Get the free RM50,000 per annum - mswg org

Show details

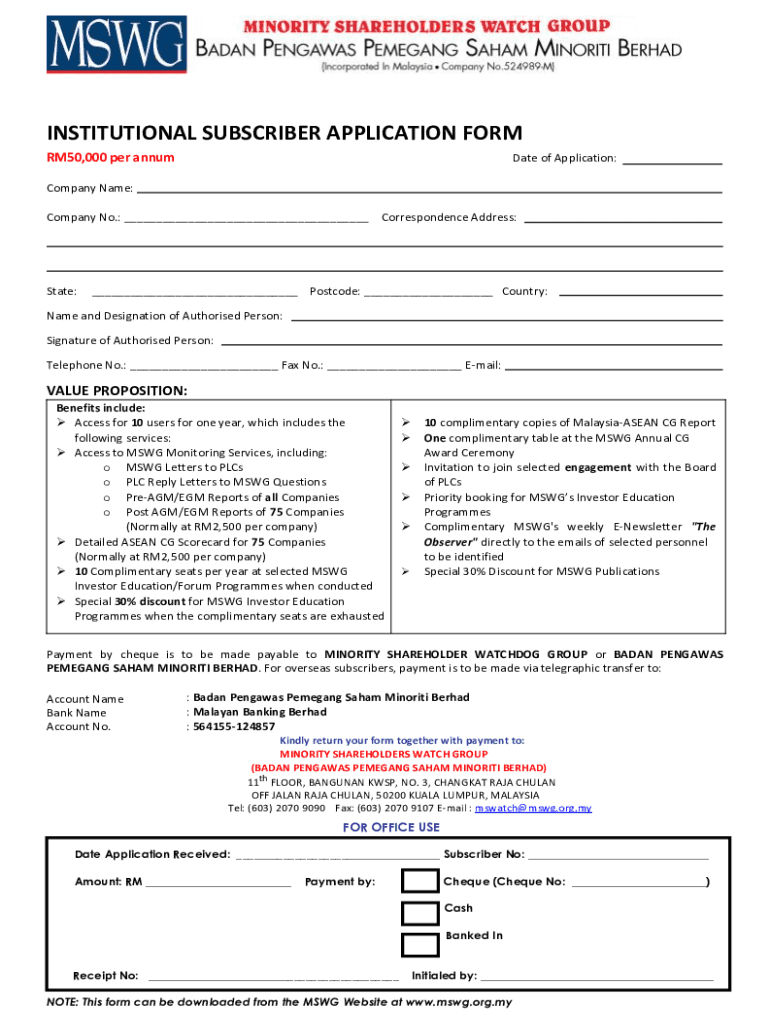

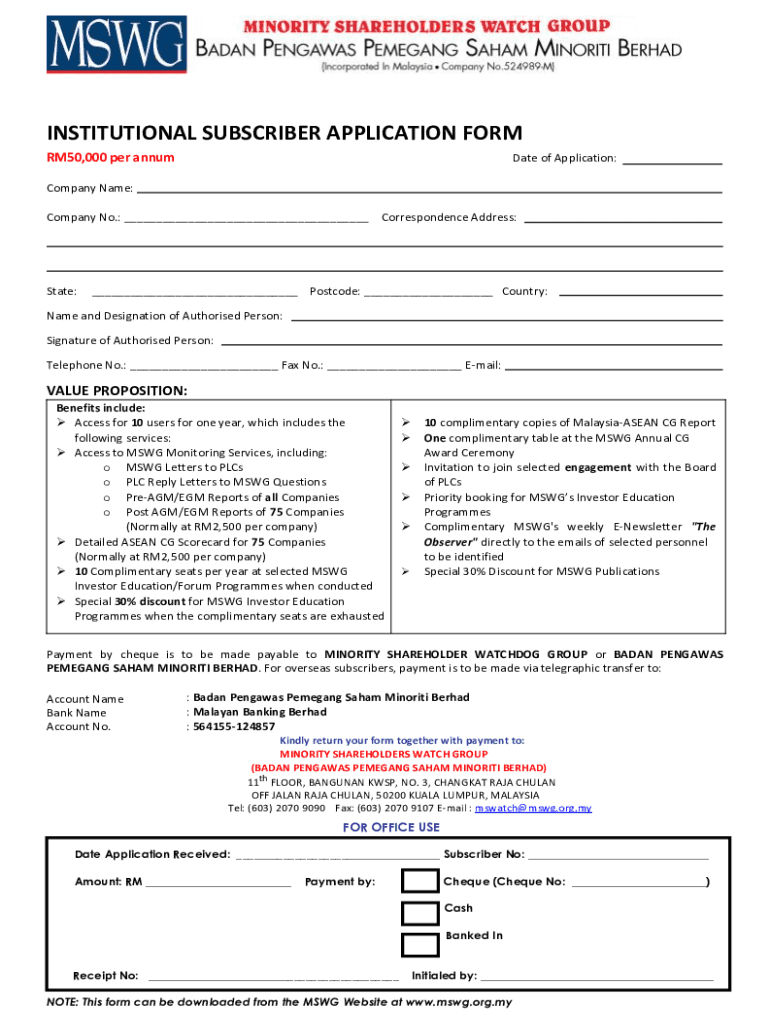

INSTITUTIONAL SUBSCRIBER APPLICATION FORM RM50,000 per animate of Application:Company Name: Company No.: Correspondence Address: State: Postcode: Country: Name and Designation of Authorized Person:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rm50000 per annum

Edit your rm50000 per annum form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rm50000 per annum form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rm50000 per annum online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rm50000 per annum. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rm50000 per annum

How to fill out rm50000 per annum

01

Determine your income sources: Before filling out the RM50000 per annum, you need to know the different sources of income you have. This can include salary, bonuses, investments, rental income, etc.

02

Calculate your total income: Add up all your income sources to determine your annual income. Make sure to include any additional income you expect to receive throughout the year.

03

Deduct your expenses: Subtract your expenses from your total income. This includes rent/mortgage, bills, groceries, transportation costs, and any other regular expenses you have.

04

Set financial goals: Determine what you want to achieve with the RM50000 per annum. It could be saving for a down payment, paying off debt, investing in a business, or any other financial goal.

05

Budget wisely: Create a budget plan to allocate the RM50000 per annum towards your financial goals. Allocate a certain percentage towards savings, investments, and debt repayment, based on your priorities.

06

Track your progress: Regularly monitor your finances and track your progress towards your financial goals. Make adjustments to your budget if needed, and celebrate milestones along the way.

07

Seek professional advice: If you're unsure about how to best utilize the RM50000 per annum, consider consulting with a financial advisor who can provide personalized guidance and help you optimize your financial strategy.

Who needs rm50000 per annum?

01

Individuals with financial goals: Anyone who has specific financial goals, such as saving for a house, starting a business, or paying off debt, can benefit from having RM50000 per annum to allocate towards those goals.

02

