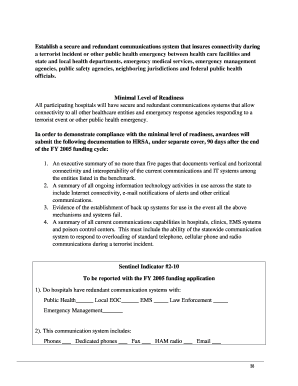

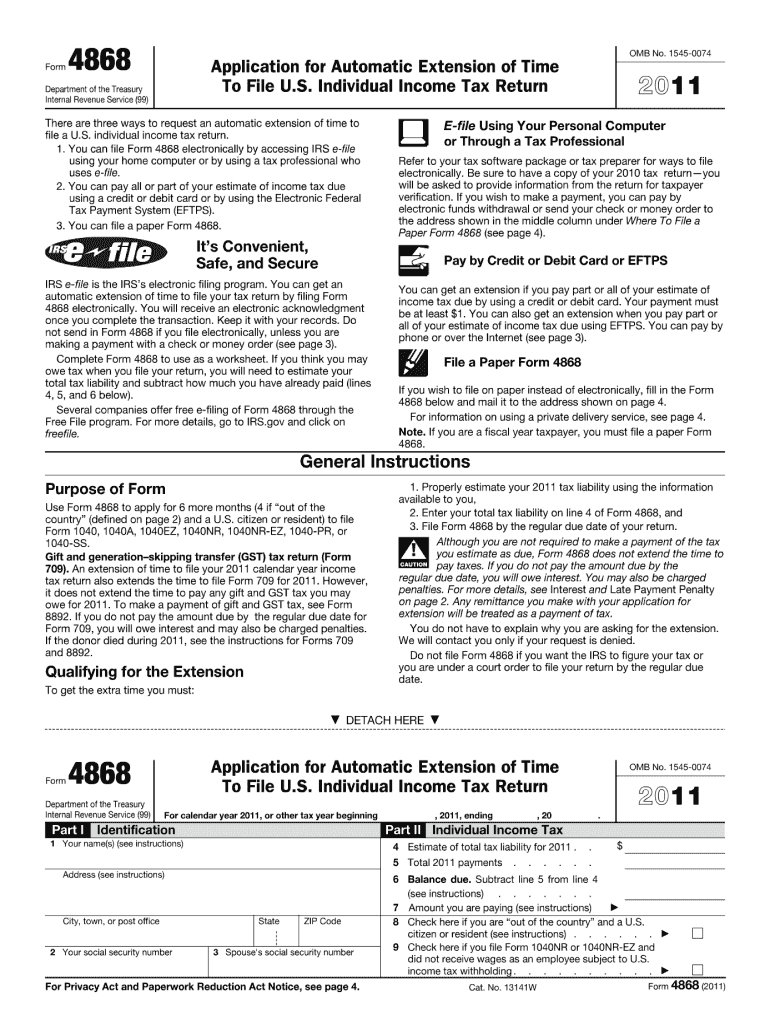

IRS 4868 2011 free printable template

Instructions and Help about IRS 4868

How to edit IRS 4868

How to fill out IRS 4868

About IRS 4 previous version

What is IRS 4868?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 4868

What should I do if I realize I've made a mistake after submitting the 4868 2011 form?

If you discover an error after submitting the 4868 2011 form, you can correct it by filing an amended form. The IRS allows corrections, but ensure that you clearly mark the new form as amended to avoid confusion. Keep copies of all submitted documents for your records.

How can I check the status of my 4868 2011 form submission?

To verify the status of your 4868 2011 form, you can use the IRS 'Where's My Refund?' tool if applicable or contact the IRS directly. Be prepared with your personal information to facilitate the inquiry process regarding your submission's receipt and processing timeline.

Are there e-filing fees associated with submitting the 4868 2011 form?

Yes, when e-filing the 4868 2011 form through third-party software, there may be service fees, which vary by provider. Check for any associated fees upfront, as they might affect your choice of e-filing service for tax purposes.

What should I do if my 4868 2011 form is rejected when submitted electronically?

If your e-filed 4868 2011 form is rejected, carefully review the provided rejection codes to determine the reason. Fix the identified issues and resubmit your form promptly to avoid any tax penalties or complications during your filing process.

Can I use an e-signature on my 4868 2011 form?

Yes, the IRS accepts e-signatures for the 4868 2011 form when filing electronically through authorized providers. Ensure that the e-signature meets IRS standards to avoid issues with your submission.

See what our users say