Get the free Deed of Gift - New York State Archives

Show details

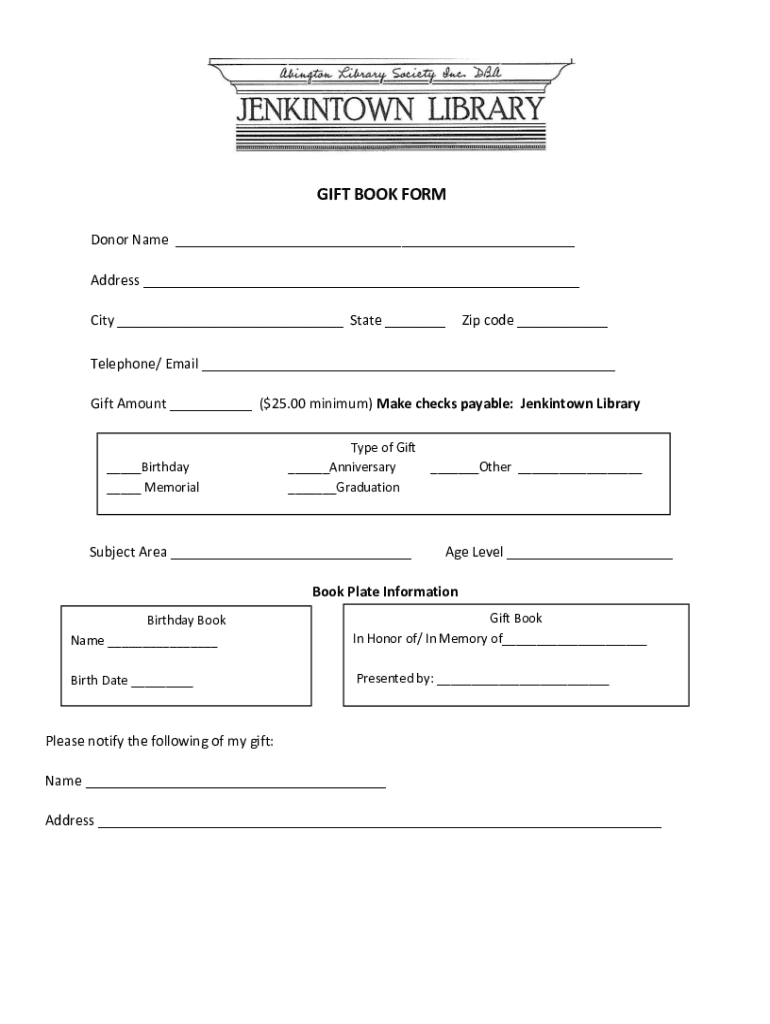

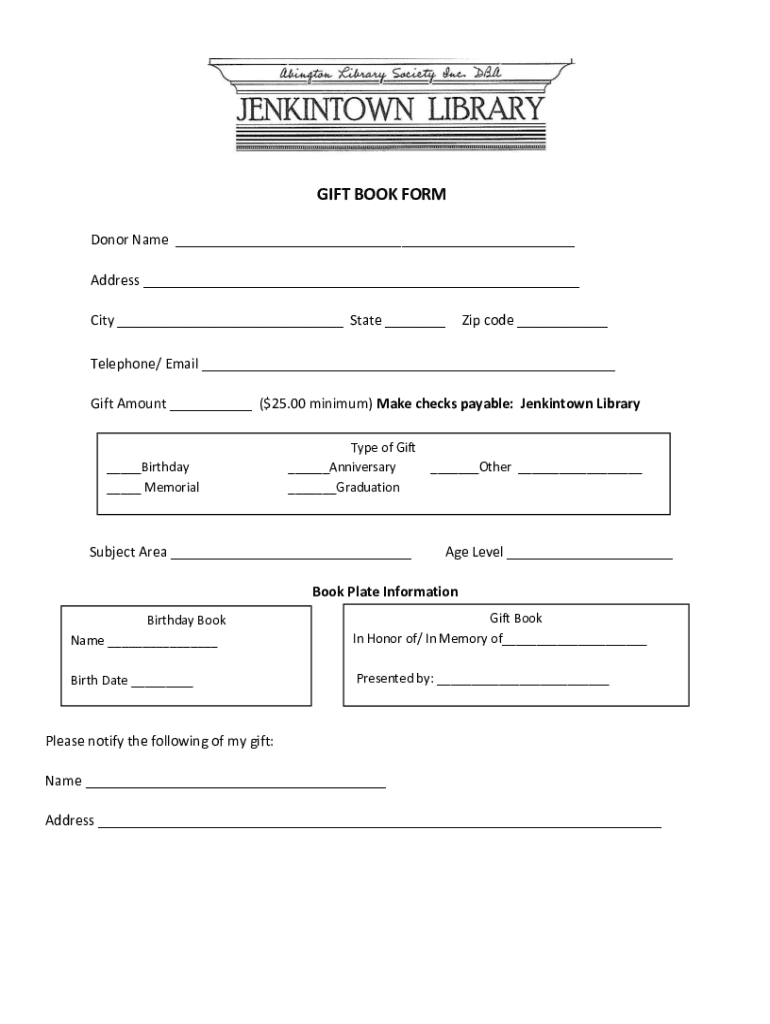

GIFT BOOK FORM Donor Name Address City State Zip code Telephone/ Email Gift Amount ($25.00 minimum) Make checks payable: Jenkintown Library Birthday Memorialize of Gift Anniversary GraduationSubject

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deed of gift

Edit your deed of gift form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed of gift form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deed of gift online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit deed of gift. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deed of gift

How to fill out deed of gift

01

To fill out a deed of gift, follow these steps:

02

Start by including the names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift).

03

Clearly state the details of the gift, including a description of the item or property being given. Be as specific and detailed as possible to avoid any confusion later on.

04

Include any conditions or restrictions on the gift, if applicable. For example, if the gift is a piece of artwork, you might want to specify that it cannot be sold or transferred without permission.

05

Specify whether the gift is being given immediately or if there are any specific dates or conditions for its transfer.

06

Include a statement that the donor is giving up all rights and ownership of the gift and that the recipient will have full control and responsibility for it.

07

Sign and date the deed of gift, and have both the donor and recipient sign it as well. It is advisable to have the document notarized to make it legally binding.

08

Keep a copy of the completed deed of gift for your records.

09

Remember, it's always a good idea to consult with a legal professional to ensure that the deed of gift meets all legal requirements and addresses your specific needs.

Who needs deed of gift?

01

A deed of gift is typically needed in the following situations:

02

- When someone wants to legally transfer ownership of an item, property, or assets as a gift to another person.

03

