Get the free Pre-Authorized Tax Payment Plan Enrolment Form

Show details

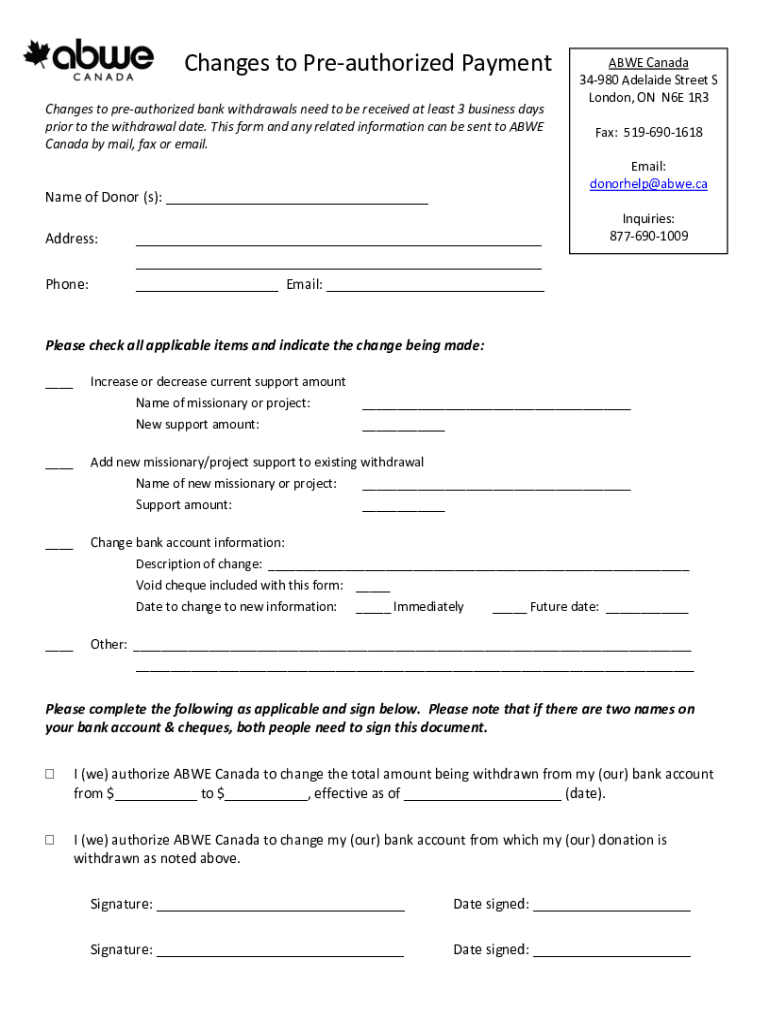

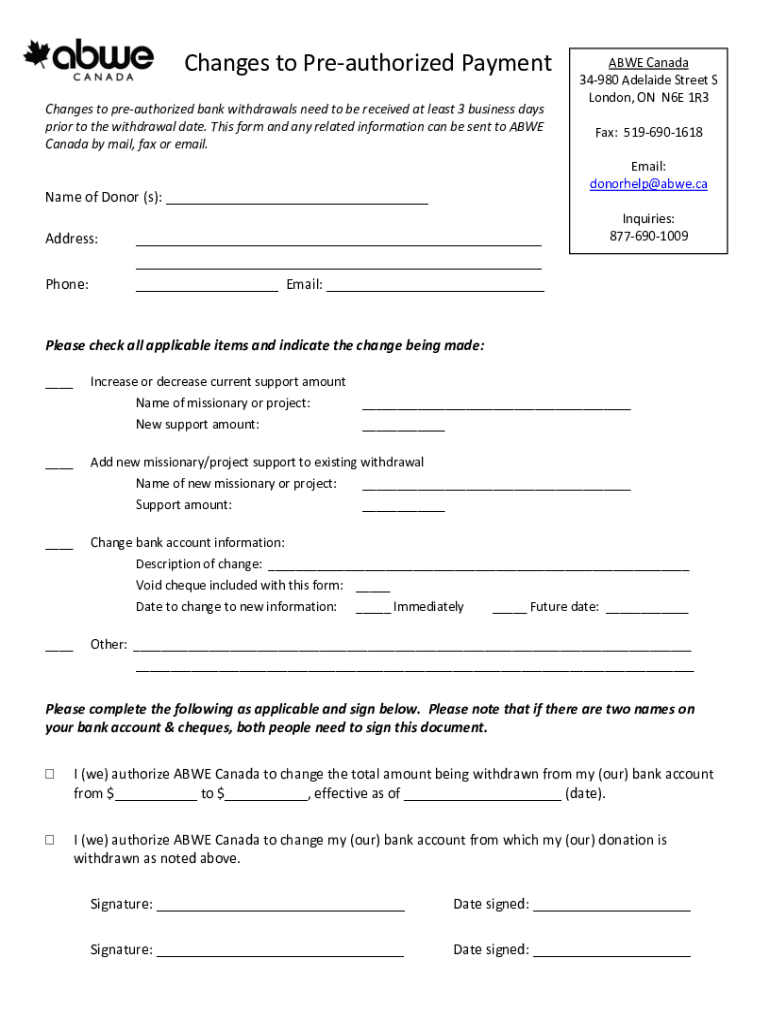

Changes to Preauthorized Payment Changes to preauthorized bank withdrawals need to be received at least 3 business days prior to the withdrawal date. This form and any related information can be sent

