Get the free FILING FORMS W2/W3 ELECTRONICALLY - irs

Show details

This document provides guidance on electronically filing W2 and W3 forms with the Social Security Administration, detailing procedures, common errors, electronic filing benefits, and important contacts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign filing forms w2w3 electronically

Edit your filing forms w2w3 electronically form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your filing forms w2w3 electronically form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit filing forms w2w3 electronically online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit filing forms w2w3 electronically. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out filing forms w2w3 electronically

How to fill out FILING FORMS W2/W3 ELECTRONICALLY

01

Obtain the required W2/W3 forms from the IRS website or your payroll software.

02

Ensure that all employee information is accurate and complete, including Social Security numbers and addresses.

03

Fill out the W2 form for each employee by entering their wages, taxes withheld, and other relevant information.

04

Once all W2 forms are completed, prepare the W3 form to summarize the total of all W2 forms.

05

Use the IRS's e-file system or approved third-party software to electronically submit your W2/W3 forms.

06

Verify submission and keep confirmation for your records.

Who needs FILING FORMS W2/W3 ELECTRONICALLY?

01

Employers who have employees and are required to report wages to the IRS.

02

Businesses that have more than one employee during the calendar year.

03

Payroll service providers that handle W2/W3 filing on behalf of businesses.

Fill

form

: Try Risk Free

People Also Ask about

When must Forms W-2 and W3 be filed?

Employers must file their copies of Form W-2, Wage and Tax Statement and Form W-3, Transmittal of Wage and Tax Statements with the Social Security Administration by January 31. Additional information on how to file can be found in Topic No. 752, Filing Forms W-2 and W-3.

Who receives W3?

Any employer who paid an employee $600 or more in wages during the tax year and withheld any of those wages for FICA or federal income taxes must file a W-2 form — which means they'll also need to file a W-3 form. Fortunately, employers don't have to provide employees with a copy of a W-3 the way they do for a W-2.

What is the due date for e filing form W3?

Those who miss the January 31 deadline can still file, but may be subject to penalties. The W-2s and the W-3 forms submitted in January contain data for employee earnings and withholdings for the full prior tax year. Whether you file electronically or by mail, the January 31 deadline is the same.

Can W-2 and W3 be handwritten?

Type all entries using black ink and, if possible, in a 12-point Courier font. Entries are read by machine. Handwritten, script, or italicized fonts are discouraged. Entries made in other than black ink can't be read.

What is the purpose of W3?

A W3 is a form utilized by employers to report the cumulative wages and taxes withheld from their employees during a specific tax year to the IRS. The form serves a dual function, first, it reconciles the data reported on Forms W-2 and 1099-MISC with the information on the employer's federal income tax return.

Is a W3 the same as a W-2?

The W3 form is submitted by the employer, and it summarizes the information from all of the W2 forms that have been issued to their employees. Both forms are important for different reasons and play a crucial role in the tax filing process.

How do I file W-2 and W3 electronically in Quickbooks?

W2 & W3 efiling Go to the Employees menu, then Payroll Center. Click the File Forms tab. Select Annual Form W-2c/W-3c - Corrected Wage and Tax Statement, then Create Form. Tap the employee's last name. Hit OK. Choose the employee who needs a W-2c.

What is the difference between W-2 and W3?

What's the Difference Between Form W-2 and Form W-3? Employees use the information provided by their employer on the Form W-2 to complete and file their personal income tax returns. Employers use Form W-3 to report employee income to the IRS and Social Security Administration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

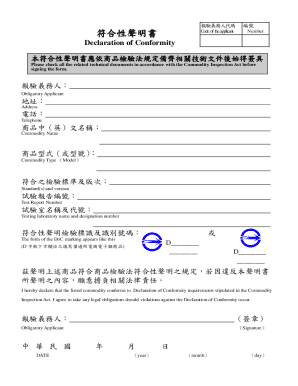

What is FILING FORMS W2/W3 ELECTRONICALLY?

Filing forms W-2 and W-3 electronically refers to the process of submitting these wage and tax statements to the IRS in a digital format rather than using paper forms. This involves using approved electronic filing methods, which can expedite processing and enhance accuracy.

Who is required to file FILING FORMS W2/W3 ELECTRONICALLY?

Employers who are required to file 250 or more W-2 forms in a calendar year must file forms W-2 and W-3 electronically. However, smaller employers can also choose to file electronically for convenience and accuracy.

How to fill out FILING FORMS W2/W3 ELECTRONICALLY?

To fill out forms W-2 and W-3 electronically, employers should use tax software or IRS-approved e-filing systems. They need to gather the employee's wage and tax information, accurately fill out the required fields, and then submit the forms via the IRS's online system or designated e-filing platform.

What is the purpose of FILING FORMS W2/W3 ELECTRONICALLY?

The purpose of filing forms W-2 and W-3 electronically is to simplify the reporting process, reduce errors, accelerate processing time, and enhance record-keeping efficiency for employers and the IRS.

What information must be reported on FILING FORMS W2/W3 ELECTRONICALLY?

Forms W-2 must report the employee's annual wages, federal income tax withheld, Social Security and Medicare wages, and other relevant compensation information. Form W-3 summarizes the total earnings and tax information reported on the W-2 forms submitted by an employer.

Fill out your filing forms w2w3 electronically online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Filing Forms W2W3 Electronically is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.