Get the free Defined-Benefit vs. Defined-Contribution Plan: What's the ...

Show details

ENROLL POLYMERS Defined Contribution Plush all the financial priorities you might be juggling, it can be easy to overlook the need to save for retirement. But let's be honest we are not going to work

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign defined-benefit vs defined-contribution plan

Edit your defined-benefit vs defined-contribution plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your defined-benefit vs defined-contribution plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit defined-benefit vs defined-contribution plan online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit defined-benefit vs defined-contribution plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out defined-benefit vs defined-contribution plan

How to fill out defined-benefit vs defined-contribution plan

01

To fill out a defined-benefit plan:

02

Gather information about your employment history, such as the dates of employment and salary history.

03

Understand the formula used to calculate the pension benefit, which may be based on factors like years of service and average salary.

04

Determine the desired retirement age and choose a payout option, such as a single life annuity or joint and survivor annuity.

05

Complete the necessary paperwork provided by your employer or pension provider.

06

Review the completed form for accuracy and submit it within the specified timeframe.

07

08

To fill out a defined-contribution plan:

09

Determine how much you want to contribute to the plan and calculate the maximum contribution allowed.

10

Choose the investment options available within the plan, considering factors like risk tolerance and desired returns.

11

Complete the enrollment form provided by your employer or plan provider, providing necessary personal and financial information.

12

Specify the contribution amount and investment allocation percentages.

13

Review the completed form for accuracy and submit it within the specified timeframe.

Who needs defined-benefit vs defined-contribution plan?

01

A defined-benefit plan is suitable for individuals who:

02

- Prefer a guaranteed, fixed income during retirement.

03

- Have a long-term employment with the same company.

04

- Are risk-averse and prioritize stability.

05

- Are willing to trade flexibility for the security of a consistent pension benefit.

06

07

A defined-contribution plan is suitable for individuals who:

08

- Prefer greater control over their retirement savings and investment decisions.

09

- Have multiple employers or frequently change jobs.

10

- Value flexibility in contributions and investment choices.

11

- Are comfortable with market fluctuations and are willing to take investment risks.

12

- Desire portability of retirement savings if changing employers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my defined-benefit vs defined-contribution plan in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your defined-benefit vs defined-contribution plan and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I fill out defined-benefit vs defined-contribution plan using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign defined-benefit vs defined-contribution plan and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit defined-benefit vs defined-contribution plan on an Android device?

You can make any changes to PDF files, like defined-benefit vs defined-contribution plan, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

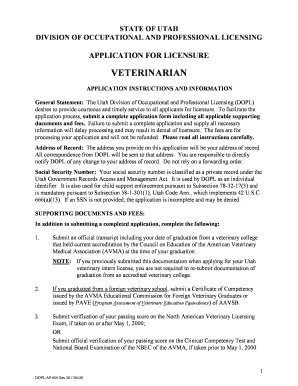

What is defined-benefit vs defined-contribution plan?

A defined-benefit plan guarantees a specified payment amount in retirement, based on salary and years of service, whereas a defined-contribution plan allows employees and/or employers to contribute to an individual account, which is used to provide retirement income based on the account's investment performance.

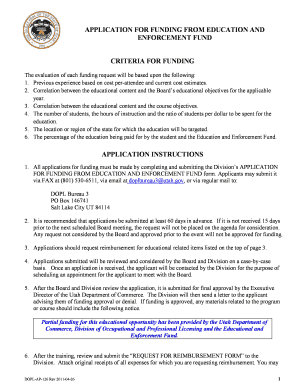

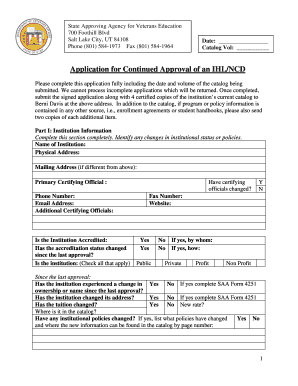

Who is required to file defined-benefit vs defined-contribution plan?

Employers who either maintain a defined-benefit plan or a defined-contribution plan and meet certain criteria set by the IRS and the Department of Labor are required to file the appropriate forms. Specifically, Form 5500 must be filed for most plans.

How to fill out defined-benefit vs defined-contribution plan?

To fill out a defined-benefit or defined-contribution plan, employers must complete the appropriate Form 5500 with information about plan structure, contributions, investments, expenses, and the number of participants, ensuring all required fields and attachments are accurately completed.

What is the purpose of defined-benefit vs defined-contribution plan?

The purpose of a defined-benefit plan is to provide employees with a predictable retirement income based on a formula, while the purpose of a defined-contribution plan is to encourage individual retirement savings, where employees invest their own contributions along with any employer contributions.

What information must be reported on defined-benefit vs defined-contribution plan?

The reported information typically includes the plan's financial condition, assets and liabilities, contributions received, participant count, benefit distributions, and any transactions with related parties, among other details.

Fill out your defined-benefit vs defined-contribution plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Defined-Benefit Vs Defined-Contribution Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.