Get the free First Mortgage - Columbus Metro

Show details

MORTGAGE APPLICATIONSUBMIT TO: Jennifer Manatee, Loan Specialist NLS# 264583 Email: manatee columbusmetro.org Direct: 6142390210 Ext. 3026How were you referred to our mortgage options: Are you interested

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign first mortgage - columbus

Edit your first mortgage - columbus form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your first mortgage - columbus form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing first mortgage - columbus online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit first mortgage - columbus. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out first mortgage - columbus

How to fill out first mortgage - columbus

01

To fill out a first mortgage in Columbus, follow these steps:

02

Obtain the required documents: You will need to gather various documents such as proof of income, employment history, identification, and property information.

03

Contact a lender: Research and get in touch with a reputable lender in Columbus who can assist you with the mortgage process.

04

Meet the lender: Schedule a meeting with your chosen lender to discuss your financial situation, preferences, and goals.

05

Complete an application: Fill out the mortgage application provided by the lender, providing accurate and detailed information.

06

Submit the necessary documentation: Provide the lender with the required documents, such as bank statements, tax returns, pay stubs, and property details.

07

Await pre-approval: The lender will evaluate your application and documentation to determine if you meet their criteria for pre-approval.

08

Obtain an appraisal: The lender may require an appraisal to determine the value of the property you plan to purchase.

09

Review and sign the mortgage agreement: Once you are pre-approved, carefully review the terms and conditions of the mortgage agreement. Seek legal advice if needed.

10

Complete mortgage underwriting: The lender will thoroughly analyze your financial information, credit history, and property details to finalize the mortgage underwriting process.

11

Schedule a closing: Set a date for the closing of the mortgage, where you will sign the final paperwork and receive the funds.

12

Attend the closing: On the scheduled date, attend the closing meeting with the lender and other parties involved, such as a real estate agent and attorney, to complete the transaction.

13

Make regular mortgage payments: Once the mortgage is finalized, ensure you make timely payments as agreed upon in the mortgage agreement.

Who needs first mortgage - columbus?

01

First mortgage in Columbus is needed by individuals or families who are looking to purchase a property for the first time.

02

It is also relevant for those who are looking to refinance their current mortgage in Columbus.

03

First-time homebuyers, real estate investors, or individuals relocating to Columbus may all require a first mortgage to finance their property purchase.

04

It is essential to meet the financial qualifications set by lenders and have a stable income to qualify for a first mortgage in Columbus.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send first mortgage - columbus for eSignature?

first mortgage - columbus is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for the first mortgage - columbus in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your first mortgage - columbus.

Can I edit first mortgage - columbus on an Android device?

You can make any changes to PDF files, like first mortgage - columbus, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

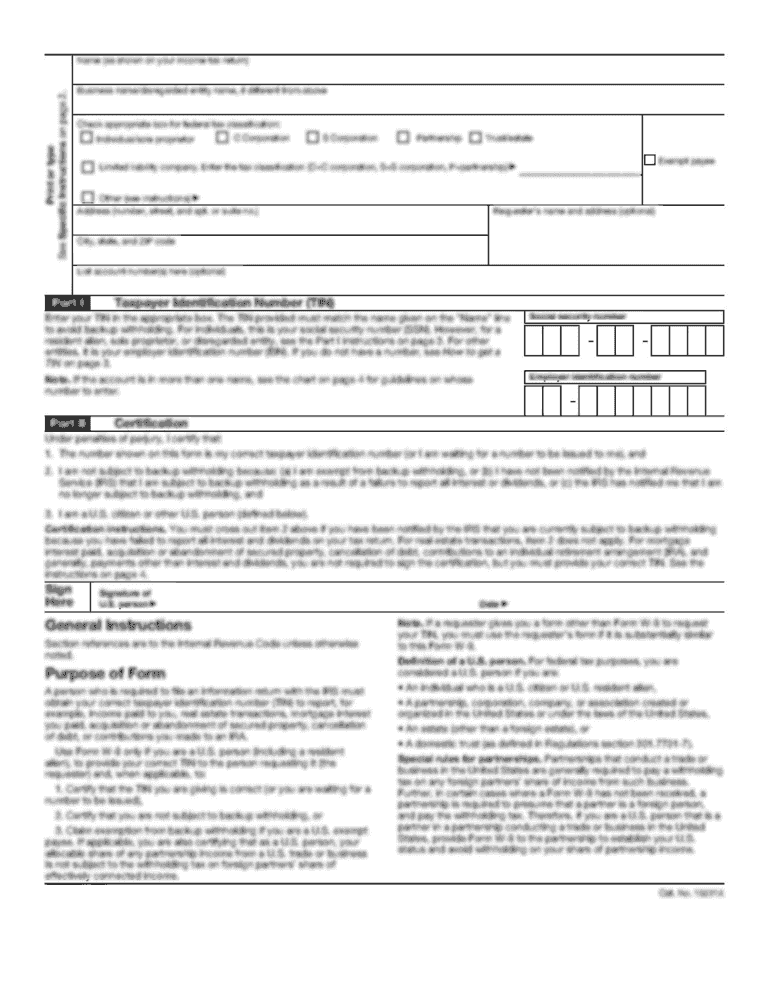

What is first mortgage - columbus?

A first mortgage in Columbus refers to a loan secured by real property, which has primary lien status over any other mortgages on the same property. It is typically used by homebuyers to purchase a property.

Who is required to file first mortgage - columbus?

Individuals or entities that secure a first mortgage on a property in Columbus are required to file the mortgage documents with the appropriate county recording office.

How to fill out first mortgage - columbus?

To fill out a first mortgage in Columbus, borrowers need to complete a mortgage application form, provide necessary documents such as income verification and credit history, and ensure that all required fields related to the property and borrower information are accurately filled.

What is the purpose of first mortgage - columbus?

The purpose of a first mortgage in Columbus is to provide financing for the purchase of real estate by using the property as collateral, ensuring the lender has a legal claim to the property in case of default.

What information must be reported on first mortgage - columbus?

The information that must be reported on a first mortgage in Columbus includes the borrower's and lender's names, the property's legal description, loan amount, interest rate, and terms, as well as any liens or encumbrances.

Fill out your first mortgage - columbus online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

First Mortgage - Columbus is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.