Those looking to build wealth: RM50000 per annum can be a significant amount of money to invest and grow wealth over time. Individuals interested in building long-term wealth and achieving financial independence can benefit from having this additional annual income.

03

People with unexpected expenses: Life is unpredictable, and having RM50000 per annum can provide a financial safety net for unexpected expenses, such as medical emergencies, home repairs, or vehicle breakdowns.

04

Individuals with high living costs: In regions with high living costs, such as major cities or areas with a high cost of living, having RM50000 per annum can help cover daily expenses and maintain a comfortable lifestyle.

05

Those looking to retire comfortably: RM50000 per annum can contribute to a more comfortable retirement by boosting retirement savings and ensuring a steady income stream during retirement years.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my rm50000 per annum in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign rm50000 per annum and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I edit rm50000 per annum on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share rm50000 per annum from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete rm50000 per annum on an Android device?

Complete rm50000 per annum and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is rm50000 per annum?

RM50000 per annum refers to an annual income or revenue threshold of 50,000 Malaysian Ringgit, which may have tax implications or regulatory requirements.

Who is required to file rm50000 per annum?

Individuals or entities whose annual income equals or exceeds RM50000 are typically required to file relevant tax returns or reports.

How to fill out rm50000 per annum?

To fill out the RM50000 per annum forms, provide accurate income details, necessary tax identifiers, and any deductions or credits applicable, ensuring compliance with local filing requirements.

What is the purpose of rm50000 per annum?

The purpose of RM50000 per annum is to assess tax obligations, determine eligibility for tax relief, and ensure compliance with fiscal regulations.

What information must be reported on rm50000 per annum?

Information that must be reported includes total income, deductions, taxable income, and any relevant financial statements or supporting documents.

Fill out your rm50000 per annum online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

rm50000 Per Annum is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.