Get the free As Religiosity Changes, Donor Engagement Needs to Adapt

Show details

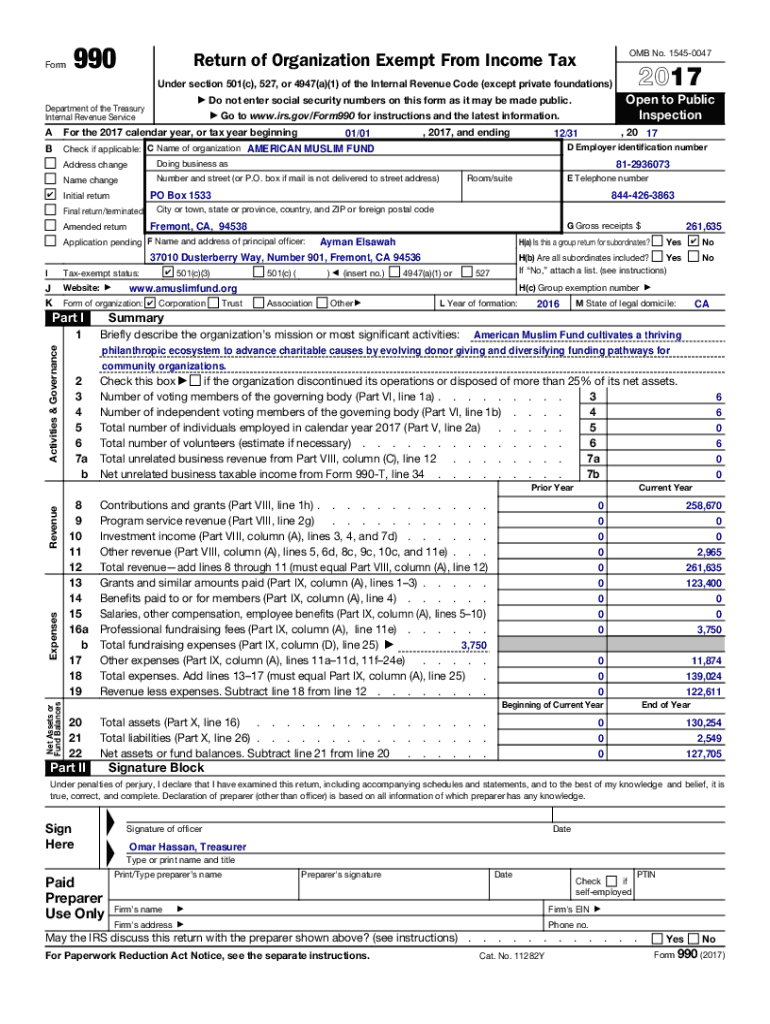

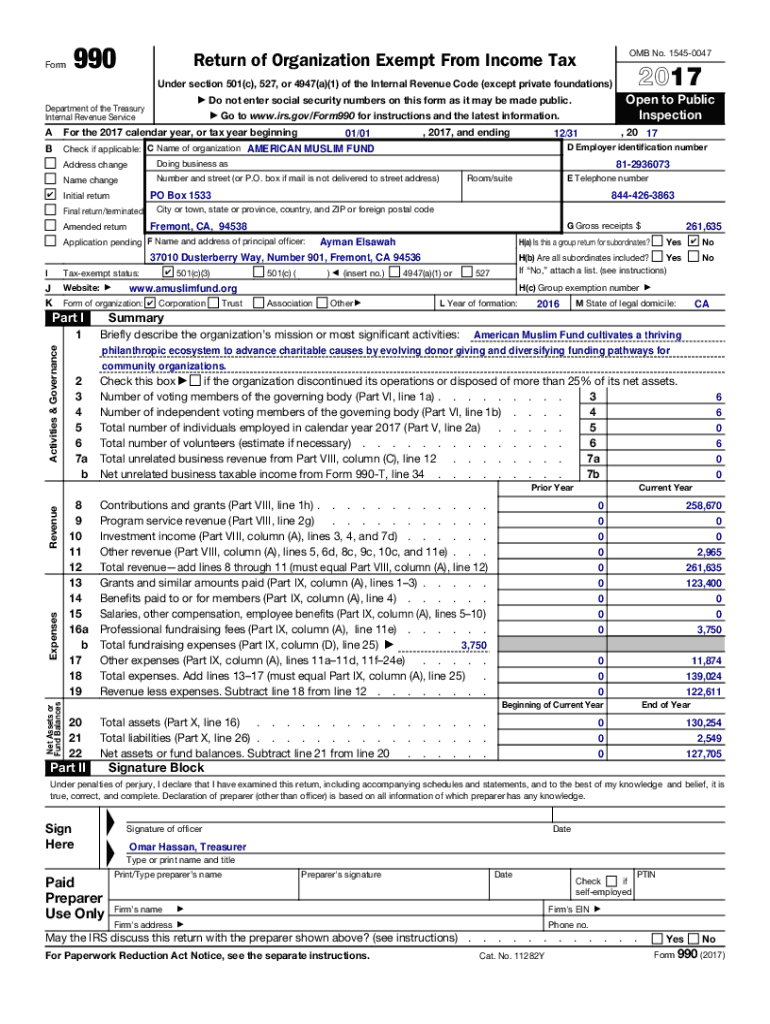

Form990OMB No. 15450047Return of Organization Exempt From Income Tax2017Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)

Department of the Treasury

Internal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign as religiosity changes donor

Edit your as religiosity changes donor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your as religiosity changes donor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing as religiosity changes donor online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit as religiosity changes donor. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out as religiosity changes donor

How to fill out as religiosity changes donor

01

Start by assessing your own religiosity and understanding the specific ways in which it has changed.

02

Research and identify organizations or causes that align with your new religious beliefs or lack thereof.

03

Review the donation guidelines and requirements of each organization or cause to ensure your contributions will be accepted.

04

Consider reallocating your donations from religious institutions to secular nonprofits or charities that promote causes important to you.

05

Take the time to educate yourself about the potential impact of your donations on different organizations and choose those that align with your values.

06

Regularly reassess your religiosity and revisit your donation choices to ensure they continue to reflect your beliefs as they evolve.

07

Consider seeking guidance from community leaders, experts, or fellow donors who have gone through similar religious changes.

08

Do not feel pressured to donate to organizations solely based on religious affiliations or traditions if they no longer resonate with your personal views.

09

Be open and candid about your changing religiosity with family, friends, or loved ones who may be impacted by your donation choices.

Who needs as religiosity changes donor?

01

Individuals who experience changes in their religiosity may need to explore new avenues for their philanthropic efforts.

02

People who are shifting away from religious affiliations or traditions may need to find organizations or causes that better align with their evolving beliefs.

03

Secular nonprofits or charities that focus on social justice, humanitarian causes, education, healthcare, environment, or other specific areas may be of interest to those experiencing changes in religiosity.

