Get the Gst Book 6th Edition cTax DeductionTaxesFree 30-day ...

Show details

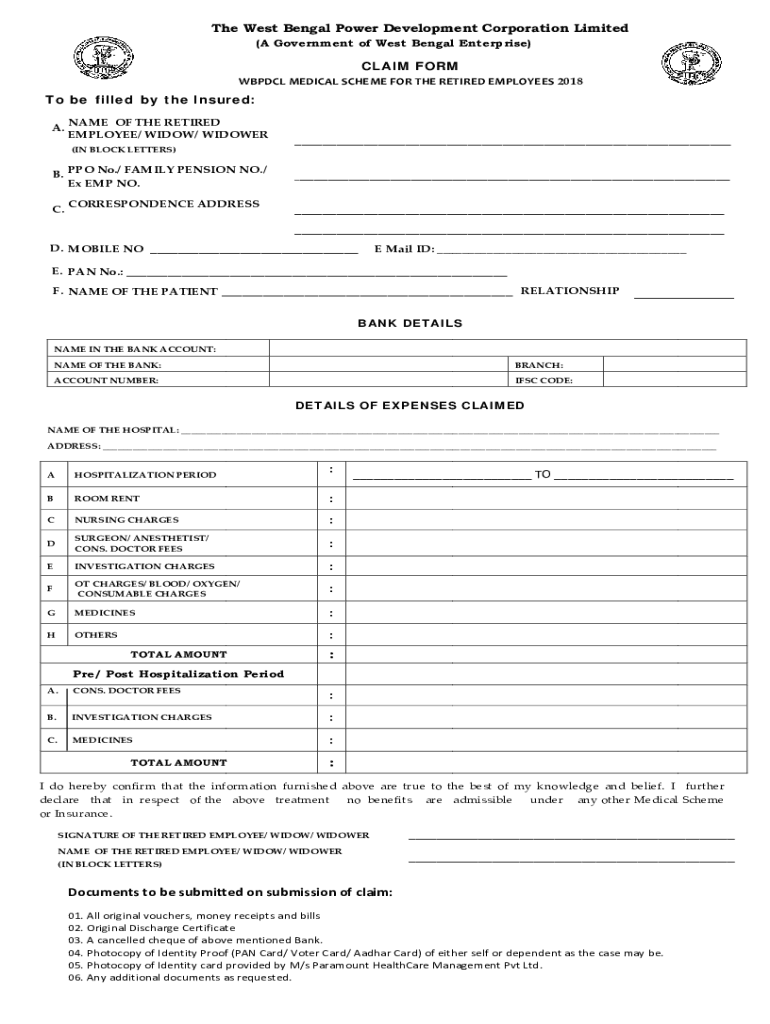

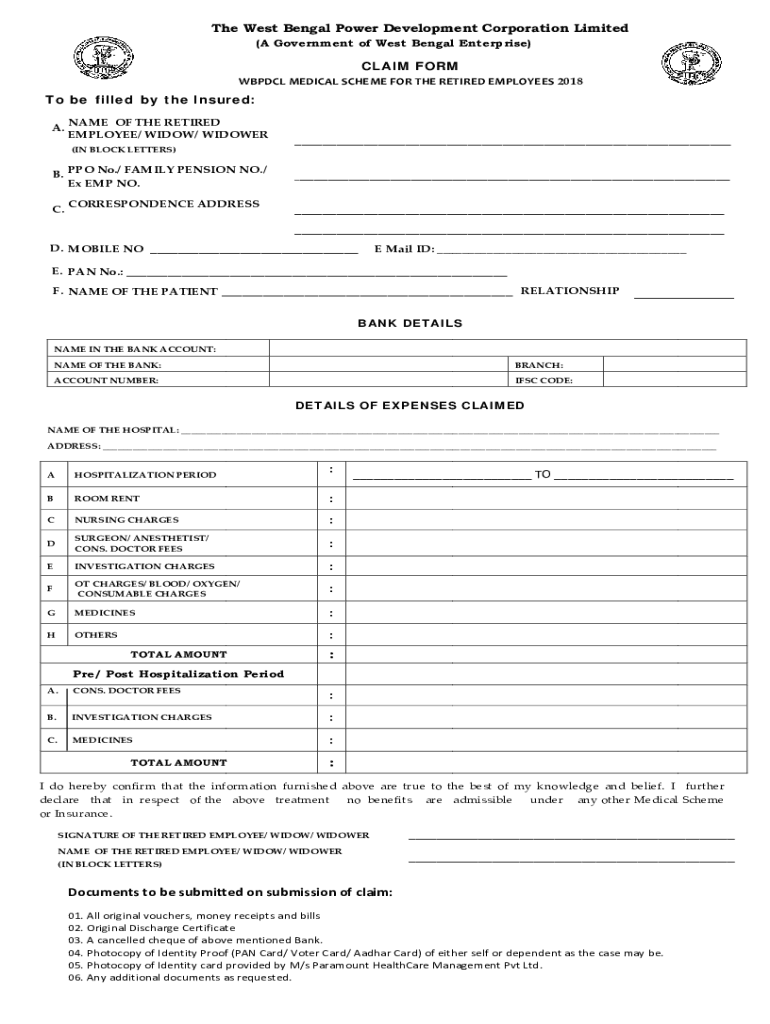

The West Bengal Power Development Corporation Limited (A Government of West Bengal Enterprise)CLAIM FORM ABDUL MEDICAL SCHEME FOR THE RETIRED EMPLOYEES 2018To be filled by the Insured: A.NAME OF THE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gst book 6th edition

Edit your gst book 6th edition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst book 6th edition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gst book 6th edition online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gst book 6th edition. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gst book 6th edition

How to fill out gst book 6th edition

01

To fill out GST Book 6th Edition, follow these points:

02

Collect all relevant financial documents such as invoices, receipts, and purchase records.

03

Open the GST Book and locate the first entry section.

04

Fill in the date of the transaction in the designated column.

05

Enter the transaction description or details in the appropriate field.

06

Identify whether the transaction is a purchase or sale and mark it accordingly.

07

Enter the amount of the transaction in the respective column.

08

Calculate the applicable GST amount and record it in the designated column.

09

Repeat steps 3-7 for each transaction conducted during the reporting period.

10

Summarize the total values at the end of each column for easy reference.

11

Double-check all entries for accuracy and make any necessary corrections.

12

Close the GST Book once all transactions have been recorded for the reporting period.

13

Store the GST Book in a safe and easily accessible location for future reference.

Who needs gst book 6th edition?

01

Businesses, individuals, or organizations that are required to comply with goods and services tax (GST) regulations in their respective jurisdictions need the GST Book 6th Edition.

02

Accountants, tax consultants, and financial professionals also need the GST Book to properly record and document GST transactions for their clients.

