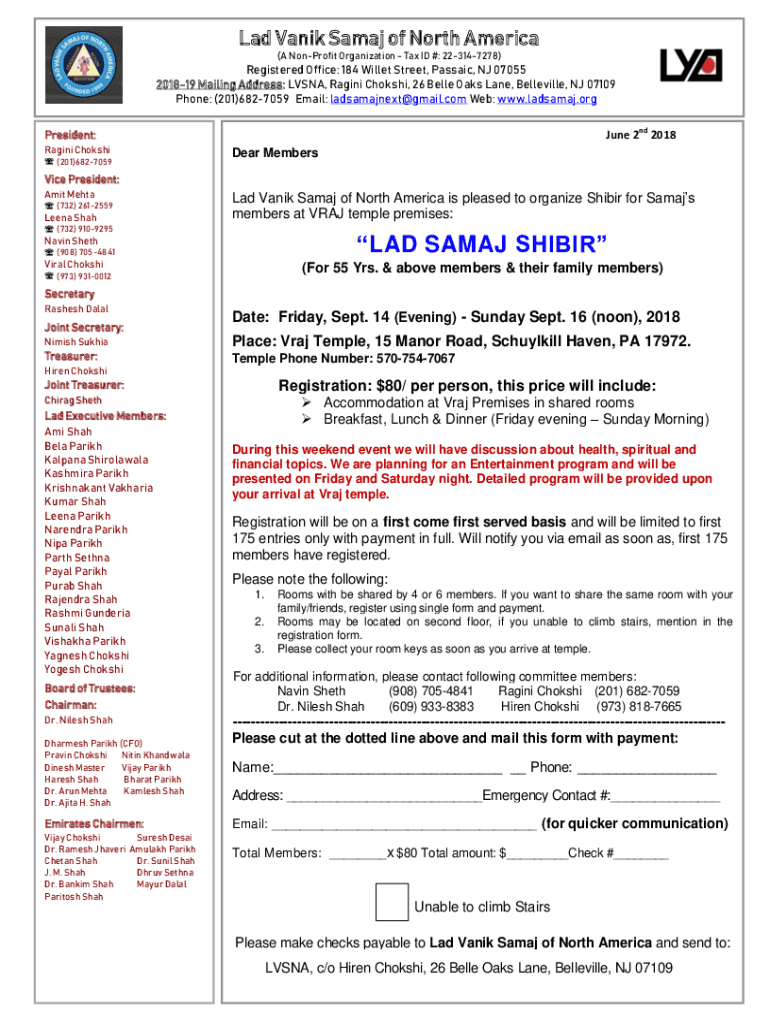

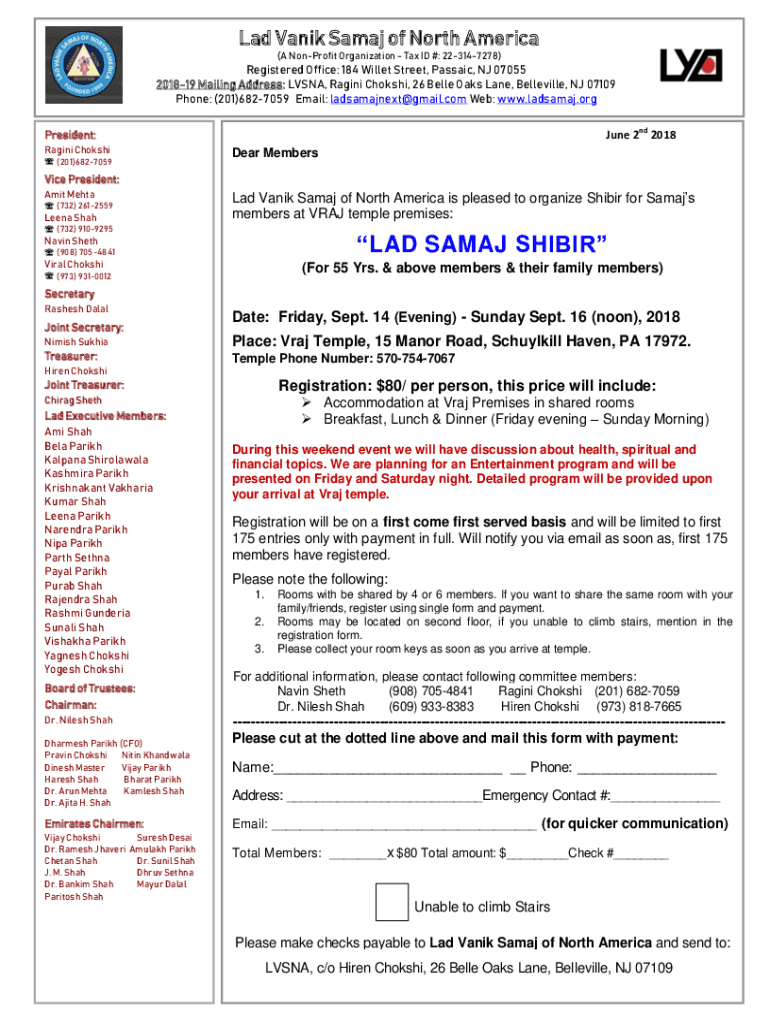

Get the free (A Non-Profit Organization - Tax ID #: 22-314-7278)

Show details

Lad Vania Samar of North America (A Nonprofit Organization Tax ID #: 223147278)Registered Office: 184 Millet Street, Passaic, NJ 07055 201819 Mailing Address: LISA, Raging Chukchi, 26 Belle Oaks Lane,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a non-profit organization

Edit your a non-profit organization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a non-profit organization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing a non-profit organization online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit a non-profit organization. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a non-profit organization

How to fill out a non-profit organization

01

Start by gathering all the necessary documents and information, such as the organization's mission statement, bylaws, and financial information.

02

Determine the type of non-profit organization you want to establish, whether it's a charitable organization, a religious organization, or an educational organization.

03

Choose a name for your non-profit organization and check for its availability. Make sure the name aligns with the mission and purpose of the organization.

04

File the necessary paperwork with the appropriate government agency, such as the IRS in the United States, to obtain tax-exempt status.

05

Develop a board of directors and elect officers to oversee the organization's activities and decisions.

06

Create a budget and establish financial systems to track the organization's income and expenses.

07

Develop a fundraising plan and explore different sources of funding, such as grants, donations, and sponsorships.

08

Build relationships with other non-profit organizations, potential donors, and community members to expand your network and support base.

09

Develop and implement programs and services that align with the mission of your non-profit organization.

10

Continuously evaluate and improve the effectiveness of your non-profit organization's operations and impact.

Who needs a non-profit organization?

01

Non-profit organizations are needed by various groups and individuals who are passionate about addressing social, cultural, educational, or environmental issues.

02

Examples of individuals who may need a non-profit organization include social activists, community organizers, and philanthropists.

