Get the free Partnership Income TaxDepartment of Taxation

Show details

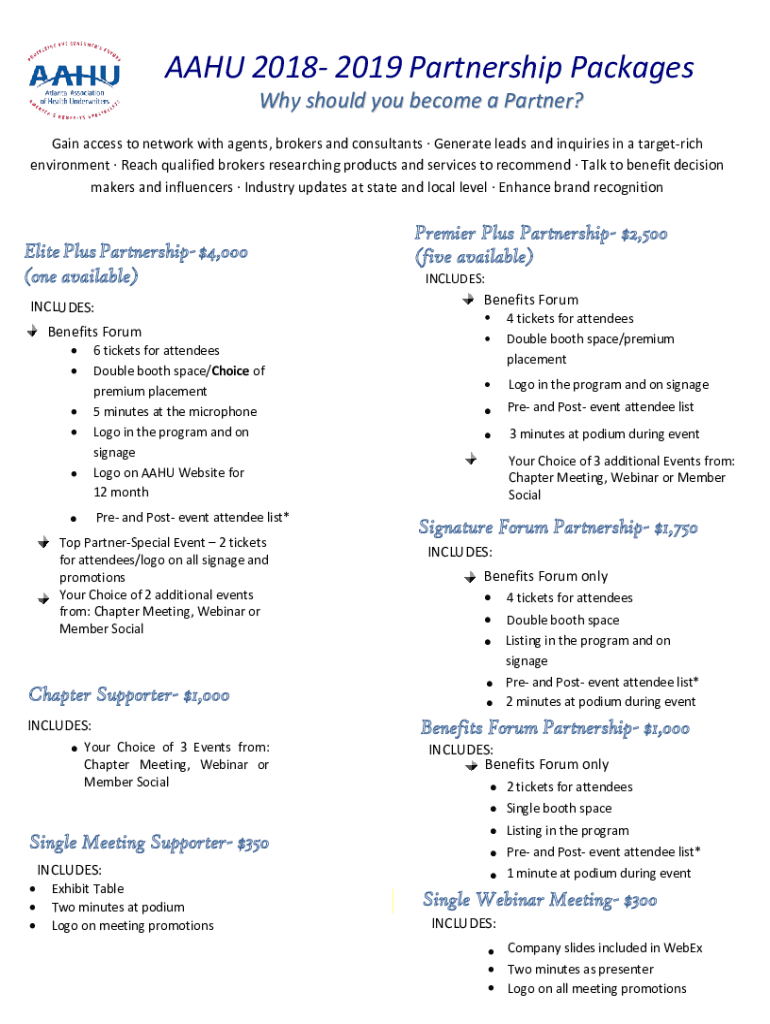

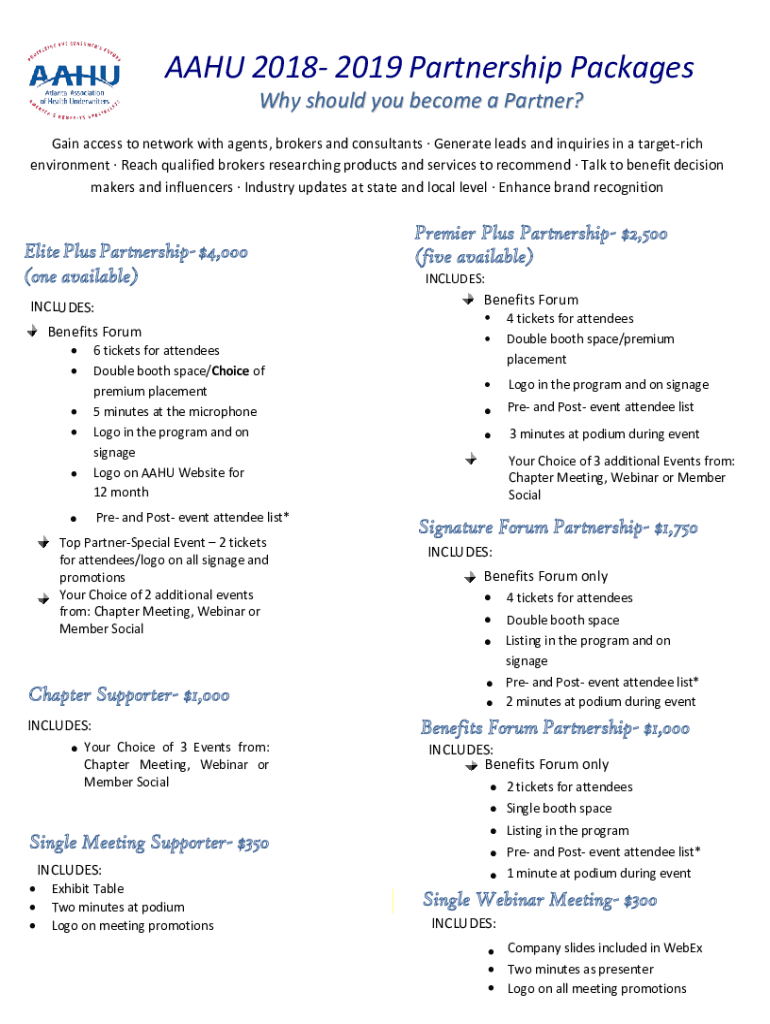

AAU 2018 2019 Partnership Packages Why should you become a Partner? Gain access to network with agents, brokers and consultants Generate leads and inquiries in a target rich environment Reach qualified

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign partnership income taxdepartment of

Edit your partnership income taxdepartment of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your partnership income taxdepartment of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing partnership income taxdepartment of online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit partnership income taxdepartment of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out partnership income taxdepartment of

How to fill out partnership income taxdepartment of

01

Gather all necessary financial documents such as profit and loss statements, balance sheets, and income records for the partnership.

02

Review the tax form specific to partnership income tax, typically Form 1065.

03

Fill out the basic information section of the form, including the name and address of the partnership.

04

Provide information about the partners, such as their names, addresses, and social security numbers or taxpayer identification numbers.

05

Report the partnership's income and deductions in the designated sections of the form.

06

Calculate the partnership's taxable income and apply any applicable deductions or credits.

07

Complete any additional schedules or forms required by the IRS for partnership income tax.

08

Review the completed form for accuracy and make any necessary corrections.

09

Sign and date the form, and attach any required supporting documents.

10

Submit the filled-out form and accompanying documents to the appropriate tax department.

11

Keep a copy of the completed form and supporting documents for your records.

Who needs partnership income taxdepartment of?

01

Partnerships and limited liability companies (LLCs) treated as partnerships for tax purposes are required to file partnership income tax returns.

02

Partnerships with at least two partners and a profit motive must file Form 1065 and report the partnership's income, deductions, gains, and losses.

03

