Get the free Credit Card Fraud Detection with Artificial Immune System - IME-USP - ime usp

Show details

Credit Card Fraud Detection with Art?coal Immune System Manuel Fernando Alonso Gadi1,2, Midi Wang3 and Clear Pereira do Lago1 1 2 Department de Ci NCAA de Computa AO e c Institute de Matem Tina e

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card fraud detection

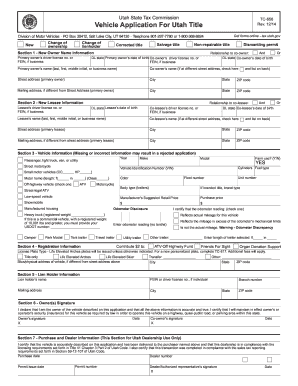

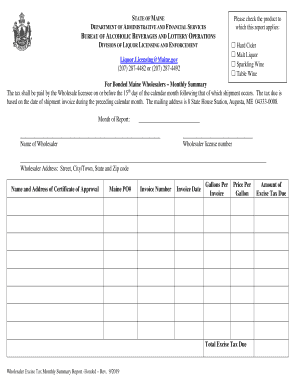

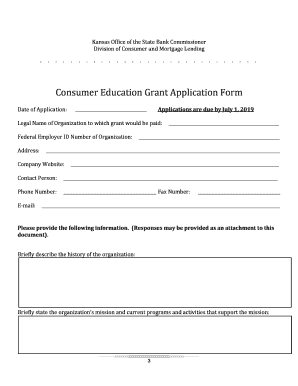

Edit your credit card fraud detection form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card fraud detection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit card fraud detection online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit card fraud detection. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card fraud detection

How to fill out credit card fraud detection:

01

Obtain the necessary information: Gather all relevant details such as the customer's name, credit card number, transaction amount, and any suspicious activity associated with the transaction.

02

Analyze transaction patterns: Compare the current transaction with the customer's previous purchase history, spending patterns, and typical transaction behavior. Look for any deviations or anomalies that could indicate potential fraud.

03

Utilize fraud detection tools: Make use of advanced fraud detection software and algorithms to analyze the transaction in real-time. These tools can identify patterns, flag suspicious activities, and calculate risk scores to determine the likelihood of fraud.

04

Review additional security measures: Consider implementing additional security measures such as address verification, CVV verification, and two-factor authentication to further protect against fraudulent transactions.

05

Investigate suspicious cases: If the fraud detection system raises an alert or flags a transaction as potentially fraudulent, investigate further by contacting the customer directly or reaching out to the credit card issuer for assistance.

06

Take necessary actions: Depending on the severity of the fraud risk, take appropriate actions such as blocking the transaction, placing the card on hold, or contacting law enforcement if necessary.

07

Monitor and adapt: Continuously monitor transactional data, analyze fraud patterns, and adapt fraud detection strategies accordingly. Stay updated with the latest industry standards and tools to effectively combat credit card fraud.

Who needs credit card fraud detection:

01

E-commerce businesses: Online retailers and service providers who accept credit card payments are particularly susceptible to credit card fraud. Implementing fraud detection measures safeguards their business and reduces financial losses.

02

Financial institutions: Banks, credit card companies, and other financial institutions need credit card fraud detection to protect their customers and ensure the integrity of their payment systems. Detecting and preventing fraudulent transactions is crucial for maintaining trust and security.

03

Customers: Credit card fraud detection benefits customers by providing them with confidence in conducting secure transactions. It helps prevent unauthorized charges, protects their personal information, and minimizes the inconvenience caused by fraudulent activity on their credit cards.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credit card fraud detection?

Credit card fraud detection is the process of identifying and preventing fraudulent activities related to credit card transactions.

Who is required to file credit card fraud detection?

Credit card issuers, merchants, and organizations involved in payment processing are required to file credit card fraud detection reports.

How to fill out credit card fraud detection?

Credit card fraud detection reports can typically be filled out online through secure platforms provided by payment processing companies or financial institutions.

What is the purpose of credit card fraud detection?

The purpose of credit card fraud detection is to protect consumers and businesses from financial losses and maintain the security of credit card transactions.

What information must be reported on credit card fraud detection?

Credit card fraud detection reports typically require information such as transaction details, suspicious activities, and any measures taken to prevent fraud.

How can I modify credit card fraud detection without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your credit card fraud detection into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit credit card fraud detection straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit credit card fraud detection.

How do I fill out credit card fraud detection using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign credit card fraud detection and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your credit card fraud detection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Fraud Detection is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.