Get the free MONEY MANAGEMENT TRUST

Show details

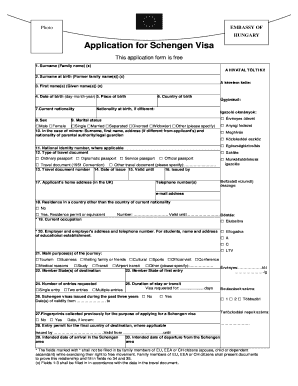

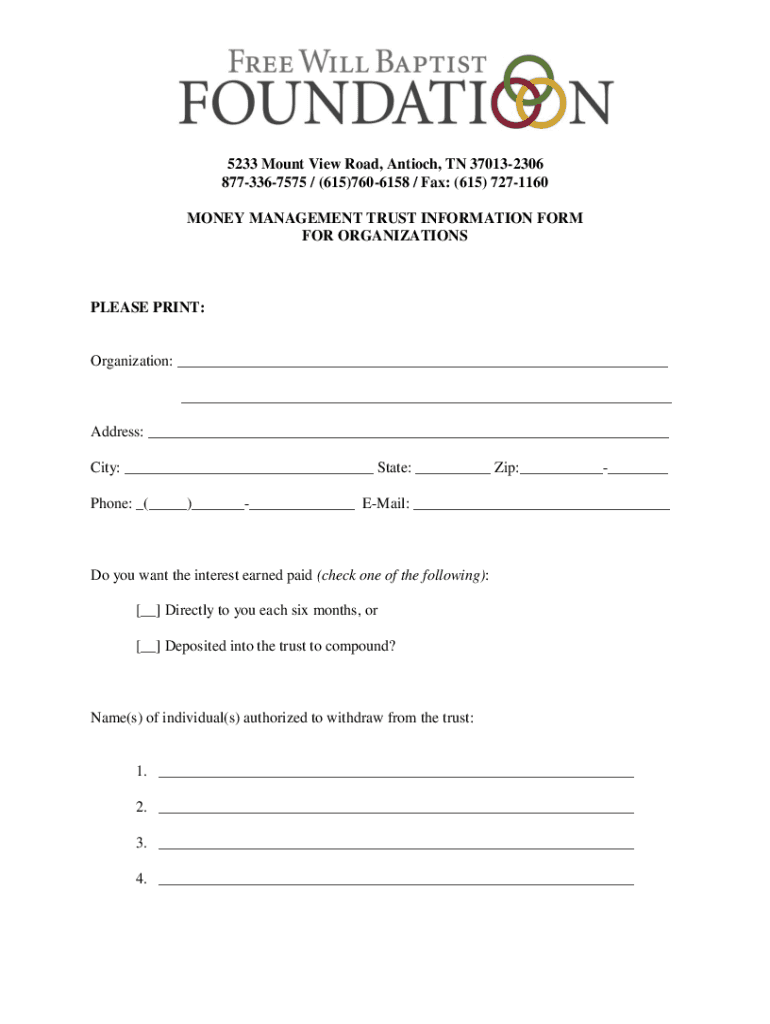

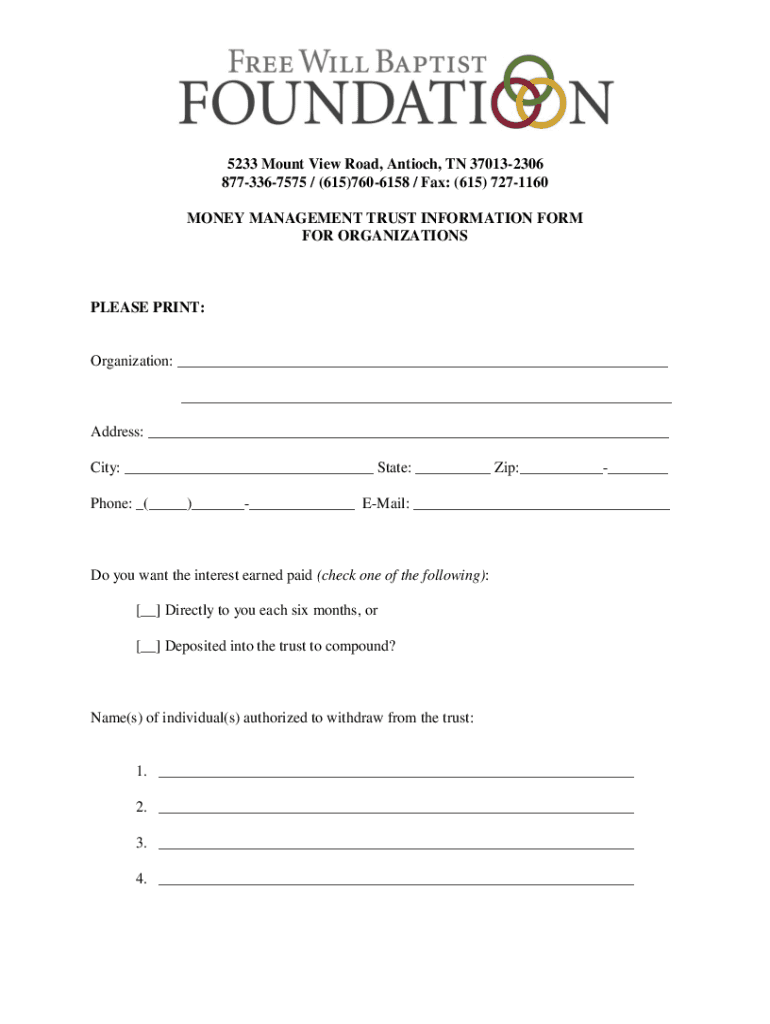

5233 Mount View Road, Antioch, TN 370132306 8773367575 / (615)7606158 / Fax: (615) 7271160 MONEY MANAGEMENT TRUST INFORMATION FORM FOR ORGANIZATIONSPLEASE PRINT:Organization: Address: City: State:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign money management trust

Edit your money management trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your money management trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing money management trust online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit money management trust. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out money management trust

How to fill out money management trust

01

Obtain the necessary documents: Gather all the required paperwork, including the trust agreement, financial statements, and any other relevant documents.

02

Identify the trust assets: Determine the assets that will be managed under the money management trust. This may include cash, investments, real estate, or other valuable assets.

03

Appoint a trustee: Select a trustworthy and qualified individual or institution to act as the trustee. The trustee will have the legal authority to manage and distribute the trust assets according to the terms outlined in the trust agreement.

04

Establish the goals and objectives: Clearly define the goals and objectives of the trust. This may include preserving capital, generating income, or meeting specific financial needs.

05

Develop an investment strategy: Collaborate with the trustee to develop an investment strategy that aligns with the trust's goals. Consider factors such as risk tolerance, time horizon, and diversification.

06

Execute the trust agreement: Once all decisions have been made, execute the trust agreement. Ensure that all parties involved fully understand their roles, responsibilities, and obligations.

07

Fund the trust: Transfer the identified trust assets into the money management trust. This may involve liquidating certain assets or reassigning ownership.

08

Continually monitor and review: Regularly review the performance of the trust assets and reassess the investment strategy if necessary. Stay updated on any changes in financial circumstances or legal regulations that may affect the trust.

09

Consider professional advice: If needed, seek professional advice from attorneys, financial advisors, or tax experts to ensure compliance with applicable laws and optimize the management of the money management trust.

10

Communicate with beneficiaries: Maintain open and transparent communication with the trust beneficiaries, keeping them informed about the trust's progress and decisions that may affect them.

11

