Get the free E I T I Children Youth Teens: Agles Nternational Raining ...

Show details

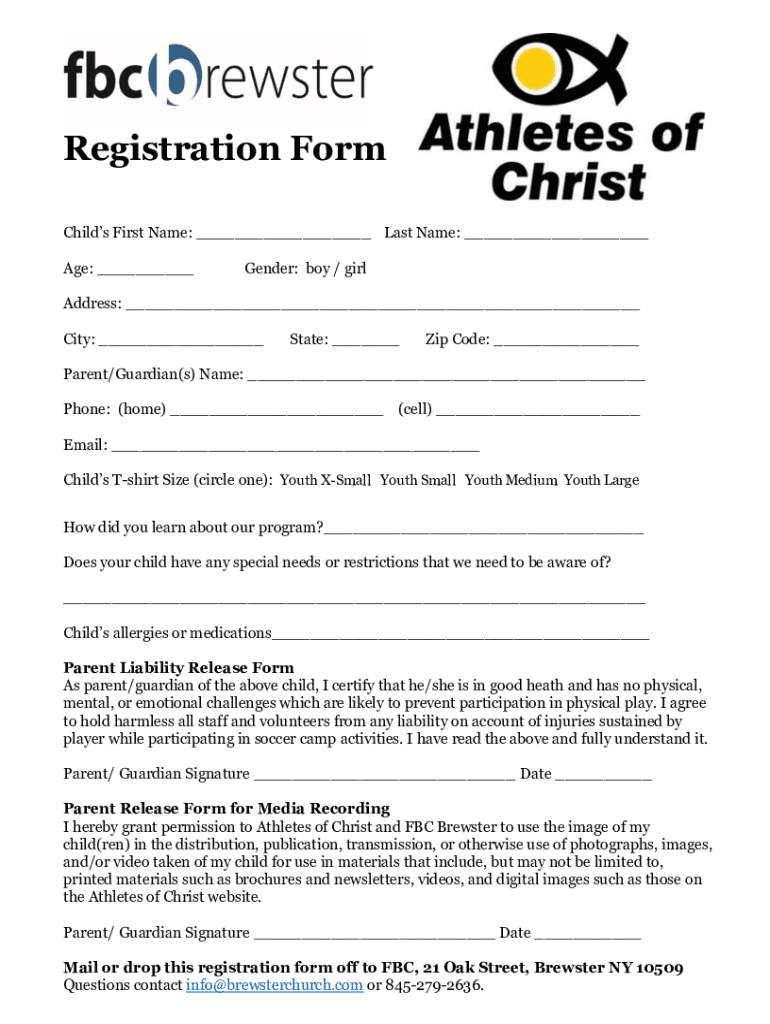

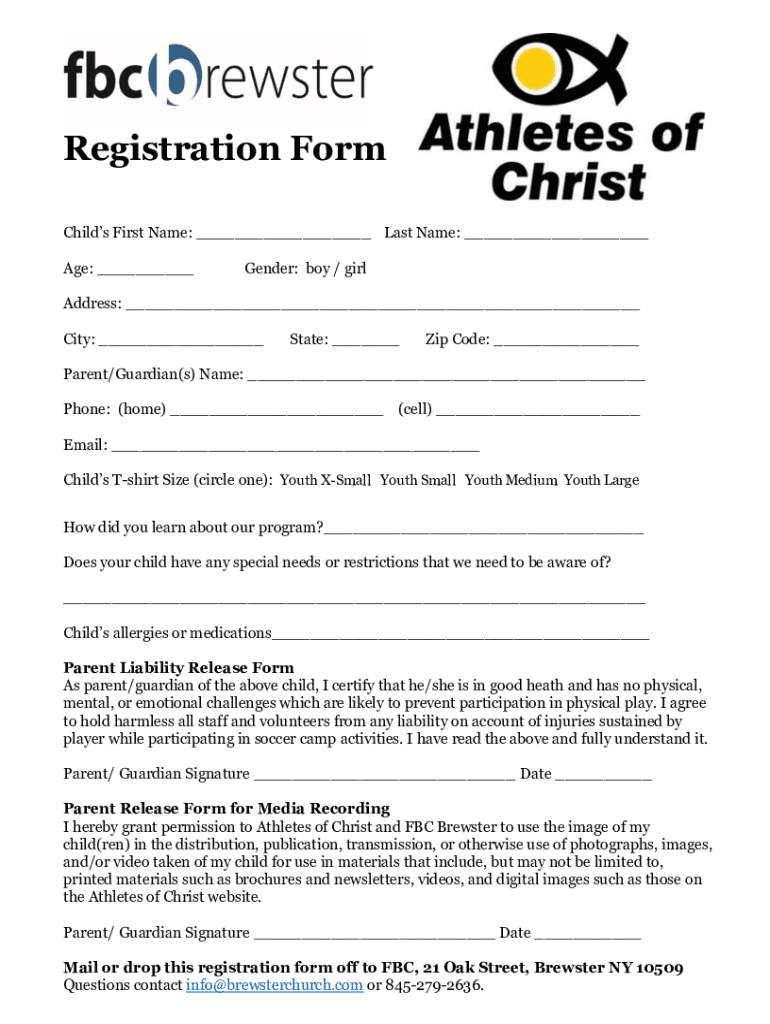

Registration Form Child's First Name: Last Name: Age: Gender: boy / readdress: City: State: Zip Code: Parent/Guardian(s) Name: Phone: (home) (cell) Email: Child's Shirt Size (circle one): Youth Small

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign e i t i

Edit your e i t i form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your e i t i form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit e i t i online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit e i t i. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out e i t i

How to fill out e i t i

01

To fill out an EITI (Extractive Industries Transparency Initiative) report, follow these steps:

02

Gather all relevant financial and trade data from extractive industry companies operating in the country.

03

Identify the specific reporting requirements set by the EITI Standard, which may vary based on country-specific guidelines.

04

Prepare the required templates and forms for reporting, ensuring accuracy and completeness.

05

Fill in the necessary information in the report, including details about payments made by extractive companies, government revenues, and other relevant data.

06

Ensure compliance with the EITI Standard's guidelines, including data reconciliation and validation processes.

07

Submit the completed report to the designated EITI authority or national secretariat.

08

Follow any additional instructions or requirements provided by the EITI authority or national secretariat.

09

Engage in the EITI multi-stakeholder process and participate in any follow-up activities or discussions related to the report.

10

Note: It is recommended to consult the official EITI guidelines and manuals for detailed instructions specific to the country of reporting.

Who needs e i t i?

01

Various stakeholders can benefit from the EITI report, including:

02

- Governments: EITI reports help governments ensure transparency and accountability in the extractive industries, facilitating better resource governance.

03

- Extractive Companies: Reporting under EITI can enhance the reputation of companies and their adherence to ethical business practices.

