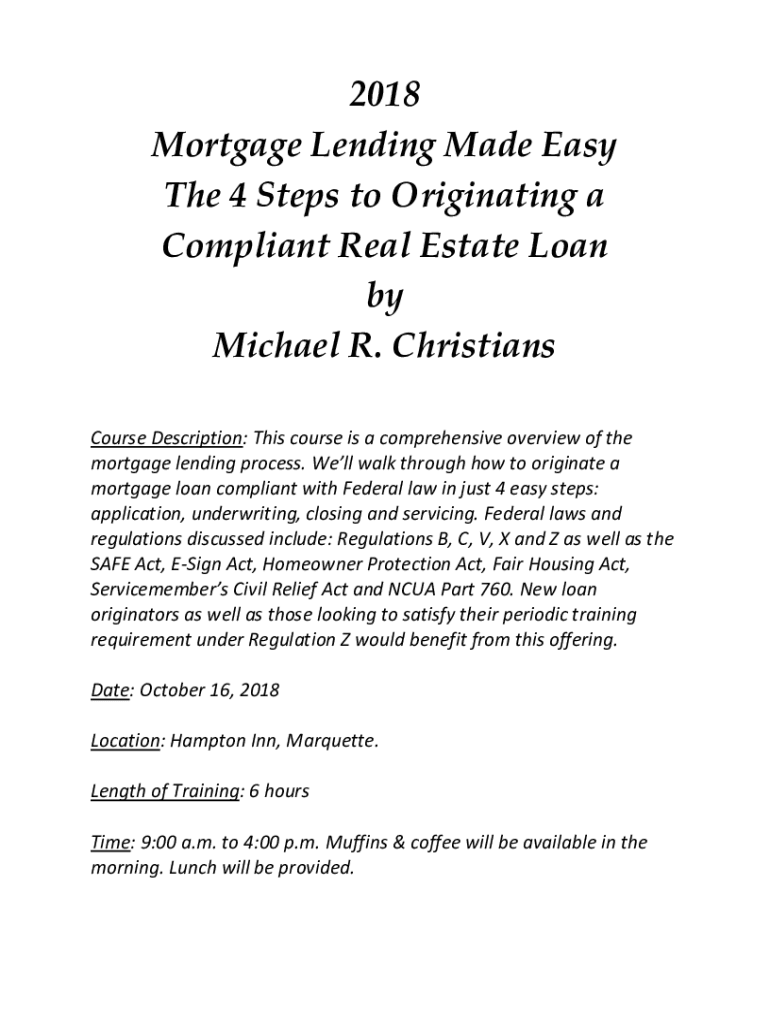

2018

Mortgage Lending Made Easy

The 4 Steps to Originating a

Compliant Real Estate Loan

by

Michael R. Christians

Course Description: This course is a comprehensive overview of the

mortgage lending

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage lending made easy

Edit your mortgage lending made easy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage lending made easy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage lending made easy online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage lending made easy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage lending made easy

How to fill out mortgage lending made easy

01

Gather all necessary financial documents, including proof of income, employment history, and any outstanding debts.

02

Research different mortgage lenders to find the best rates and terms for your financial situation.

03

Use a mortgage calculator to determine how much you can afford to borrow and what your monthly payments will be.

04

Fill out the mortgage application form accurately and provide all required information.

05

Submit the completed application along with the necessary documents to the chosen mortgage lender.

06

Wait for the lender to review your application and provide you with a loan estimate.

07

Review the loan estimate carefully, including the interest rate, fees, and closing costs.

08

If satisfied with the terms, sign the necessary documents and complete any additional requirements from the lender.

09

Prepare for the home appraisal and inspection process, if required.

10

Work closely with the lender to fulfill any additional requests or requirements during the underwriting process.

11

Once the loan is approved, schedule a closing date and review the final loan documents.

12

Attend the closing meeting and sign all necessary paperwork to finalize the mortgage loan.

13

Begin making regular mortgage payments as outlined in the loan agreement.

14

Maintain communication with the lender and stay updated on any changes or updates related to your mortgage.

Who needs mortgage lending made easy?

01

Anyone who is looking to purchase a home or property but does not have enough funds to pay for it in full.

02

Individuals who prefer to finance their home purchase over time rather than paying the full amount upfront.

03

First-time homebuyers who may need assistance and guidance in navigating the mortgage lending process.

04

Existing homeowners who wish to refinance their current mortgage to take advantage of lower interest rates or better terms.

05

People who want to invest in real estate or properties for rental purposes.

06

Individuals or families who want to upgrade to a larger or more suitable home.

07

Those who are relocating and need a new mortgage in their new location.

08

Entrepreneurs or business owners who want to secure a mortgage for commercial or investment purposes.

09

Borrowers who want to consolidate their debts or use their home equity for other financial needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in mortgage lending made easy without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your mortgage lending made easy, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the mortgage lending made easy in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your mortgage lending made easy.

How do I edit mortgage lending made easy on an iOS device?

Use the pdfFiller mobile app to create, edit, and share mortgage lending made easy from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is mortgage lending made easy?

Mortgage lending made easy refers to streamlined processes and simplified documentation for obtaining a mortgage, making it more accessible for borrowers.

Who is required to file mortgage lending made easy?

Lenders and mortgage institutions involved in providing mortgage loans are typically required to file mortgage lending made easy.

How to fill out mortgage lending made easy?

To fill out mortgage lending made easy, complete the designated forms provided by the lending institution, ensuring all required information is accurately entered.

What is the purpose of mortgage lending made easy?

The purpose of mortgage lending made easy is to simplify the mortgage application process, making it more efficient and reducing barriers for borrowers.

What information must be reported on mortgage lending made easy?

Information such as borrower details, loan amount, interest rate, and property information must be reported in mortgage lending made easy.

Fill out your mortgage lending made easy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Lending Made Easy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.