Get the free Closing a partnershipInternal Revenue Service

Show details

Annual Partnership Opportunities 20182019 July 1, 2018, June 30, 2019Annual support of The Forum of Executive Women provides our partners with ongoing visibility in support of our mission and vision

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign closing a partnershipinternal revenue

Edit your closing a partnershipinternal revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your closing a partnershipinternal revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing closing a partnershipinternal revenue online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit closing a partnershipinternal revenue. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

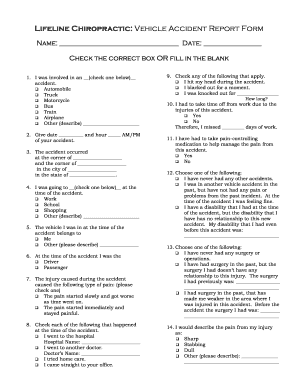

How to fill out closing a partnershipinternal revenue

How to fill out closing a partnershipinternal revenue

01

Obtain the necessary forms and schedules for closing a partnership with the Internal Revenue Service (IRS). These include Form 1065, Schedule K-1, and any other relevant schedules.

02

Gather all the financial records and documents related to the partnership's income, expenses, assets, and liabilities for the final year of operation.

03

Fill out Form 1065, providing all the required information about the partnership, its partners, and the final year's financial details. Pay attention to the instructions on the form to ensure accurate reporting.

04

Complete Schedule K-1 for each partner, reporting their share of the partnership's income, losses, deductions, and credits. Make sure to provide each partner with their respective K-1 form.

05

Attach any additional schedules or supporting documents required by the IRS, such as Schedule D for capital gains and losses, Schedule E for supplemental income and loss, etc.

06

Double-check all the filled forms and schedules for accuracy and completeness. Ensure that all calculations are correct and that all necessary information is provided.

07

Sign and date the forms where required. Each partner should also review and sign their respective Schedule K-1.

08

Make copies of all the completed forms and schedules for your records and for each partner involved in the partnership.

09

Submit the original forms and schedules to the designated IRS office according to their instructions. Keep proof of submission, such as certified mail or payment receipt.

10

Follow up with the IRS if necessary, addressing any inquiries or requests for additional information regarding the partnership's closure.

11

Keep the copies of the completed forms and schedules, as well as any related correspondence with the IRS, in a safe and organized manner for future reference.

Who needs closing a partnershipinternal revenue?

01

Partnerships that are terminating their operations or dissolving their business entity structure need to file closing partnership returns with the Internal Revenue Service (IRS). This applies to general partnerships, limited partnerships, and limited liability partnerships (LLPs) that are subject to U.S. federal income tax regulations.

02

Individuals or entities who were partners in the closing partnership also need to be aware of the process and requirements for closing a partnership with the IRS. They will receive their respective K-1 forms and may need to report the partnership's final income, deductions, and credits on their personal tax returns.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find closing a partnershipinternal revenue?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific closing a partnershipinternal revenue and other forms. Find the template you need and change it using powerful tools.

How do I execute closing a partnershipinternal revenue online?

With pdfFiller, you may easily complete and sign closing a partnershipinternal revenue online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I edit closing a partnershipinternal revenue on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing closing a partnershipinternal revenue.

What is closing a partnership internal revenue?

Closing a partnership internal revenue refers to the process of settling the financial affairs of a partnership and reporting its final income, expenses, and distributions to the IRS. This includes preparing the final tax return for the partnership.

Who is required to file closing a partnership internal revenue?

Typically, the partners of the partnership are required to file the closing internal revenue documentation, particularly if the partnership has ceased operations or if it is being formally dissolved.

How to fill out closing a partnership internal revenue?

To fill out the closing partnership internal revenue forms, partners must provide information about the partnership's income, deductions, and distributions for the final reporting period. This is usually done using IRS Form 1065 and Schedule K-1 for partners.

What is the purpose of closing a partnership internal revenue?

The purpose of closing a partnership internal revenue is to formally report the cessation of partnership activities, settle any outstanding tax obligations, and provide documentation for the final financial standing of the partnership.

What information must be reported on closing a partnership internal revenue?

The closing report must include details such as the partnership's income, deductions, distributions to partners, and any applicable final adjustments for the last year of operation.

Fill out your closing a partnershipinternal revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Closing A Partnershipinternal Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.