Get the free Flexible Spending Account Plan Election/Change Form

Show details

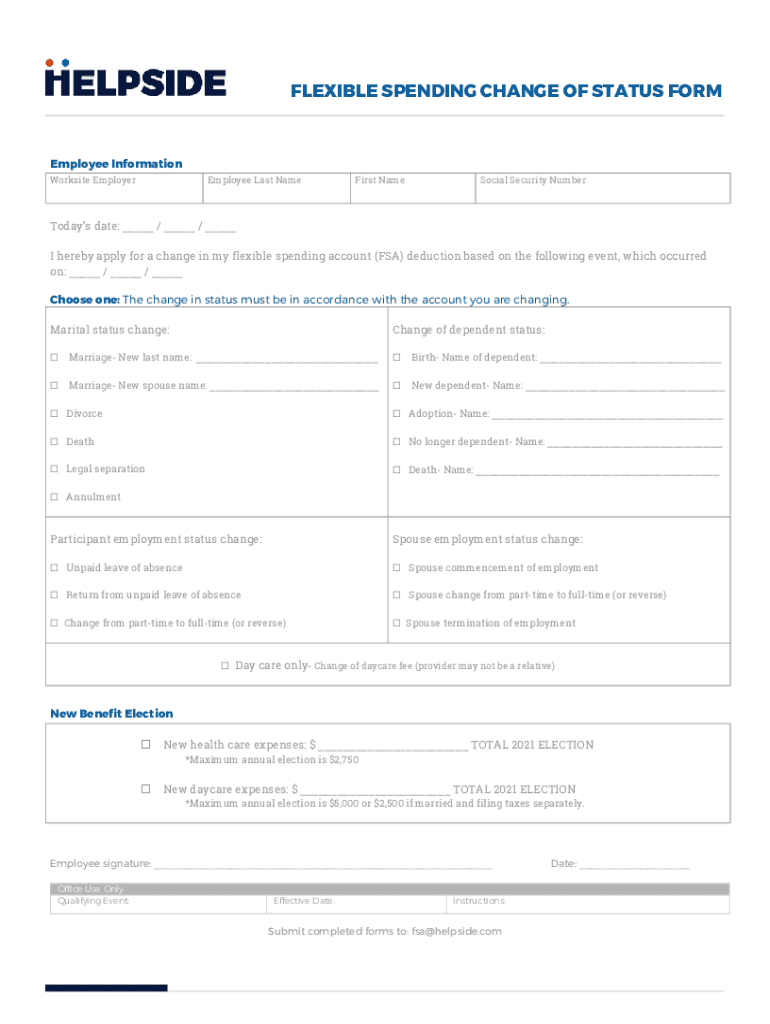

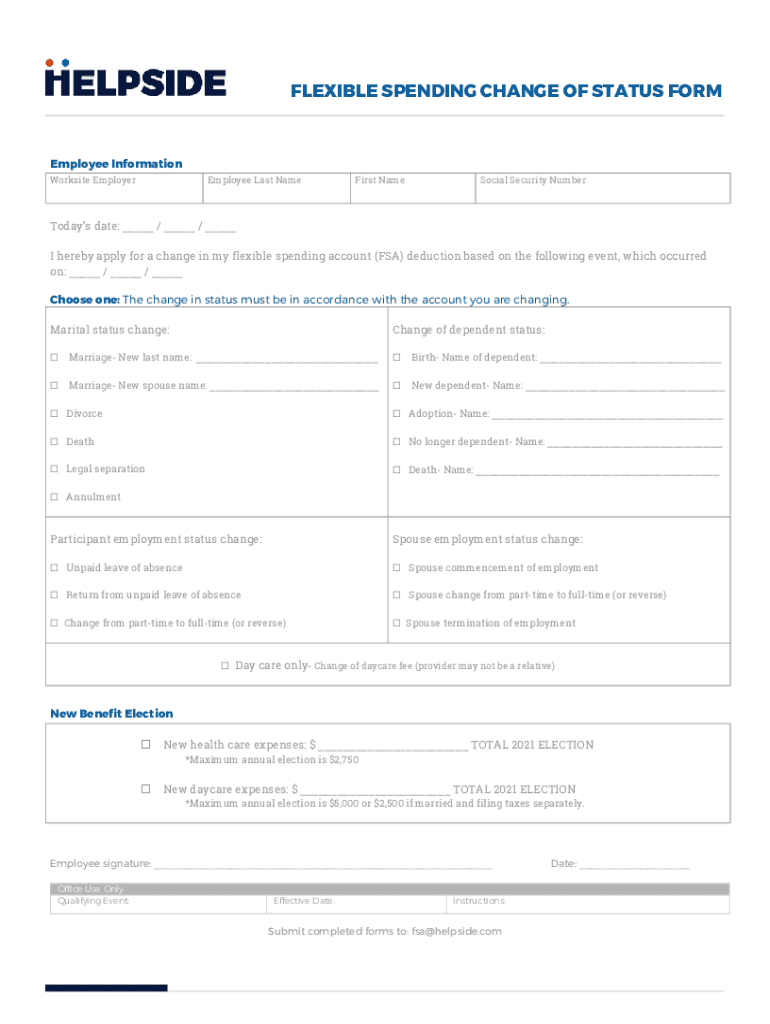

FLEXIBLE SPENDING CHANGE OF STATUS FORMEmployee Information Worksite EmployerEmployee Last NameFirst Asocial Security NumberTodays date: / / I hereby apply for a change in my flexible spending account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flexible spending account plan

Edit your flexible spending account plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flexible spending account plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing flexible spending account plan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit flexible spending account plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flexible spending account plan

How to fill out flexible spending account plan

01

To fill out a flexible spending account plan, follow these steps:

02

- Review the guidelines and requirements provided by your employer or plan administrator. It is important to understand the specific rules and limitations of your flexible spending account plan.

03

- Determine the amount of your expected expenses that are eligible for reimbursement through the flexible spending account. This may include qualified medical expenses, dependent care expenses, or other eligible expenses specified in the plan.

04

- Keep track of your receipts and documentation for all eligible expenses. Make sure to gather all necessary supporting documents to substantiate your claims.

05

- Complete the necessary forms or online submission process provided by your employer or plan administrator. Provide accurate and detailed information about the expenses, dates, providers, and any additional required information.

06

- Submit your reimbursement claim within the designated timeframe specified by your employer or plan administrator. Ensure all required documentation is attached and follow any submission instructions provided.

07

- Await approval and processing of your reimbursement claim. This may vary depending on the specific procedures and timelines of your flexible spending account plan.

08

- Receive reimbursement for approved expenses, either through direct deposit or a check, as determined by your employer or plan administrator.

09

- Keep a record of your reimbursement transactions for future reference or tax purposes.

10

- Regularly review your flexible spending account balance and remaining funds to ensure proper utilization and avoid forfeiture of unused funds at the end of the plan year.

Who needs flexible spending account plan?

01

