Get the free Best Self Directed IRA Providers, Custodian - New Direction ...

Show details

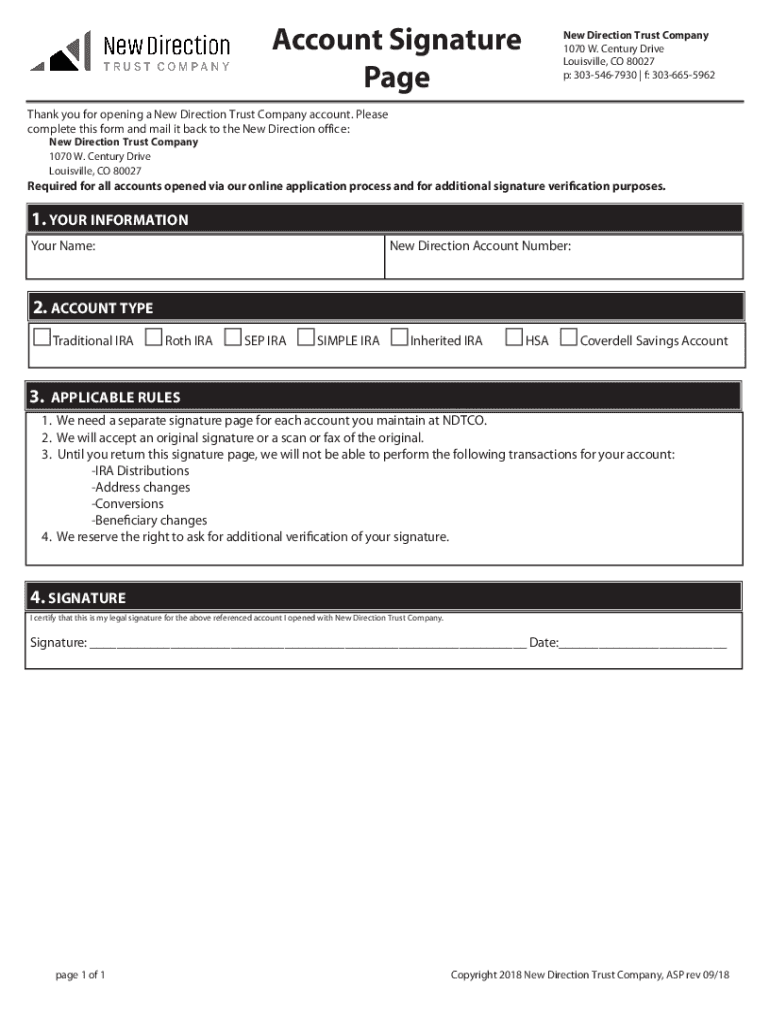

Account Signature Agnew Direction Trust Company 1070 W. Century Drive Louisville, CO 80027 p: 3035467930 f: 3036655962Thank you for opening a New Direction Trust Company account. Please complete this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign best self directed ira

Edit your best self directed ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your best self directed ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing best self directed ira online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit best self directed ira. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out best self directed ira

How to fill out best self directed ira

01

Gather all necessary documents, such as identification and tax records

02

Research and choose a reputable self-directed IRA custodian

03

Open a self-directed IRA account with the chosen custodian

04

Fund the account by transferring funds from other retirement accounts or making contributions

05

Identify and evaluate investment opportunities that are allowed within a self-directed IRA

06

Submit investment instructions to the custodian and complete required paperwork

07

Monitor and manage your investments within the self-directed IRA

08

Keep detailed records of all transactions and consult with professionals for tax and legal guidance

Who needs best self directed ira?

01

Individuals who want more control over their retirement investments

02

Investors looking for a wider range of investment options beyond traditional assets

03

People who have knowledge or interest in alternative investments

04

Those who want to diversify their retirement portfolio

05

Individuals looking to take advantage of potential tax benefits and grow their retirement savings

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send best self directed ira to be eSigned by others?

When you're ready to share your best self directed ira, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I edit best self directed ira on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing best self directed ira right away.

How do I fill out the best self directed ira form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign best self directed ira. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is best self directed ira?

The best self-directed IRA is an individual retirement account that allows investors to direct their own investments, including real estate, stocks, bonds, and other assets, without the restriction of a traditional IRA.

Who is required to file best self directed ira?

Anyone who opens and makes contributions to a self-directed IRA, or reports income from investments held within the account, is typically required to file the necessary IRS forms associated with the account.

How to fill out best self directed ira?

To fill out a self-directed IRA application, obtain the appropriate forms from the IRA custodian, provide personal information, choose your investment options, and sign the agreement.

What is the purpose of best self directed ira?

The purpose of a self-directed IRA is to provide individuals with more control over their retirement investments and to allow them to diversify their portfolios beyond traditional stocks and bonds.

What information must be reported on best self directed ira?

Information that must be reported includes contributions made, distributions taken, and any income or gains from investments held within the IRA.

Fill out your best self directed ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Best Self Directed Ira is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.