Get the free Taking a 401k loan or withdrawalWhat you should know ...

Show details

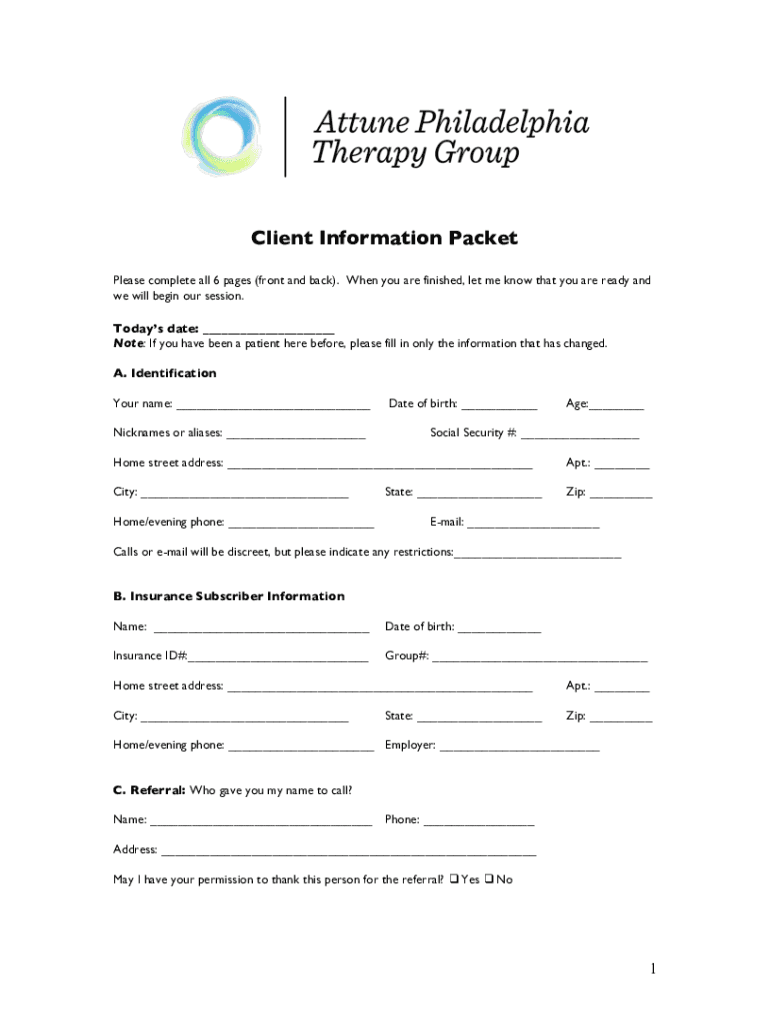

Client Information Packet Please complete all 6 pages (front and back). When you are finished, let me know that you are ready, and we will begin our session. Today's date: Note: If you have been a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taking a 401k loan

Edit your taking a 401k loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taking a 401k loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit taking a 401k loan online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit taking a 401k loan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taking a 401k loan

How to fill out taking a 401k loan

01

Contact your 401k plan administrator to find out if taking a loan is allowed and what the process entails.

02

Determine the maximum amount you are eligible to borrow based on the rules of your plan.

03

Fill out the necessary loan application form provided by your plan administrator.

04

Specify the loan amount you wish to borrow and the desired repayment period.

05

Provide any required documentation, such as proof of need for the loan or any supporting financial documents.

06

Review and sign the loan agreement, understanding the terms and conditions, including interest rate, repayment schedule, and any associated fees.

07

Wait for approval from your plan administrator, whom you may need to contact to check the status of your loan application.

08

Once approved, the funds will be disbursed to you, either in a lump sum or in installments, as per your request.

09

Use the loan amount for the intended purpose, such as paying off debts or covering financial emergencies.

10

Make timely loan repayments according to the agreed-upon schedule to avoid penalties or defaulting on the loan.

Who needs taking a 401k loan?

01

Anyone who is facing a financial need or emergency but wants to avoid early withdrawal penalties associated with a 401k.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send taking a 401k loan to be eSigned by others?

Once you are ready to share your taking a 401k loan, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit taking a 401k loan straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing taking a 401k loan.

Can I edit taking a 401k loan on an Android device?

With the pdfFiller Android app, you can edit, sign, and share taking a 401k loan on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is taking a 401k loan?

A 401k loan is a borrowing option that allows an employee to withdraw money from their 401k retirement savings plan, usually with the obligation to repay it with interest within a specified timeframe.

Who is required to file taking a 401k loan?

Typically, the employee taking a 401k loan is required to complete necessary forms as per the plan's guidelines, but no formal tax filings are required for the loan itself.

How to fill out taking a 401k loan?

To fill out a 401k loan application, the employee must complete the loan application form provided by their 401k plan administrator, including details like loan amount, repayment period, and purpose.

What is the purpose of taking a 401k loan?

The primary purpose of taking a 401k loan is to provide a source of funds for personal financial needs, such as purchasing a home, paying for education, or covering medical expenses.

What information must be reported on taking a 401k loan?

Generally, the loan amount, repayment schedule, and any applicable interest charges should be documented by the plan administrator, but this information is not reported on tax forms until there is a default or if the loan is deemed a distribution.

Fill out your taking a 401k loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taking A 401k Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.