Get the free of GST)

Show details

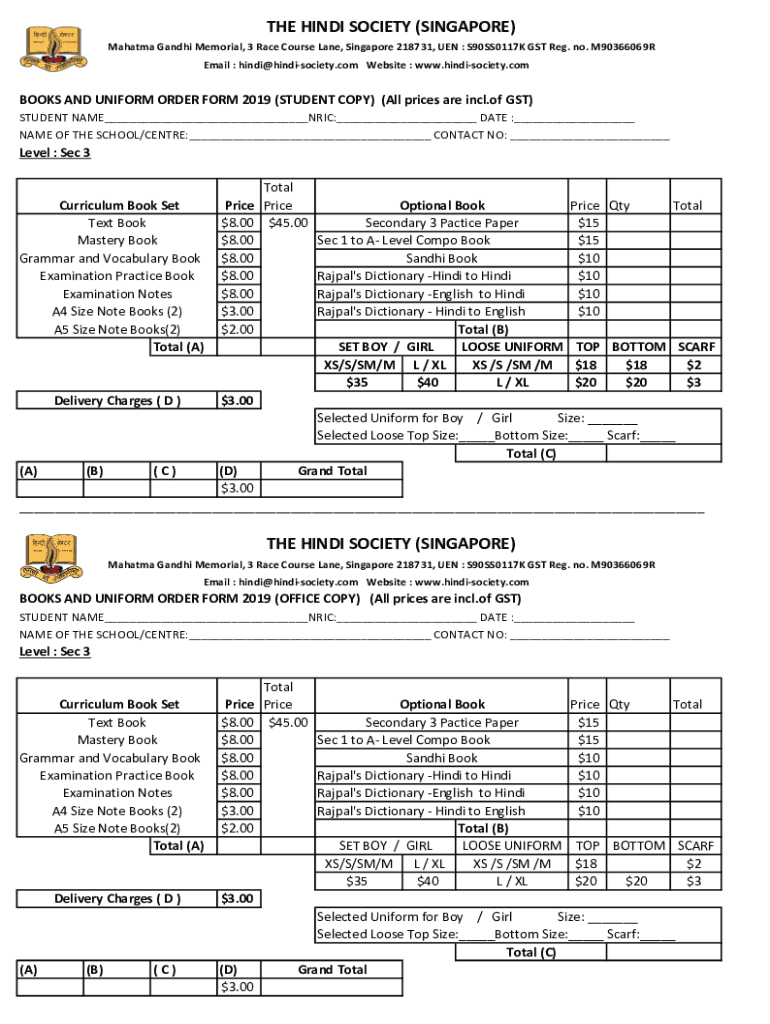

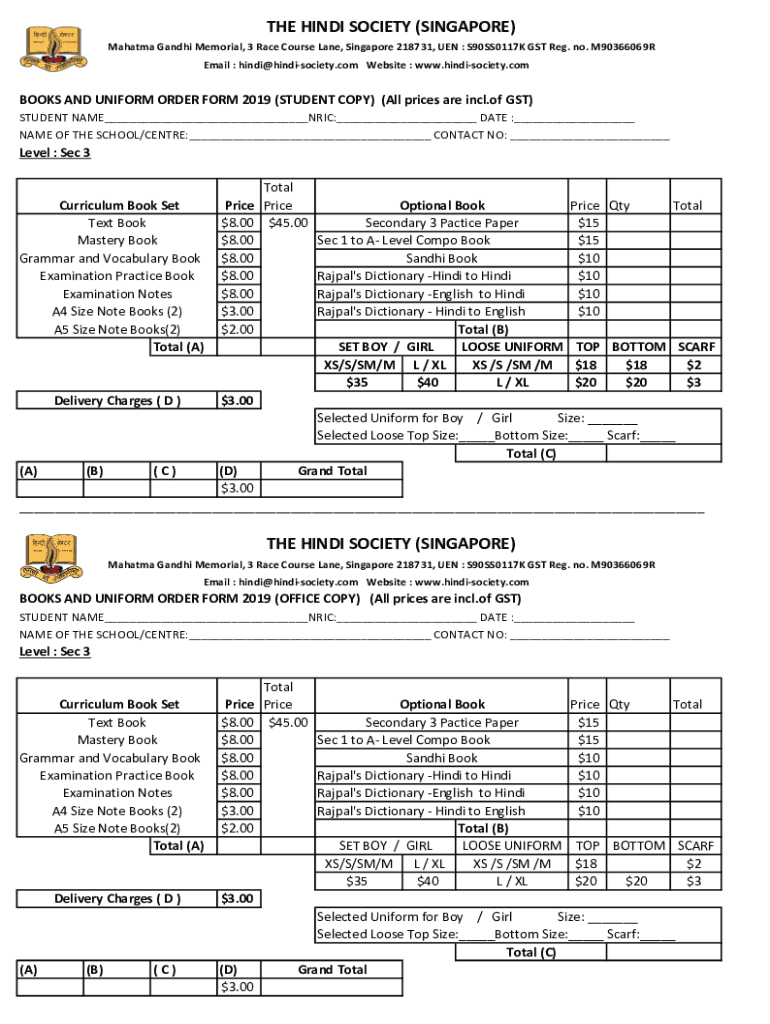

THE HINDI SOCIETY (SINGAPORE) Mahatma Gandhi Memorial, 3 Race Course Lane, Singapore 218731, MEN : S90SS0117K GST Reg. No. M90366069R Email : Hindi hindisociety.com Website : www.hindisociety.comBOOKS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign of gst

Edit your of gst form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your of gst form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit of gst online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit of gst. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out of gst

How to fill out of gst

01

To fill out GST, follow these steps:

02

Determine your eligibility: Determine if your business is required to register for GST.

03

Gather information: Collect all the necessary information and documents required for filing GST returns.

04

Register for GST: If your business is eligible, register for GST with the tax authorities.

05

Obtain GSTIN: After registration, you will receive a unique Goods and Services Tax Identification Number (GSTIN).

06

Understand tax rates and slabs: Familiarize yourself with the different tax rates and slabs applicable to your business.

07

Maintain proper records: Keep a record of all transactions, invoices, and other relevant documents for future reference.

08

File GST returns: File your GST returns on a regular basis as per the prescribed schedule.

09

Pay GST dues: Calculate the amount of GST you owe and make the payment within the specified due dates.

10

Claim input tax credit: If eligible, claim input tax credit on your purchases made for business purposes.

11

Get GST audit (if required): Undergo a GST audit if your business meets the criteria for audit.

12

Rectify errors (if any): Review your filed returns periodically and rectify any errors or discrepancies as soon as possible.

13

Seek professional help: Consider seeking professional assistance from a tax consultant or accountant to ensure accurate GST compliance.

Who needs of gst?

01

GST is needed by:

02

- Registered businesses: All businesses that are engaged in the supply of goods or services and have an annual turnover above the prescribed threshold need to register for GST.

03

- Manufacturers and traders: Businesses involved in manufacturing, trading, or selling goods are required to register for GST.

04

