Get the free 529 College Savings Plans for Your Future ... - Bright Start

Show details

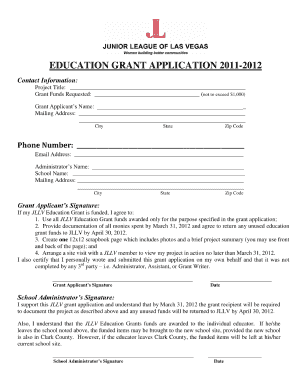

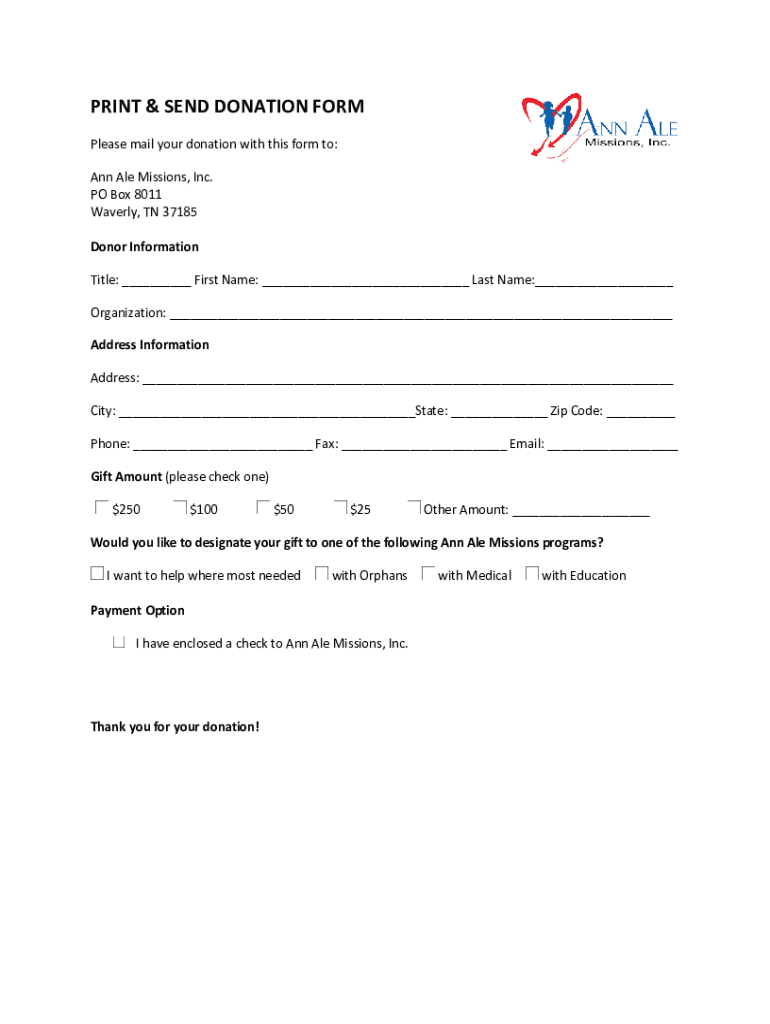

PRINT & SEND DONATION FORM Please mail your donation with this form to: Ann Ale Missions, Inc. PO Box 8011 Waverley, TN 37185 Donor Information Title: First Name: Last Name: Organization: Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 529 college savings plans

Edit your 529 college savings plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 529 college savings plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 529 college savings plans online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 529 college savings plans. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 529 college savings plans

How to fill out 529 college savings plans

01

Step 1: Gather the necessary documents such as your Social Security Number, address, and phone number.

02

Step 2: Research and choose a 529 college savings plan that best fits your needs and goals.

03

Step 3: Open an account with the chosen plan provider.

04

Step 4: Provide the required personal information and beneficiary details, such as the student's name and date of birth.

05

Step 5: Determine the contribution amount and funding method, whether it's through automatic deductions or manual contributions.

06

Step 6: Set up a payment schedule if desired, whether it's monthly, quarterly, or yearly.

07

Step 7: Review and sign the necessary paperwork, including the terms and conditions of the plan.

08

Step 8: Make your initial contribution to the 529 college savings plan.

09

Step 9: Monitor your account regularly and consider adjusting your contributions or investment options as needed.

10

Step 10: Stay informed about any changes or updates regarding the 529 college savings plan and the funds' performance.

Who needs 529 college savings plans?

01

Anyone who wants to save for a child's or their own future higher education expenses can benefit from a 529 college savings plan.

02

Parents or guardians, grandparents, relatives, or even individuals planning to pursue further education themselves can utilize these plans.

03

It is particularly useful for those who want to ensure that funds are available for education purposes and want to take advantage of potential tax benefits.

04

529 college savings plans are a popular choice for individuals who wish to save specifically for college expenses and want their investments to grow tax-free.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 529 college savings plans to be eSigned by others?

When you're ready to share your 529 college savings plans, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make edits in 529 college savings plans without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing 529 college savings plans and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit 529 college savings plans on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share 529 college savings plans from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is 529 college savings plans?

A 529 college savings plan is a tax-advantaged savings plan designed to encourage saving for future education costs. It is named after Section 529 of the Internal Revenue Code.

Who is required to file 529 college savings plans?

There is generally no requirement to file a 529 college savings plan; however, account owners (usually parents or guardians) must report contributions and withdrawals for tax purposes.

How to fill out 529 college savings plans?

To fill out a 529 college savings plan, you typically need to complete an application provided by the plan administrator, providing personal information, beneficiary details, and contribution amounts.

What is the purpose of 529 college savings plans?

The purpose of 529 college savings plans is to help families save for future educational expenses, including tuition, fees, room and board, and other qualified expenses.

What information must be reported on 529 college savings plans?

Information that must be reported includes contributions, distributions, and the account balance, as well as any earnings that may be subject to tax.

Fill out your 529 college savings plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

529 College Savings Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.