Get the free Lenders Single Interest Loss Information Form. Conversion (Skip) Losses Only

Show details

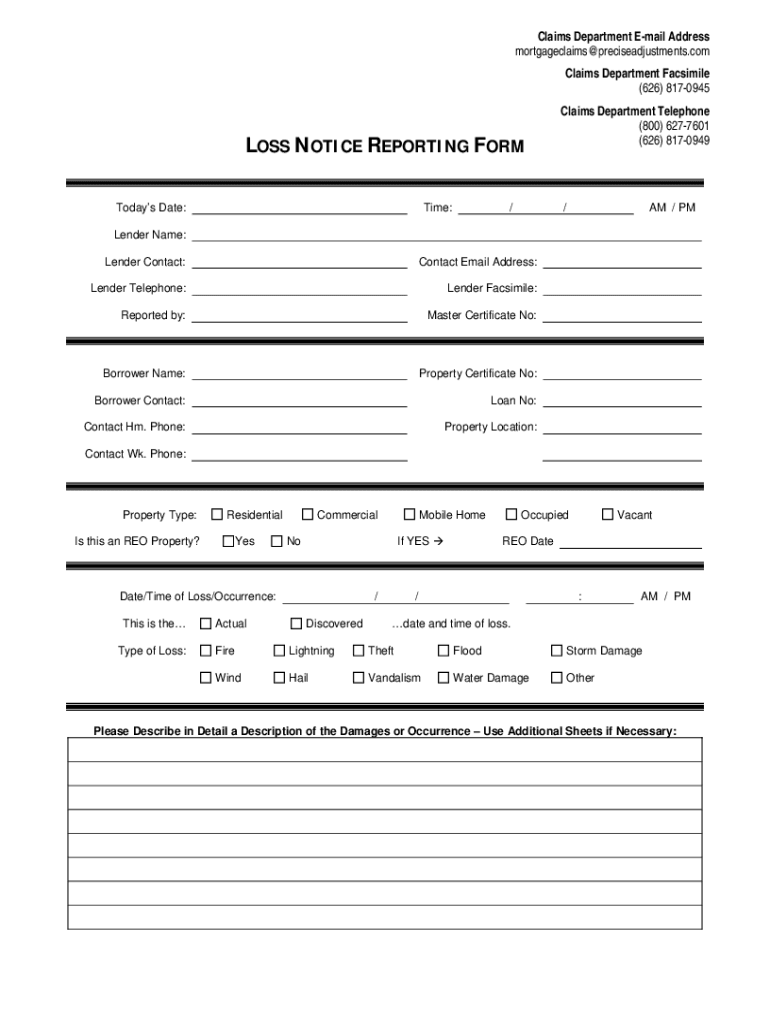

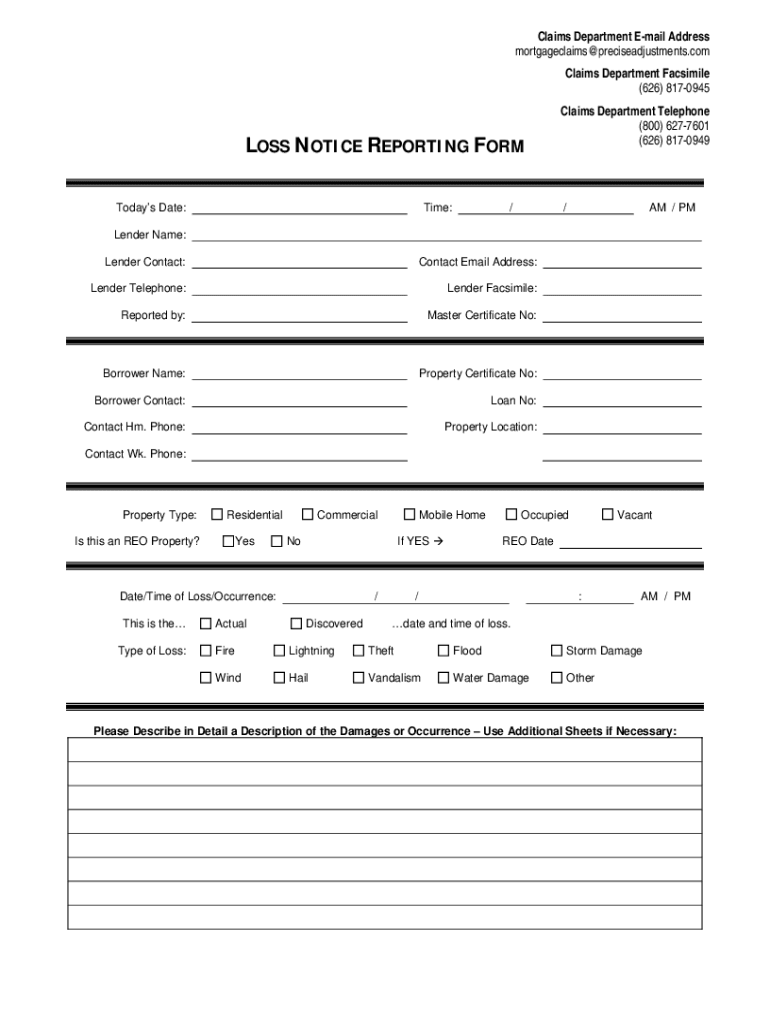

Claims Department Email Address

mortgageclaims@preciseadjustments.com

Claims Department Facsimile

(626) 8170945LOSS NOTICE REPORTING FORM

Today's Date:Time:/Claims Department Telephone

(800) 6277601

(626)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lenders single interest loss

Edit your lenders single interest loss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lenders single interest loss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lenders single interest loss online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit lenders single interest loss. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lenders single interest loss

How to fill out lenders single interest loss

01

To fill out lenders single interest loss, follow these steps:

02

Start by gathering all the necessary information and documents, such as insurance policies, loan agreements, and relevant financial records.

03

Identify the specific lender or lenders that need to be included in the loss report.

04

Determine the time period for which the loss report will be prepared.

05

Calculate the total amount of loss incurred by each lender during the specified time period.

06

Fill out the loss report form, providing accurate details about each lender's loss, including the amount, date, and cause of the loss.

07

Review and double-check the completed loss report for any errors or missing information.

08

Submit the filled-out loss report to the appropriate authority or organization as required.

Who needs lenders single interest loss?

01

Lenders single interest loss is needed by financial institutions that provide loans and have a vested interest in protecting their investment.

02

It is particularly relevant for lenders who finance assets that are prone to loss or damage, such as vehicles, equipment, or real estate.

03

Lenders may require lenders single interest loss to assess the level of risk associated with their loan portfolio and make informed decisions regarding insurance coverage and loan terms.

04