03

Small business owners, freelancers, and anyone involved in trading goods or services can utilize the GST Book to keep track of their GST obligations and ensure compliance with tax laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find gst book 6th edition?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the gst book 6th edition in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute gst book 6th edition online?

With pdfFiller, you may easily complete and sign gst book 6th edition online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out gst book 6th edition on an Android device?

Use the pdfFiller app for Android to finish your gst book 6th edition. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is gst book 6th edition?

The GST Book 6th Edition is a comprehensive guide that outlines the Goods and Services Tax (GST) framework, detailing regulations, compliance requirements, and procedures for businesses and tax professionals.

Who is required to file gst book 6th edition?

Individuals or businesses that are registered under the Goods and Services Tax and are required to report their GST transactions must file the GST Book 6th Edition.

How to fill out gst book 6th edition?

To fill out the GST Book 6th Edition, one must follow the instructions provided in the guide, accurately entering details regarding sales, purchases, and tax calculations, and ensuring all information aligns with the GST regulations.

What is the purpose of gst book 6th edition?

The purpose of the GST Book 6th Edition is to assist businesses in understanding their tax obligations and to ensure compliance with GST laws, thereby facilitating accurate reporting and tax management.

What information must be reported on gst book 6th edition?

Information that must be reported includes details of sales, purchases, GST collected and paid, input tax credits, and other relevant financial data that complies with GST requirements.

Fill out your gst book 6th edition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gst Book 6th Edition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.