Get the free Venture Capital, Private Equity and M&A DatabasePitchBook

Show details

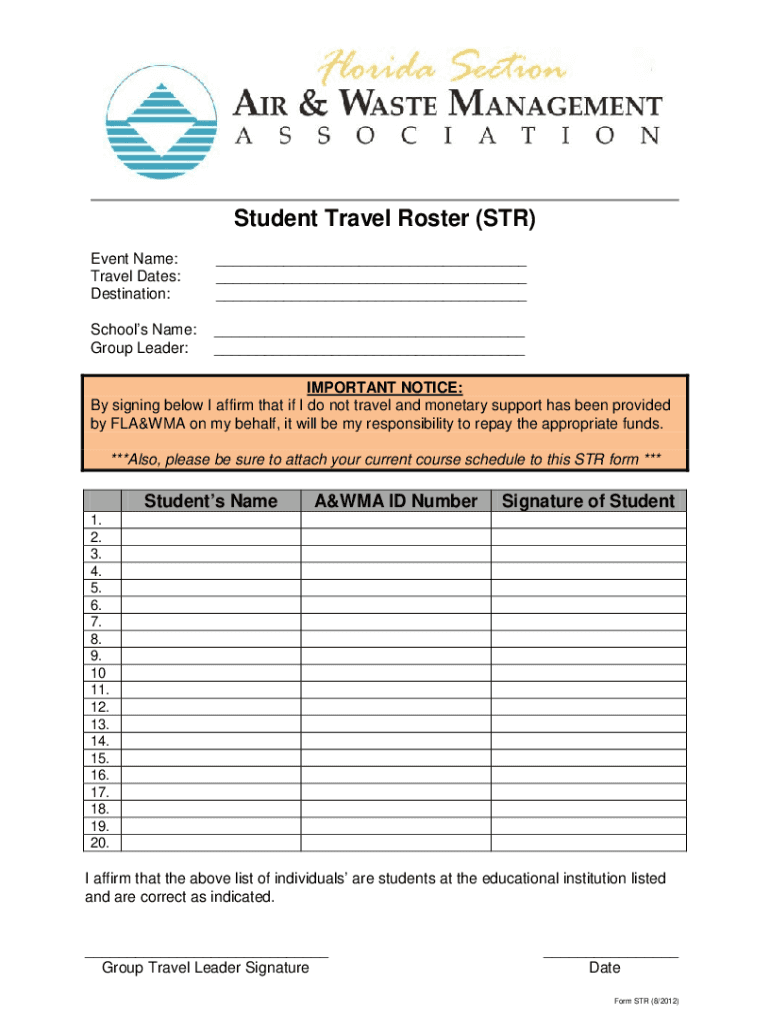

Student Travel Roster (STR) Event Name: Travel Dates: Destination: Schools Name: Group Leader: IMPORTANT NOTICE: By signing below I affirm that if I do not travel and monetary support has been provided

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign venture capital private equity

Edit your venture capital private equity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your venture capital private equity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing venture capital private equity online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit venture capital private equity. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out venture capital private equity

How to fill out venture capital private equity

01

Research and identify potential venture capital firms or private equity investors.

02

Prepare a detailed business plan and financial projections to showcase your company's growth potential.

03

Create a compelling pitch deck that highlights your unique value proposition and investment opportunity.

04

Reach out to the venture capital firms or private equity investors and submit your business plan and pitch deck.

05

Attend meetings and presentations with potential investors to discuss your company's financials, growth strategy, and exit plans.

06

Negotiate terms and conditions of the investment, including valuation, ownership percentage, and board representation.

07

Conduct due diligence to allow the investors to assess the risks and potential rewards of investing in your company.

08

Finalize the investment agreement and legal documentation with the chosen venture capitalist or private equity firm.

09

Implement the agreed-upon investment and utilize the funds to fuel the growth of your company.

10

Maintain regular communication and reporting with your investors to provide updates on the company's performance and progress.

Who needs venture capital private equity?

01

Startups and early-stage companies that require capital to fund their growth and expansion.

02

Companies in high-growth industries that need significant capital infusion to scale their operations.

03

Entrepreneurs looking to finance their innovative business ideas and bring them to market.

04

Established companies seeking financial support for mergers, acquisitions, or management buyouts.

05

Businesses in need of capital to fund research and development, product launches, or market expansion.

06

Companies facing financial distress or restructuring that could benefit from an injection of capital.

07

Innovators and inventors who require funding to develop and commercialize their intellectual property.

08

Small and medium-sized enterprises (SMEs) aiming to accelerate their growth and reach new markets.

09

Entities aiming to leverage the expertise and network of venture capitalists or private equity investors to drive business success.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send venture capital private equity for eSignature?

venture capital private equity is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit venture capital private equity straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing venture capital private equity.

Can I edit venture capital private equity on an Android device?

You can edit, sign, and distribute venture capital private equity on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is venture capital private equity?

Venture capital private equity refers to funds that invest in early-stage companies or startups with high growth potential in exchange for equity, providing not just capital but also strategic support to help these companies grow.

Who is required to file venture capital private equity?

Firms managing venture capital funds or private equity funds generally need to file with regulatory authorities depending on their jurisdiction, specifically if they meet certain asset thresholds or investor numbers.

How to fill out venture capital private equity?

Filling out venture capital private equity typically involves submitting forms detailing the fund's structure, investor information, financial projections, and compliance with regulatory standards as required by governing bodies.

What is the purpose of venture capital private equity?

The purpose of venture capital private equity is to provide capital to startups and emerging companies, helping them to grow and scale operations while offering investors the potential for high returns on their investments.

What information must be reported on venture capital private equity?

Information required typically includes details about investments, fund performance, expenses, governance structure, and investor contributions, along with compliance with applicable laws and regulations.

Fill out your venture capital private equity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Venture Capital Private Equity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.