Additionally, lenders may need this information for accounting purposes, regulatory compliance, or to file insurance claims in the event of a loss.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my lenders single interest loss in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your lenders single interest loss along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an electronic signature for the lenders single interest loss in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your lenders single interest loss in seconds.

How do I fill out lenders single interest loss on an Android device?

Use the pdfFiller app for Android to finish your lenders single interest loss. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is lenders single interest loss?

Lender's single interest loss refers to a type of insurance coverage that protects lenders in the event of loss or damage to collateralized property due to incidents such as theft, fire, or accidents. It ensures that the lender recoups its investment even if the borrower defaults or the collateral is compromised.

Who is required to file lenders single interest loss?

Typically, lenders or financial institutions that have financed loans or leases secured by collateralized assets are required to file lender's single interest loss claims. This is to ensure they are protected against potential losses.

How to fill out lenders single interest loss?

To fill out a lender's single interest loss claim, the filer must gather relevant information such as the loan details, insured amounts, collateral description, and any loss or damage details. The appropriate form must then be completed accurately and submitted to the insurance provider.

What is the purpose of lenders single interest loss?

The purpose of lender's single interest loss insurance is to protect the financial interests of lenders by providing coverage against losses incurred from damage or loss of collateralized assets, ensuring they do not suffer financial setbacks due to borrower default or asset destruction.

What information must be reported on lenders single interest loss?

The information that must be reported includes details about the borrower, account numbers, descriptions of the collateral, nature of the loss, date of the event, and any relevant supporting documentation such as police reports or repair estimates.

Fill out your lenders single interest loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lenders Single Interest Loss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.