Get the free 401(k) Plan vs. 457 Plan: Whats the Difference?

Show details

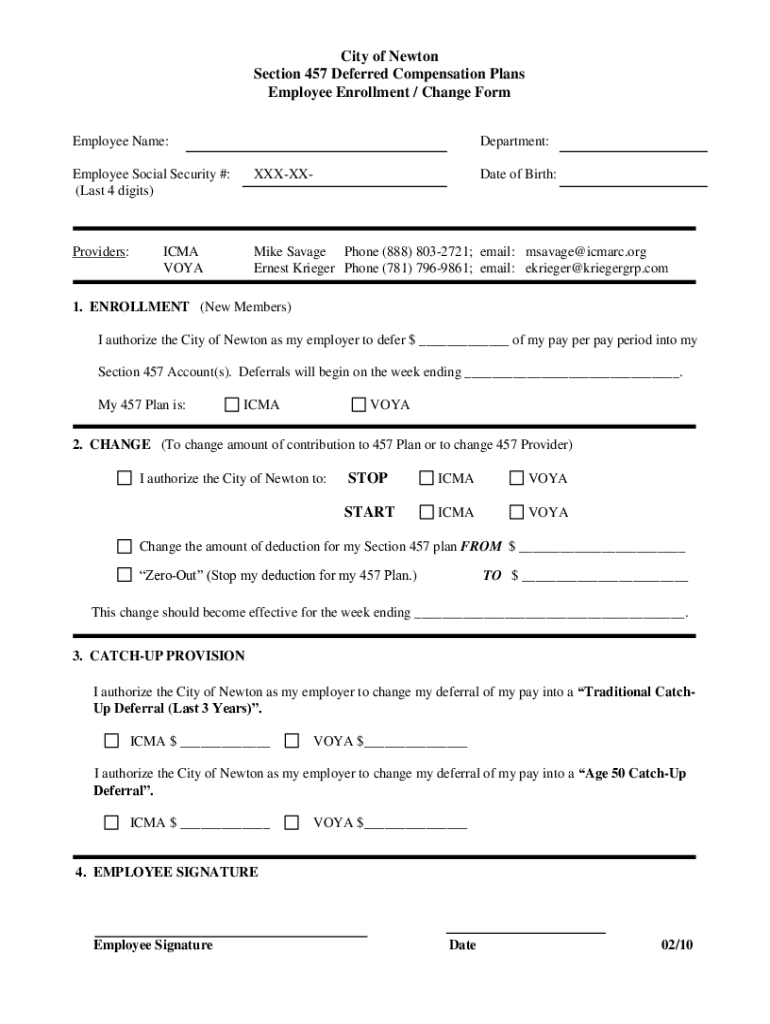

City of Newton Section 457 Deferred Compensation Plans Employee Enrollment / Change Form Employee Name:Department:Employee Social Security #: (Last 4 digits)XXXXXProviders:Mike Savage Phone (888)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401k plan vs 457

Edit your 401k plan vs 457 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401k plan vs 457 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 401k plan vs 457 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 401k plan vs 457. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401k plan vs 457

How to fill out 401k plan vs 457

01

Start by gathering all the necessary documents and information for both the 401k plan and 457.

02

Understand the key differences between the two plans. The 401k plan is typically offered by private employers, while the 457 plan is usually available to state and local government employees.

03

Evaluate the contribution limits for each plan. The 401k plan allows individuals to contribute up to $19,500 (2021 limit), while the 457 plan has a separate limit of $19,500 for elective deferrals.

04

Determine if your employer offers matching contributions for either plan. Some employers match a portion of their employees' contributions, which can significantly boost your retirement savings.

05

Consider the investment options provided by each plan. Both the 401k and 457 plans offer a variety of investment choices, such as mutual funds or target-date funds. It is important to assess these options based on your risk tolerance and investment goals.

06

Research the withdrawal rules for both plans. While the 401k plan imposes a penalty for early withdrawals before the age of 59 and a half, the 457 plan offers more flexibility in this regard, allowing withdrawals without penalty after separation from service.

07

Review any additional features or benefits specific to your employer's plans. Some employers may offer unique features, such as profit-sharing contributions or extra catch-up contributions for older employees.

08

Finally, make an informed decision based on your individual circumstances and financial goals. If you are unsure about which plan suits you best, consider seeking guidance from a financial advisor.

Who needs 401k plan vs 457?

01

Individuals who work for private employers usually need a 401k plan. This plan allows employees to save for retirement through pre-tax contributions, and employers may offer matching contributions to incentivize participation.

02

On the other hand, individuals working for state and local governments usually need a 457 plan. This plan also allows employees to save for retirement through pre-tax contributions, with the advantage of more flexible withdrawal options compared to the 401k plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 401k plan vs 457 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your 401k plan vs 457 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I fill out 401k plan vs 457 using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign 401k plan vs 457. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit 401k plan vs 457 on an Android device?

You can edit, sign, and distribute 401k plan vs 457 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is 401k plan vs 457?

A 401(k) plan is a retirement savings plan offered by an employer that allows employees to invest a portion of their wages in a tax-deferred account. A 457 plan is a type of non-qualified, deferred compensation retirement plan that is available for state and local government employees and some non-profit organizations, allowing them to save for retirement with similar tax benefits.

Who is required to file 401k plan vs 457?

Employers that offer 401(k) plans must file Form 5500 annually, while employers that sponsor 457 plans may have different filing requirements. Generally, both types of plans must adhere to IRS regulations, but specific filing obligations can vary by plan type and structure.

How to fill out 401k plan vs 457?

To fill out a 401(k) or 457 plan, participants need to complete enrollment forms provided by their employer, which typically include personal information, contribution amount elections, and investment choices. Employers will handle the actual plan paperwork for compliance, reporting, and administration.

What is the purpose of 401k plan vs 457?

The purpose of a 401(k) plan is to encourage employees to save for retirement by offering tax advantages and a structured savings option through payroll deductions. The 457 plan serves a similar purpose for government and certain non-profit employees, providing an effective way to save for retirement while allowing for tax-deferred growth.

What information must be reported on 401k plan vs 457?

Employers must report various information on Form 5500 for 401(k) plans, including financial statements, participant counts, and plan assets. For 457 plans, reporting requirements may include details about contributions, investments, and expenses, often dictated by state regulations or plans' policies.

Fill out your 401k plan vs 457 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Plan Vs 457 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.