Get the free Health savings account - WikipediaHealth savings account - WikipediaHealth savings a...

Show details

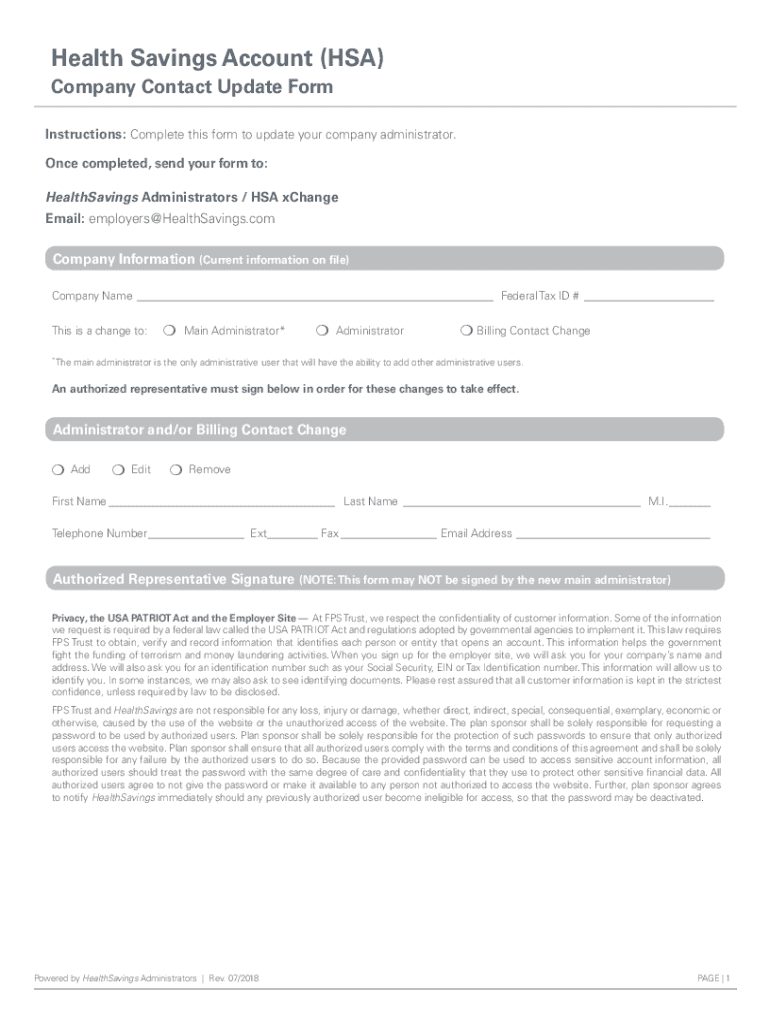

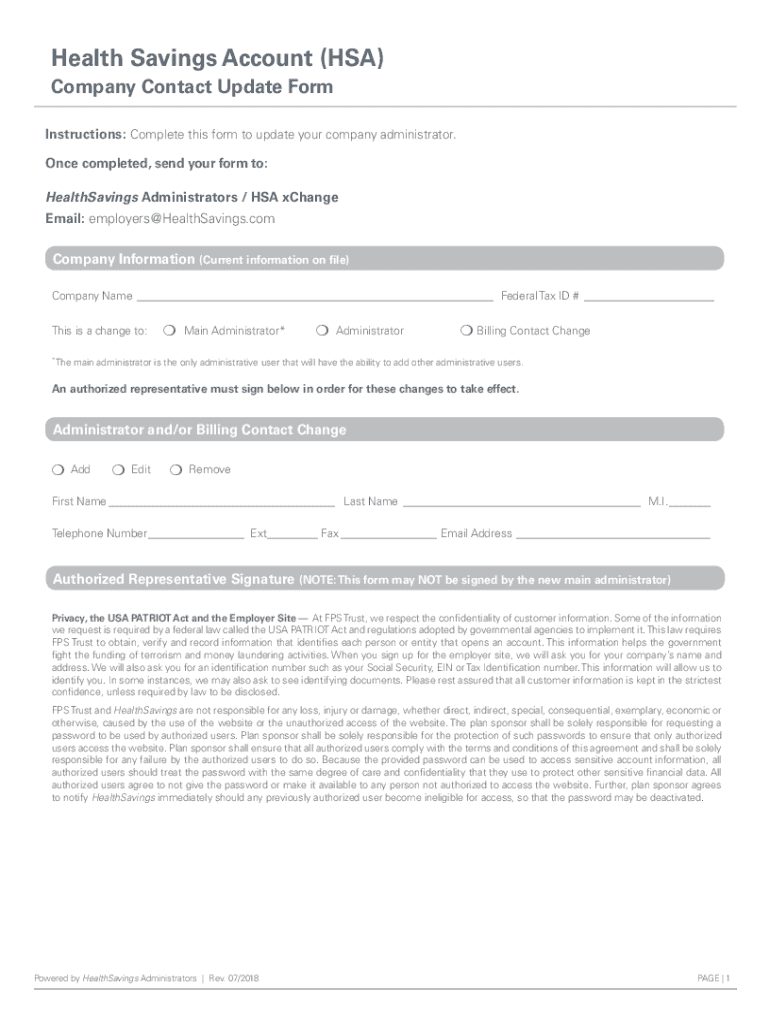

Health Savings Account (HSA) Company Contact Update Form Instructions: Complete this form to update your company administrator. Once completed, send your form to:HealthSavings Administrators / HSA

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health savings account

Edit your health savings account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health savings account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit health savings account online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit health savings account. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health savings account

How to fill out health savings account

01

To fill out a health savings account, follow these steps:

02

Determine your eligibility: Make sure you are eligible for a health savings account (HSA). You must have a high-deductible health plan (HDHP) and cannot be enrolled in Medicare.

03

Open an HSA: Find a financial institution or bank that offers HSA accounts and open one.

04

Fund your HSA: Contribute money to your HSA. You can do this through direct deposit from your paycheck or by making a contribution yourself.

05

Keep track of expenses: Maintain records of all expenses paid from your HSA. It's important to keep receipts and documentation for tax purposes.

06

Use HSA funds for qualified medical expenses: Only use the funds in your HSA for qualified medical expenses as defined by the IRS. These may include doctor visits, prescriptions, and medical procedures.

07

Report contributions and withdrawals: When filing your taxes, report contributions made to your HSA as well as any withdrawals. This will ensure you receive any tax benefits and avoid penalties.

08

Stay informed: Stay updated on the latest rules and regulations regarding HSA contributions, withdrawals, and eligible expenses to maximize the benefits of your HSA.

Who needs health savings account?

01

A health savings account (HSA) is beneficial for individuals who:

02

- Have a high-deductible health plan (HDHP): HSAs are specifically designed to work in conjunction with HDHPs, so individuals with HDHPs can benefit from an HSA.

03

- Want to save for future medical expenses: HSAs allow individuals to contribute pre-tax dollars towards medical expenses that they may incur in the future. This is particularly useful for individuals who anticipate higher healthcare costs.

