Get the free State Property Tax Programs in the United States: A Review ...

Show details

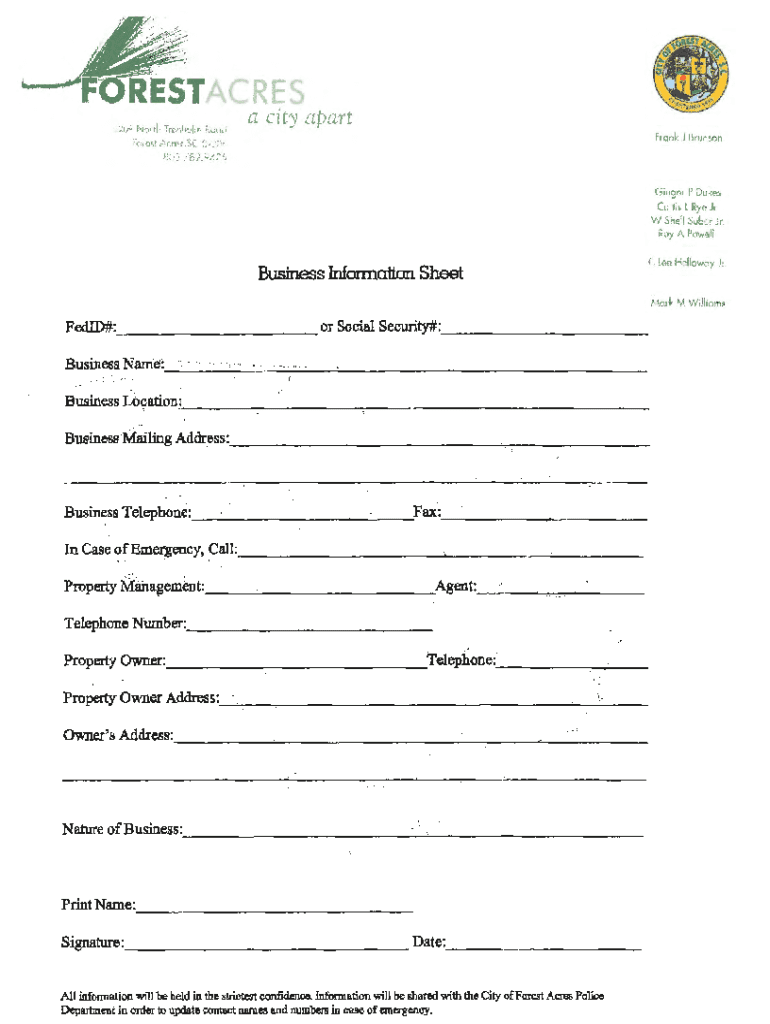

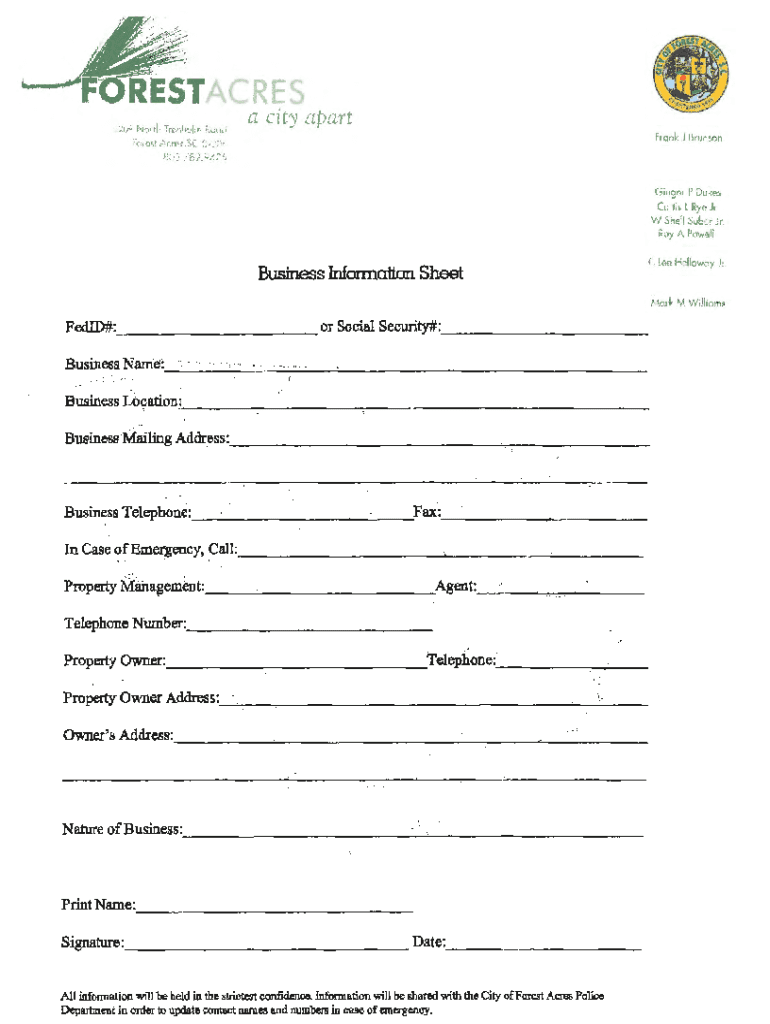

Format :.z(No, ti Try 'hl11 i Jul, 1a city apart Frank J Bronson:l 'C f, :, c, 1., ;’S ('. “H.:.61..., 4;. Ginger, P Duke Cut fa l Run, W Shells:r Jr. Roy A Pond i C:Lee.always. Business Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state property tax programs

Edit your state property tax programs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state property tax programs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state property tax programs online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit state property tax programs. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state property tax programs

How to fill out state property tax programs

01

Collect all necessary documents such as property deed, mortgage information, and previous tax statements.

02

Determine the deadline for filing property tax programs in your state.

03

Obtain the necessary tax forms from the local tax assessor's office or download them from the official website.

04

Carefully read the instructions provided with the tax forms to understand the requirements and eligibility criteria.

05

Fill out the tax forms accurately and completely. Provide all requested information such as property details, ownership information, and financial details.

06

Attach any supporting documents required, such as income verification or exemptions documentation.

07

Review the completed form and supporting documents to ensure accuracy and completeness.

08

Make a copy of the filled-out form and supporting documents for your records.

09

Submit the completed form and supporting documents to the designated tax assessor's office by the deadline. You may need to mail them or submit them in person.

10

Keep track of your submission and follow up with the tax assessor's office if necessary.

11

Pay any required fees or taxes associated with the property tax program, if applicable.

12

Await confirmation of acceptance or further instructions from the tax assessor's office regarding your property tax program.

13

Keep copies of all correspondence and records related to your property tax program for future reference.

14

If you have any questions or need assistance, contact the local tax assessor's office for guidance.

Who needs state property tax programs?

01

State property tax programs are typically needed by individuals who own real estate properties in a particular state.

02

Property owners who are required to pay property taxes based on their property's assessed value, as determined by local tax authorities, will need to fill out state property tax programs.