Individual partners of a partnership may also need the partnership income tax department to confirm their share of the partnership's income for personal tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my partnership income taxdepartment of in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your partnership income taxdepartment of and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit partnership income taxdepartment of in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing partnership income taxdepartment of and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the partnership income taxdepartment of electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your partnership income taxdepartment of in seconds.

What is partnership income tax department of?

Partnership income tax refers to the tax obligations and filings required for partnerships, which are entities formed by two or more individuals to conduct business together. Each partner typically reports their share of income, deductions, and credits on their individual tax returns.

Who is required to file partnership income tax department of?

Any business that operates as a partnership, including limited partnerships and limited liability partnerships (LLPs), is required to file partnership income tax forms, usually Form 1065 in the United States.

How to fill out partnership income tax department of?

To fill out the partnership income tax form, first gather financial information about the partnership, including income and expenses. Then complete Form 1065 by reporting the total income, deductions, and the partners' share of profit or loss. Attach Schedule K-1 for each partner, detailing their share of income, deductions, and credits.

What is the purpose of partnership income tax department of?

The purpose of partnership income tax is to report the income, deductions, gains, and losses of the partnership to the Internal Revenue Service (IRS) and allocate income or losses to each partner based on their respective ownership interests.

What information must be reported on partnership income tax department of?

Partnership income tax filings must report total income, business expenses, gains and losses, distributions to partners, and other relevant financial data. Additionally, each partner's individual distribution of income, losses, deductions, and credits must be detailed in Schedule K-1.

Fill out your partnership income taxdepartment of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Partnership Income Taxdepartment Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.