04

- Are looking for tax advantages: Contributions made to an HSA are tax-deductible, and any interest earned on the funds is tax-free. Additionally, withdrawals used for qualified medical expenses are tax-free.

05

- Prefer to have control over their healthcare spending: With an HSA, individuals have more control over how they spend their healthcare dollars. They can choose to save the funds for future use or use them immediately for eligible medical expenses.

06

- Are self-employed or have a high income: HSAs provide an opportunity for self-employed individuals or those with a high income to save money on taxes, as they can deduct contributions from their taxable income.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send health savings account for eSignature?

Once you are ready to share your health savings account, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in health savings account?

With pdfFiller, the editing process is straightforward. Open your health savings account in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the health savings account in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your health savings account and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is health savings account?

A Health Savings Account (HSA) is a tax-advantaged savings account that allows individuals to save money for medical expenses. Contributions to the account are tax-deductible, and withdrawals for qualifying medical expenses are tax-free.

Who is required to file health savings account?

Individuals who contribute to an HSA or those who have distributions from the account need to file the appropriate tax forms related to HSAs.

How to fill out health savings account?

To fill out a health savings account, individuals need to complete IRS Form 8889, which includes information about contributions and distributions during the tax year.

What is the purpose of health savings account?

The purpose of a Health Savings Account is to help individuals save money for medical expenses while benefiting from tax advantages.

What information must be reported on health savings account?

Information that must be reported includes total contributions made to the HSA, distributions for qualified medical expenses, and any amounts carried over from previous years.

Fill out your health savings account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Savings Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.