A flexible spending account plan can be beneficial for individuals who have anticipated out-of-pocket expenses that are eligible for reimbursement. Some common scenarios where a flexible spending account plan may be useful include:

02

- Employees with high medical expenses such as prescription medications, copayments, deductibles, and other eligible healthcare expenses.

03

- Individuals with dependents who require daycare or after-school care services.

04

- Those planning for elective procedures or medical treatments that are not fully covered by insurance.

05

- Employees who frequently require over-the-counter medications or medical products.

06

- Individuals with predictable dental or vision expenses.

07

- Those wanting to set aside pre-tax dollars for eligible expenses, reducing their taxable income.

08

It is important to note that eligibility and specific expenses covered may vary depending on the employer's plan design and the regulations of the flexible spending account program.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit flexible spending account plan online?

With pdfFiller, it's easy to make changes. Open your flexible spending account plan in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out the flexible spending account plan form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign flexible spending account plan and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete flexible spending account plan on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your flexible spending account plan from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is flexible spending account plan?

A flexible spending account (FSA) plan allows employees to set aside pre-tax earnings to pay for eligible healthcare expenses.

Who is required to file flexible spending account plan?

Employers who offer flexible spending accounts are required to file the plan, typically as part of their employee benefits package.

How to fill out flexible spending account plan?

To fill out a flexible spending account plan, employees need to provide personal information, election amounts, and any necessary documentation for eligible expenses.

What is the purpose of flexible spending account plan?

The purpose of a flexible spending account plan is to allow employees to save money on taxes by using pre-tax funds for qualified medical expenses.

What information must be reported on flexible spending account plan?

Information that must be reported includes the employee's personal details, plan year, amount elected for the FSA, and eligible expenses incurred.

Fill out your flexible spending account plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flexible Spending Account Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.