Get the free Property Tax Appeal Tips to Reduce Your Property Tax BillWriting a Property Tax Appe...

Show details

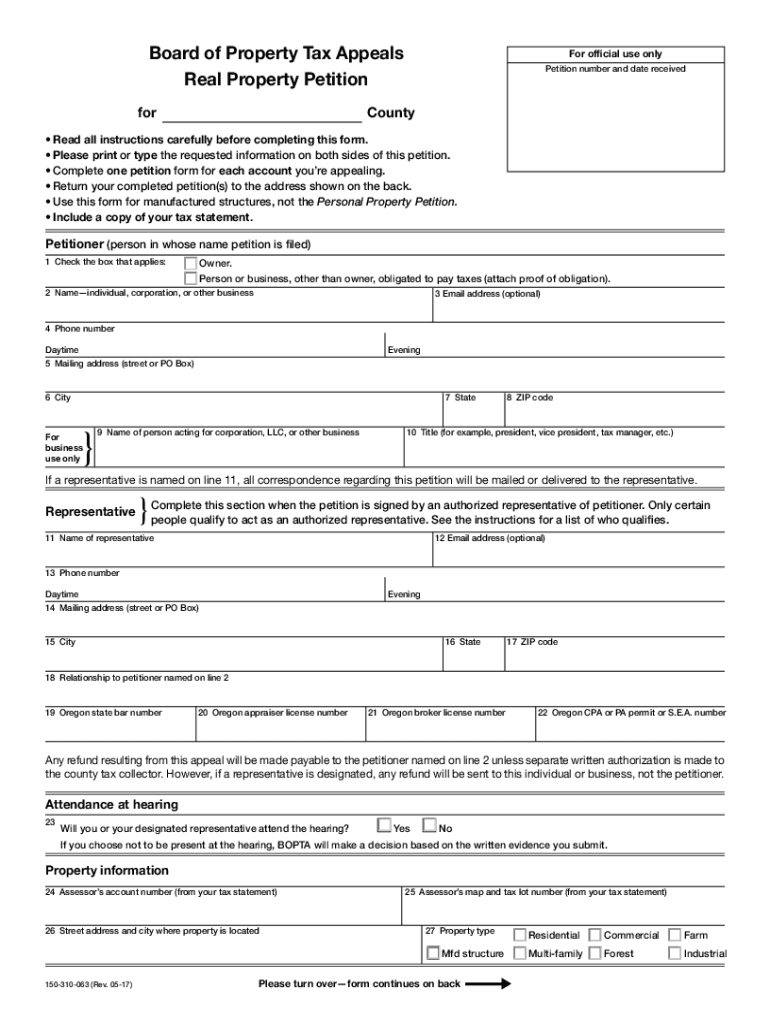

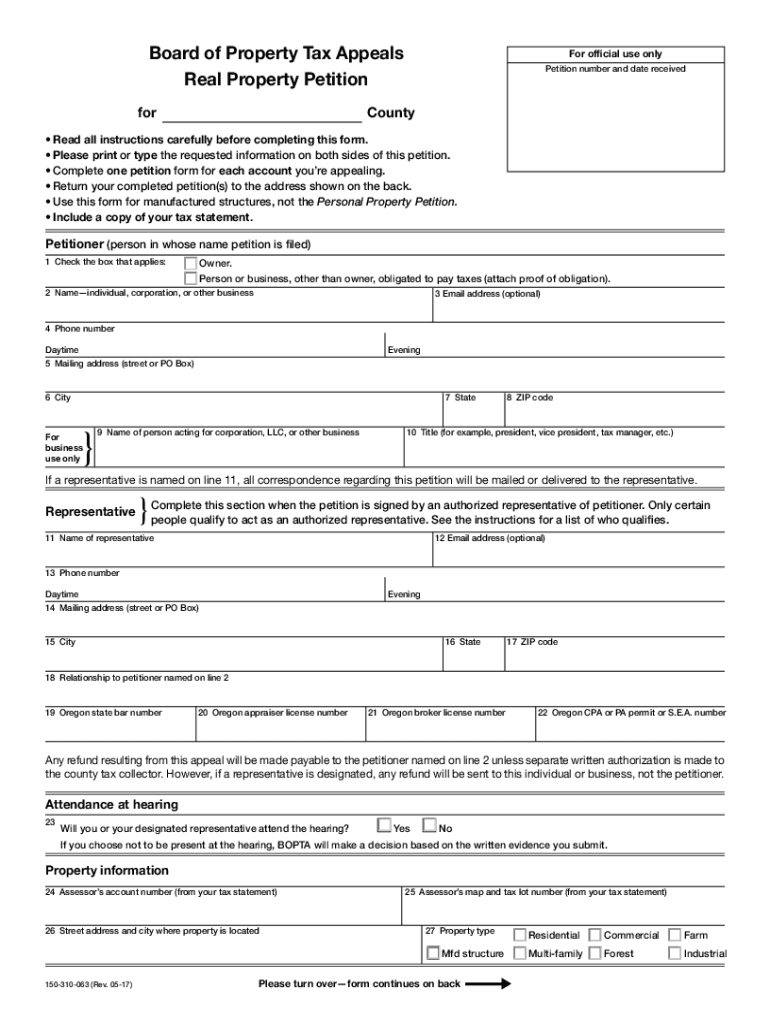

Clear corkboard of Property Tax Appeals Real Property Petition former official use only Petition number and date receivedCounty Read all instructions carefully before completing this form. Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax appeal tips

Edit your property tax appeal tips form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax appeal tips form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property tax appeal tips online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit property tax appeal tips. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax appeal tips

How to fill out property tax appeal tips

01

Gather all the necessary information about your property, including property assessment documents, tax bills, and any supporting evidence to support your appeal.

02

Research the property tax appeal process in your jurisdiction to understand the deadlines, required forms, and any specific guidelines or procedures.

03

Review your property assessment for errors or discrepancies. Look for inaccuracies in the property's square footage, number of bedrooms or bathrooms, and any other relevant details.

04

Collect evidence to support your appeal. This may include recent comparable sales data of similar properties in your area that have lower assessments, property appraisal reports, or expert opinions.

05

Prepare a written appeal letter outlining your reasons for the appeal and attaching all the supporting documentation. Clearly state the specific changes you are seeking in the property assessment.

06

Submit your property tax appeal letter and supporting documents to the appropriate tax assessment office within the designated timeframe. Keep copies of all your documents for your records.

07

Attend any scheduled hearings or meetings related to your appeal. Present your case clearly and concisely, providing any additional information or evidence that may strengthen your argument.

08

Follow up on your appeal to ensure it is being processed. Stay informed about any updates or decisions made by the tax assessment office.

09

If your appeal is successful and results in a lower property assessment, review your future tax bills to ensure that the corrected assessment is reflected in the calculations.

10

If your appeal is unsuccessful, consider seeking legal advice or exploring other avenues, such as filing a further appeal with a higher court or seeking alternative tax relief options.

