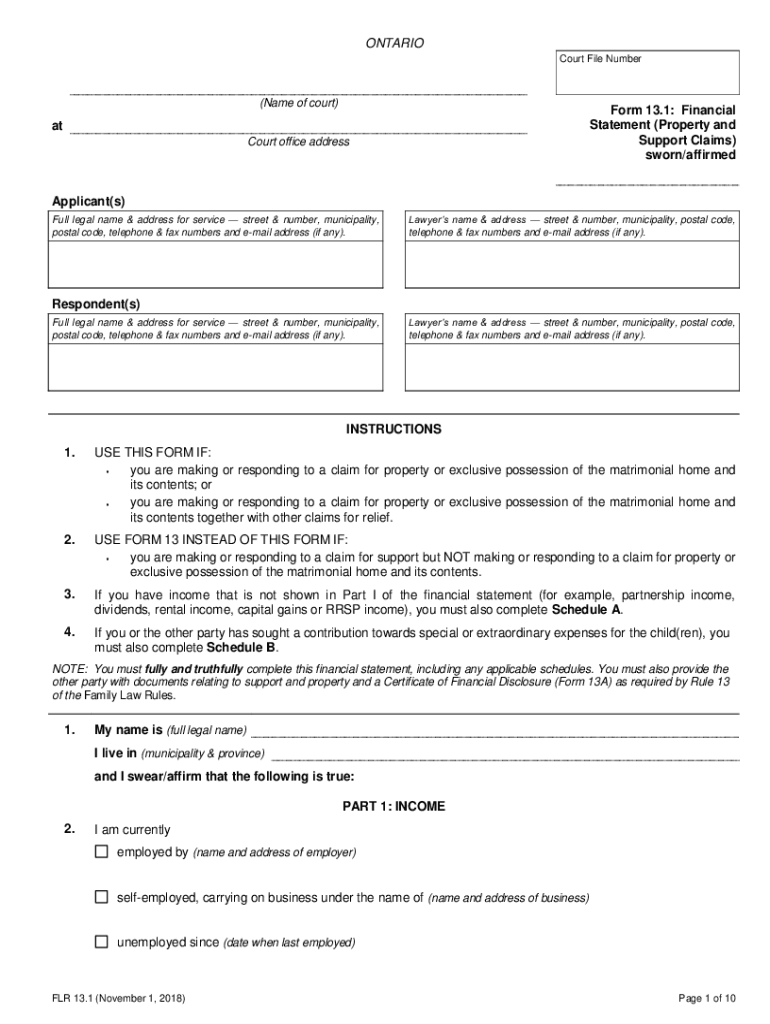

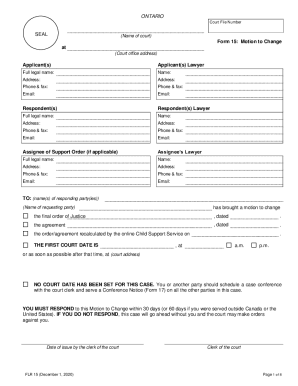

Who needs the Form 13.1?

This form is required in case an individual is making or responding to a claim for property or exclusive possessions of the matrimonial home. This form is usually sent during the divorce process.

What is the Form 13.1 for?

The Financial statement 13.1 in compliance with the family law of Ontario. As a rule, it’s required during a divorce process if the individual makes or responds to a claim for the property.

Is the Form 13.1 accompanied by other forms?

The person who sends the financial statement has to attach the copy of income tax return forms for the past three years and the copies of all the assessments received from the Canada Revenue Agency; or the statement from the Canada Revenue Agency that the individual hasn’t filed any income tax returns for the past 3 years; or a signed direction in Form 13A to the Taxation Branch of the Canada Revenue Agency for the disclosure of the tax returns to the other party; proof of the current income (paycheck stub, pension stub, employment insurance stub, or worker’s compensation stub).

How long does it take to fill the Form 13.1 out?

The estimated time of completing the Financial statement is two hours. The form should be completed on request or when there is a need.

What information should be provided in the Form 13.1?

The Financial statement is divided into the following parts:

- Personal information of the filler

- Income

- Other benefits

- Automatic deductions from income

- Total expenses

- Other income information

- Other income earners in the home

- Assets in and out of Ontario (land; general household items and vehicles; bank accounts, savings, securities and pensions; life and disability insurance; business interests; money owned; other property)

- Debts and other liabilities

- Property, debts and other liabilities on date of marriage

- Excluded property

- Disposed-of property

- Calculation of net family property

What do I do with the form after its completion?

The completed form is filed with the Superior Court of Justice in Ontario.