04

- Civil Society Organizations: EITI reports enable civil society organizations to monitor and advocate for fair distribution of extractive industry revenues, promoting socio-economic development.

05

- Investors: EITI reports provide investors with information on financial flows and risks in the extractive sector, supporting informed investment decisions.

06

- Local Communities: EITI reports empower local communities by providing access to data on extractive industry activities, revenues, and their potential impacts on the local economy and environment.

07

- International Organizations: EITI reports contribute to global efforts in promoting transparency, accountability, and sustainable development in the extractive industries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send e i t i for eSignature?

When your e i t i is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete e i t i online?

pdfFiller has made it simple to fill out and eSign e i t i. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my e i t i in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your e i t i directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is e i t i?

E I T I (Employer's Information Tax Initiative) is a tax return form filed by employers to report certain financial information and fulfill their tax obligations.

Who is required to file e i t i?

Employers who meet specific criteria regarding their income, number of employees, or other relevant factors are required to file E I T I.

How to fill out e i t i?

To fill out E I T I, employers need to gather necessary financial documents, complete the form with accurate information, and submit it by the specified deadline.

What is the purpose of e i t i?

The purpose of E I T I is to ensure that employers report their financial information accurately, facilitating the proper assessment of taxes owed.

What information must be reported on e i t i?

Information that must be reported on E I T I includes total wages paid, tax withheld, employee details, and other financial data relevant to tax obligations.

Fill out your e i t i online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

E I T I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.