- Service providers: Service providers, including professionals like doctors, lawyers, and consultants, need to register for GST if their turnover exceeds the threshold.

05

- E-commerce operators: E-commerce operators facilitating the supply of goods or services through their platforms need to register for GST.

06

- Exporters and importers: Businesses involved in the export or import of goods or services are required to register for GST.

07

- Casual taxable persons: Individuals or businesses supplying goods or services occasionally (such as during events or exhibitions) need to register for GST.

08

- Agents or intermediaries: Agents or intermediaries involved in the supply of goods or services on behalf of other taxable persons need to register for GST.

09

- Input service distributors: Input service distributors, who receive invoices for input services and distribute or allocate them to their branches or units, need to register for GST.

10

- Non-resident taxable persons: Non-resident individuals or businesses supplying taxable goods or services in India need to register for GST.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete of gst online?

With pdfFiller, you may easily complete and sign of gst online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in of gst?

With pdfFiller, it's easy to make changes. Open your of gst in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete of gst on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your of gst from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is of gst?

GST stands for Goods and Services Tax, a value-added tax levied on most goods and services sold for domestic consumption.

Who is required to file of gst?

Businesses and individuals with a turnover above a certain threshold, as determined by the tax authority, are required to file GST returns.

How to fill out of gst?

To fill out GST, taxpayers must gather their sales and purchase data, access the designated GST portal, and complete the GST return form according to their applicable GST type.

What is the purpose of of gst?

The purpose of GST is to streamline the taxation process, reduce tax evasion, and create a unified tax regime across the country.

What information must be reported on of gst?

GST returns typically require reporting of sales, purchases, input tax credits, and any tax payable or refundable.

Fill out your of gst online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Of Gst is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.