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pre-authorized tax payment plan

Edit your pre-authorized tax payment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pre-authorized tax payment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pre-authorized tax payment plan online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pre-authorized tax payment plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pre-authorized tax payment plan

How to fill out pre-authorized tax payment plan

01

Determine if you are eligible for a pre-authorized tax payment plan. Typically, individuals who owe a certain amount of tax or have a history of late or missed payments may qualify.

02

Contact the tax authority or agency responsible for collecting your taxes. This could be the IRS for federal taxes or your state's tax department for state taxes.

03

Inquire about the pre-authorized tax payment plan options available to you. These may vary depending on your jurisdiction and tax authority. Ask about the necessary forms or application process.

04

Gather the required information and documentation. This may include your tax identification number, financial statements, bank account details, and any supporting documents requested by the tax authority.

05

Complete the application or forms provided by the tax authority. Make sure to provide accurate and up-to-date information.

06

Submit your application or forms to the tax authority. Follow their instructions for submission, whether it is through mail, online portal, or in-person.

07

Await approval from the tax authority. They will review your application and determine if you are eligible for the pre-authorized tax payment plan.

08

If approved, you will receive further instructions on how to set up the pre-authorized payment plan. This may involve linking your bank account or providing authorization for automatic deductions.

09

Follow the instructions provided by the tax authority to set up the pre-authorized tax payment plan. Make sure to provide accurate banking information and authorize the necessary deductions.

10

Review the terms and conditions of the pre-authorized tax payment plan. Understand the payment schedule, interest or fees involved, and any penalties for missed payments.

11

Once your plan is set up, ensure that you have sufficient funds in your bank account to cover the automatic deductions on the scheduled payment dates.

12

Monitor your payments and tax obligations closely. Keep track of the amounts deducted and ensure that your tax payments are being properly applied.

13

If there are any changes to your financial situation or you wish to modify or cancel the pre-authorized tax payment plan, contact the tax authority to make the necessary arrangements.

14

Stay updated on any communication from the tax authority regarding changes to the pre-authorized tax payment plan or adjustments to your tax obligations.

15

If you encounter any issues or have questions about the pre-authorized tax payment plan, reach out to the tax authority for assistance and clarification.

Who needs pre-authorized tax payment plan?

01

Anyone who wants to ensure timely and consistent payment of their taxes may need a pre-authorized tax payment plan.

02

Individuals who owe a significant amount of tax or have experienced difficulties in meeting their tax obligations in the past may find a pre-authorized payment plan beneficial.

03

Business owners or self-employed individuals who have variable income throughout the year may find it easier to budget for tax payments by setting up a pre-authorized payment plan.

04

Those who prefer the convenience of automatic deductions from their bank account and want to avoid missed or late payments may also opt for a pre-authorized tax payment plan.

05

Ultimately, whether someone needs a pre-authorized tax payment plan depends on their individual circumstances and preferences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get pre-authorized tax payment plan?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the pre-authorized tax payment plan in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make changes in pre-authorized tax payment plan?

The editing procedure is simple with pdfFiller. Open your pre-authorized tax payment plan in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out the pre-authorized tax payment plan form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign pre-authorized tax payment plan and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is pre-authorized tax payment plan?

A pre-authorized tax payment plan is a system that allows taxpayers to authorize the tax authority to automatically withdraw tax payments from their bank account on a scheduled basis, typically to cover income tax obligations.

Who is required to file pre-authorized tax payment plan?

Individuals and businesses that expect to owe a certain amount of tax for the year and prefer to make regular payments instead of a lump sum at tax time may be required or may choose to file a pre-authorized tax payment plan.

How to fill out pre-authorized tax payment plan?

To fill out a pre-authorized tax payment plan, taxpayers typically need to complete the prescribed form provided by the tax authority, provide bank account details for the withdrawals, specify the payment schedule, and sign the authorization.

What is the purpose of pre-authorized tax payment plan?

The purpose of a pre-authorized tax payment plan is to help taxpayers manage their tax obligations by allowing them to pay taxes in regular installments, thus avoiding a large tax bill at the end of the year.

What information must be reported on pre-authorized tax payment plan?

Information that must be reported on a pre-authorized tax payment plan typically includes taxpayer identification information, bank account details, payment amounts, and the scheduled payment dates.

Fill out your pre-authorized tax payment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pre-Authorized Tax Payment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.