03

Groups that may benefit from non-profit organizations include disadvantaged communities, marginalized populations, and people in need of specific services or support.

04

Non-profit organizations also play a crucial role in advancing research, promoting artistic and cultural expressions, and preserving natural resources.

05

In summary, anyone who wants to make a positive impact on society or address specific societal needs can benefit from creating or supporting a non-profit organization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in a non-profit organization?

The editing procedure is simple with pdfFiller. Open your a non-profit organization in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit a non-profit organization on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign a non-profit organization right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit a non-profit organization on an Android device?

You can make any changes to PDF files, like a non-profit organization, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is a non-profit organization?

A non-profit organization is an entity that operates for purposes other than generating profit, typically focusing on social, educational, charitable, or religious goals.

Who is required to file a non-profit organization?

Non-profit organizations are required to file by the individuals or groups managing the organization, typically the board of directors or the officers of the organization.

How to fill out a non-profit organization?

To fill out a non-profit organization, one must complete the necessary forms required by the state or federal government, including articles of incorporation, bylaws, and potentially applying for 501(c)(3) status with the IRS.

What is the purpose of a non-profit organization?

The purpose of a non-profit organization is to serve a public or mutual benefit, focusing on goals like community service, education, or charity without the aim of making profits for private owners.

What information must be reported on a non-profit organization?

Non-profit organizations must report information such as financial statements, details on their activities, governance structure, and compliance with federal and state laws.

Fill out your a non-profit organization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Non-Profit Organization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.