03

These programs serve to calculate the proper tax liability of property owners and ensure compliance with state tax laws.

04

Additionally, property owners who may be eligible for certain exemptions or deductions can benefit from state property tax programs as they provide a means to claim these tax benefits.

05

Therefore, anyone who owns real estate property and is subject to state property taxes should fill out these programs to fulfill their tax obligations and potentially reduce their tax liability through eligible exemptions or deductions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit state property tax programs from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including state property tax programs. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find state property tax programs?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific state property tax programs and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit state property tax programs on an iOS device?

You certainly can. You can quickly edit, distribute, and sign state property tax programs on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is state property tax programs?

State property tax programs are initiatives implemented by state governments to assess, manage, and collect property taxes. They may provide guidelines and rules for property valuation, tax rates, exemptions, and the overall administration of property tax systems.

Who is required to file state property tax programs?

Individuals and entities who own property subject to taxation within the state are typically required to file state property tax programs, which can include homeowners, businesses, and landlords.

How to fill out state property tax programs?

To fill out state property tax programs, individuals usually need to gather relevant property information, complete the required forms accurately by providing requested details, and submit them to the appropriate state tax authority, either electronically or by mail, before the deadline.

What is the purpose of state property tax programs?

The purpose of state property tax programs is to ensure the fair assessment and collection of property taxes, providing essential revenue for local and state governments to fund public services such as education, infrastructure, and public safety.

What information must be reported on state property tax programs?

Typically, the information that must be reported includes property details like ownership, property type, assessed value, exemptions claimed, and contact information of the property owner.

Fill out your state property tax programs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Property Tax Programs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.