Get the free Are Donations to Colleges Tax Deductible?SaplingDonation Frequently Asked QuestionsD...

Show details

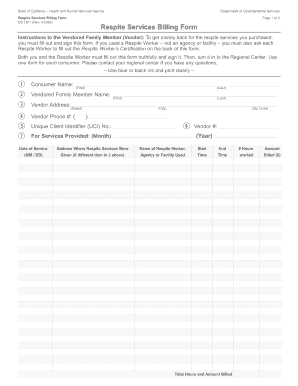

I would like to make a donation in the amount of $ to the American College of Bankruptcy Foundation. My donation is made in Honor of. In Memory of. As a general gift to support the work of the Foundation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign are donations to colleges

Edit your are donations to colleges form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your are donations to colleges form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit are donations to colleges online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit are donations to colleges. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out are donations to colleges

How to fill out are donations to colleges

01

Research the college you are interested in donating to and find out their specific donation process.

02

Contact the college's development or advancement office to inquire about donations.

03

Determine the type of donation you would like to make, such as a monetary donation, equipment donation, scholarship donation, or a donation towards a specific program or initiative.

04

Decide on the donation amount or value and ensure that it aligns with your budget and philanthropic goals.

05

Fill out any required donation forms or paperwork provided by the college.

06

Include any necessary documentation or proof of donation, such as tax receipts or gift acknowledgment forms.

07

Submit your donation to the college according to their preferred method, whether it's online, by mail, or in person.

08

Keep a record of your donation for your own reference and for tax purposes.

09

Follow up with the college to confirm receipt of your donation and express any additional intentions or preferences you may have.

10

Stay connected with the college and find out how your donation is making a difference.

Who needs are donations to colleges?

01

Colleges and universities rely on donations to support various initiatives and activities.

02

The following groups or entities may need donations to colleges:

03

- Students who require financial assistance in the form of scholarships or grants.

04

- Academic departments or programs that need resources, equipment, or funding to enhance educational experiences.

05

- Research institutions within colleges that require funding for groundbreaking research and development.

06

- Athletic programs that rely on donations for facilities, equipment, and coaching staff.

07

- Campus infrastructure and maintenance departments that require funds for ongoing operations and improvements.

08

Ultimately, anyone who believes in the mission and values of a college or university can contribute to their donations and help meet their needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my are donations to colleges in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your are donations to colleges as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in are donations to colleges?

With pdfFiller, the editing process is straightforward. Open your are donations to colleges in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit are donations to colleges on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign are donations to colleges. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What are donations to colleges?

Donations to colleges are contributions or gifts made by individuals or organizations to support the institution's operations, programs, scholarships, or infrastructure.

Who is required to file donations to colleges?

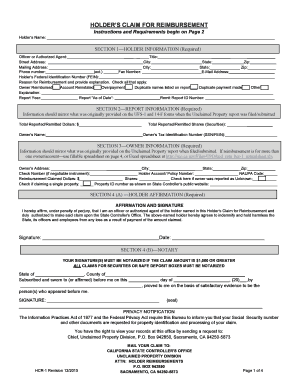

Individuals or entities who make donations to colleges and wish to claim tax deductions for those contributions are required to file the appropriate documentation with their tax returns.

How to fill out donations to colleges?

To fill out donations to colleges, individuals should gather receipts or documentation for their contributions and report them under the charitable contributions section of their tax return, ensuring compliance with IRS requirements.

What is the purpose of donations to colleges?

The purpose of donations to colleges is to provide financial support for educational programs, scholarships, research initiatives, facility improvements, and overall institutional sustainability.

What information must be reported on donations to colleges?

Taxpayers must report the total amount of the donations, the name of the institution, and any necessary receipts or acknowledgments received from the college.

Fill out your are donations to colleges online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Are Donations To Colleges is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.