- When there are specific conditions or restrictions that need to be placed on the gift, such as ensuring that it remains in the recipient's possession or cannot be sold without permission.

04

- When the donor wants to formally document the transfer of ownership and relinquish all rights and responsibilities associated with the gift.

05

- When the recipient wants to establish legal proof of ownership for the gift received.

06

It is always best to consult with a legal professional to determine if a deed of gift is necessary and to ensure that it is properly drafted and executed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify deed of gift without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including deed of gift. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete deed of gift online?

Easy online deed of gift completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for the deed of gift in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your deed of gift in seconds.

What is deed of gift?

A deed of gift is a legal document that allows a person to transfer ownership of property or assets to another person as a gift without any exchange of payment.

Who is required to file deed of gift?

Generally, the donor (the person giving the gift) is required to file a deed of gift if the gift exceeds a certain value threshold established by the IRS.

How to fill out deed of gift?

To fill out a deed of gift, provide the names and addresses of the donor and recipient, describe the property being gifted, include the date of the gift, and sign the document in the presence of a witness or notary if required.

What is the purpose of deed of gift?

The purpose of a deed of gift is to legally document the transfer of ownership of property or assets from the donor to the recipient, ensuring clarity and legal recognition of the gift.

What information must be reported on deed of gift?

The information that must be reported includes the names and addresses of the donor and recipient, a detailed description of the gifted property, the date of the gift, and the signature of the donor.

Fill out your deed of gift online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deed Of Gift is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.