04

Individuals seeking to make a positive impact in their communities or society as a whole may need to find new outlets for their donations as religious affiliations no longer guide their philanthropic choices.

05

Those who want to ensure their donations are meaningful and aligned with their personal values as their religiosity changes would benefit from exploring and identifying organizations that resonate with their evolving beliefs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send as religiosity changes donor for eSignature?

Once your as religiosity changes donor is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the as religiosity changes donor electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your as religiosity changes donor in minutes.

How do I fill out the as religiosity changes donor form on my smartphone?

Use the pdfFiller mobile app to fill out and sign as religiosity changes donor. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is as religiosity changes donor?

As religiosity changes donor refers to the documentation or reporting necessary when an individual's or organization's religious affiliation or practices influence their philanthropic contributions, particularly concerning taxes or specific donor classifications.

Who is required to file as religiosity changes donor?

Individuals or organizations who claim tax deductions related to their religious contributions or those who operate under certain religious exemptions may be required to file documentation as religiosity changes donor.

How to fill out as religiosity changes donor?

To fill out as religiosity changes donor, individuals must typically complete specific forms provided by tax authorities, which include details about their religious contributions and any relevant changes in their religious affiliation.

What is the purpose of as religiosity changes donor?

The purpose of as religiosity changes donor is to maintain transparency in charitable giving, ensuring that tax deductions align with the donor's religious contributions and affiliations.

What information must be reported on as religiosity changes donor?

Information that must be reported includes the donor's current religious affiliation, details of contributions made to religious organizations, and any changes in their religious status that may affect their tax filings.

Fill out your as religiosity changes donor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

As Religiosity Changes Donor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.