Review periodically: Periodically review the trust's objectives and make any necessary adjustments. This will help ensure that the money management trust continues to meet the intended financial goals.

Who needs money management trust?

01

Money management trust can be beneficial for individuals who want professional assistance in managing their financial assets.

02

It is particularly useful for individuals or families with substantial wealth, complex investment portfolios, or a high level of financial responsibility.

03

People who lack the expertise or time to effectively manage their investments can also benefit from a money management trust.

04

Additionally, individuals who want to ensure the proper preservation and distribution of their wealth to future generations may opt for a money management trust.

05

Trusts can also be created for charitable or philanthropic purposes to carry out specific financial objectives and benefit organizations or causes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my money management trust directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign money management trust and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an electronic signature for the money management trust in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your money management trust in seconds.

Can I create an eSignature for the money management trust in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your money management trust and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is money management trust?

A money management trust is a financial arrangement where funds are managed on behalf of an individual or organization, often with the goal of preserving and growing wealth while providing oversight and administration.

Who is required to file money management trust?

Typically, individuals or entities that are beneficiaries of a trust or those managing a trust that involves financial assets are required to file a money management trust.

How to fill out money management trust?

To fill out a money management trust, one must gather all relevant financial information, including the names of the trustees and beneficiaries, details about the assets, and complete the required forms according to the jurisdiction's regulations.

What is the purpose of money management trust?

The purpose of a money management trust is to manage and protect financial assets for the beneficiaries while ensuring compliance with legal and fiduciary obligations.

What information must be reported on money management trust?

Information that must be reported includes details about the trust's assets, income generated, expenses, distributions to beneficiaries, and the names and addresses of trustees and beneficiaries.

Fill out your money management trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Money Management Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.