Who needs property tax appeal tips?

01

Property owners who believe their property assessments are too high and want to potentially lower their property taxes.

02

Property owners who have recently experienced a decrease in their property's market value due to economic factors or specific circumstances.

03

Property owners who have evidence of errors or discrepancies in their property assessments and want to correct them.

04

Property owners who want to better understand the property tax appeal process to ensure they follow the necessary steps and meet the deadlines.

05

Property owners who are willing to invest the time and effort required to prepare a strong appeal and present their case effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the property tax appeal tips form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign property tax appeal tips and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit property tax appeal tips on an iOS device?

Use the pdfFiller mobile app to create, edit, and share property tax appeal tips from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Can I edit property tax appeal tips on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute property tax appeal tips from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is property tax appeal tips?

Property tax appeal tips are guidelines and advice on how to challenge and potentially reduce your property tax assessment by presenting valid evidence and arguments to the local tax authority.

Who is required to file property tax appeal tips?

Homeowners or property owners who believe their property has been overvalued or incorrectly assessed for tax purposes are required to file property tax appeal tips.

How to fill out property tax appeal tips?

To fill out property tax appeal tips, gather necessary documentation, complete the appeal form provided by your local tax authority, clearly state your case, and submit it with any supporting evidence.

What is the purpose of property tax appeal tips?

The purpose of property tax appeal tips is to help property owners understand the procedures and requirements for appealing their property tax assessments, ultimately aiming to obtain a fairer tax valuation.

What information must be reported on property tax appeal tips?

Information required includes your property details, the tax assessment amount, reasons for the appeal, supporting documents, and any comparative property values or assessments.

Fill out your property tax appeal tips online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Appeal Tips is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.