Get the free REVOLVING LOAN FUND (RLF) APPLICATION - Ontario ... - midf com

Show details

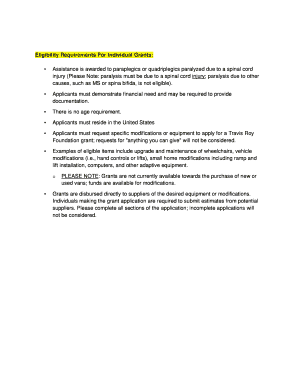

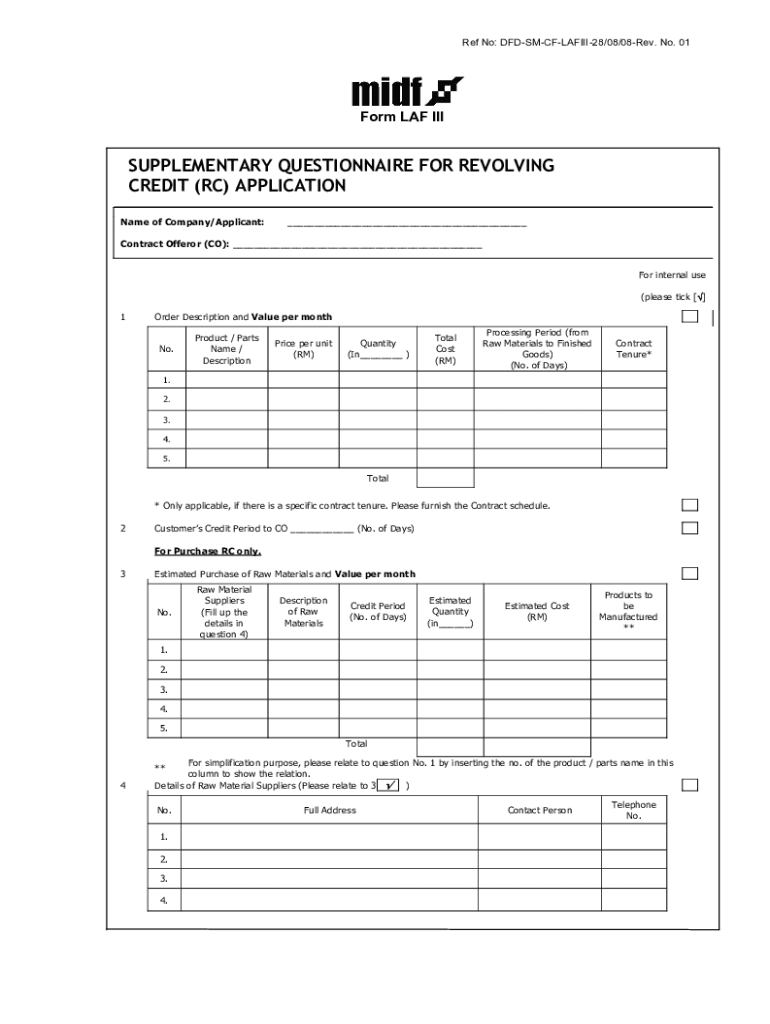

Ref No: DFDSMCFLAFIII28/08/08Rev. No. 01Form LAW SUPPLEMENTARY QUESTIONNAIRE FOR REVOLVING CREDIT (RC) APPLICATION Name of Company/Applicant: Contract Offer or (CO): For internal use (please tick

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revolving loan fund rlf

Edit your revolving loan fund rlf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revolving loan fund rlf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit revolving loan fund rlf online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit revolving loan fund rlf. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revolving loan fund rlf

How to fill out revolving loan fund rlf

01

Gather all the necessary documents and information, such as personal identification, financial statements, and business plans.

02

Research and identify the appropriate revolving loan fund (RLF) program that suits your needs and eligibility criteria.

03

Submit the completed application form along with the required documents to the designated authority or organization managing the RLF program.

04

Wait for the evaluation process to be conducted by the RLF program administrators or loan committee.

05

Attend any interviews or meetings required during the application evaluation process.

06

If approved, review and sign the loan agreement and any related legal documents.

07

Follow the disbursement instructions provided by the RLF program and utilize the funds only for the intended purpose.

08

Repay the loan according to the agreed-upon terms and conditions, including any interest and fees.

09

Keep records of all loan-related transactions and maintain communication with the RLF program administrators for reporting or compliance purposes.

10

Successfully completing the loan repayment will help build a positive credit history and may increase the chances of obtaining future funding from RLF programs or other financial institutions.

Who needs revolving loan fund rlf?

01

Small business owners who are unable to secure traditional bank loans or have limited access to capital.

02

Entrepreneurs or startups looking for initial funding to launch or expand their ventures.

03

Community development organizations seeking funds to revitalize or improve local economies.

04

Non-profit organizations and social enterprises aiming to finance projects aligned with their mission and social impact goals.

05

Individuals or businesses facing temporary financial difficulties and seeking short-term assistance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in revolving loan fund rlf without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your revolving loan fund rlf, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out revolving loan fund rlf using my mobile device?

Use the pdfFiller mobile app to fill out and sign revolving loan fund rlf on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete revolving loan fund rlf on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your revolving loan fund rlf, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is revolving loan fund rlf?

A revolving loan fund (RLF) is a financial mechanism that provides loans to support economic development while allowing the funds to be recycled as they are paid back, enabling continuous lending.

Who is required to file revolving loan fund rlf?

Typically, entities that manage or administer RLF programs, such as local governments, non-profit organizations, or other financial institutions, are required to file RLF documentation.

How to fill out revolving loan fund rlf?

To fill out the RLF documentation, applicants must complete forms detailing loan amounts, terms, borrower information, and project descriptions, along with any necessary financial statements.

What is the purpose of revolving loan fund rlf?

The purpose of RLF is to provide flexible financing for various projects that promote economic development, job creation, and local investment by making capital available to businesses and organizations.

What information must be reported on revolving loan fund rlf?

Reports must include borrower details, loan amounts, interest rates, repayment status, project outcomes, and overall financial performance of the fund.

Fill out your revolving loan fund rlf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revolving Loan Fund Rlf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.