Get the free Period ending December 31, 20

Show details

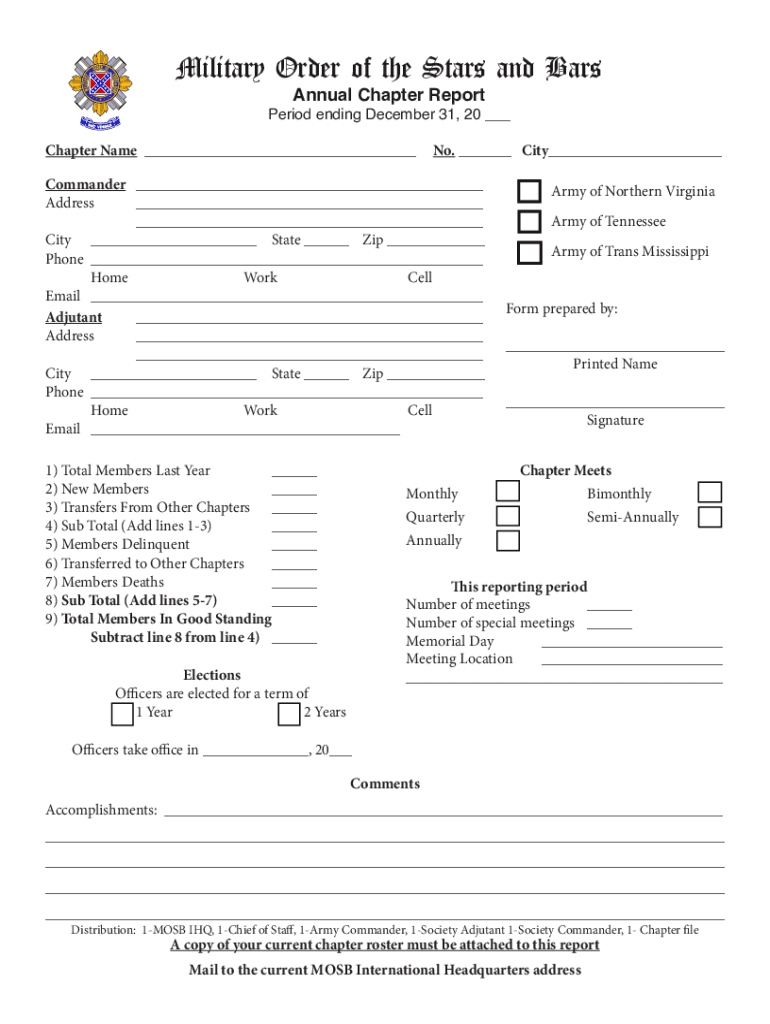

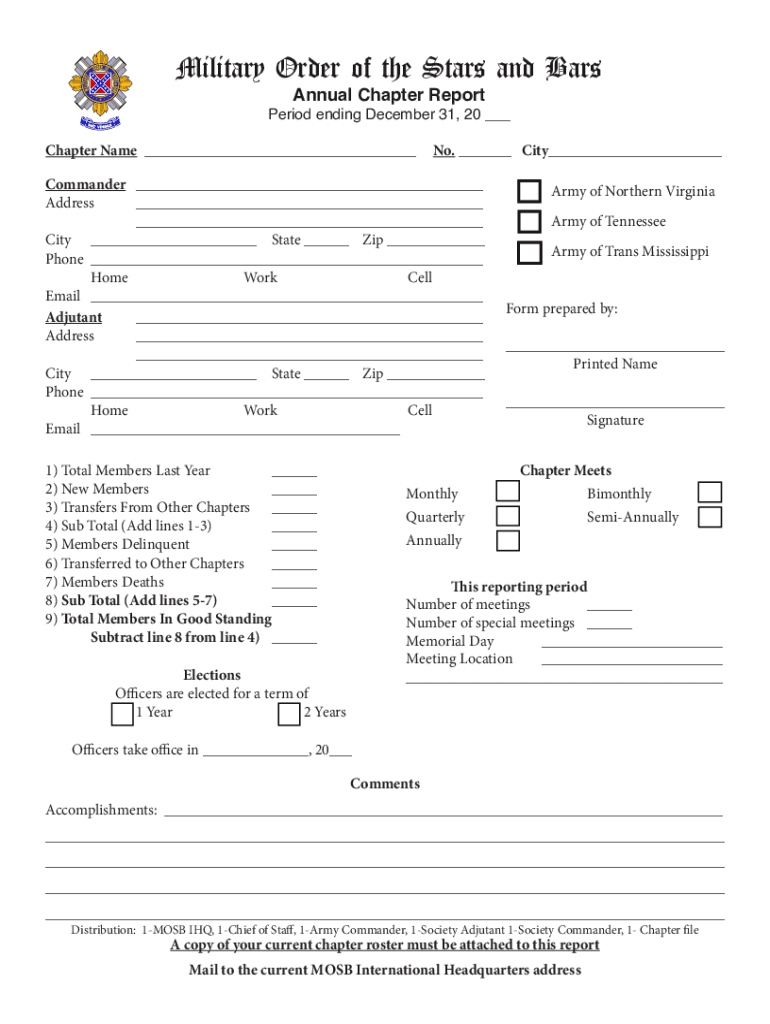

Military Order of the Stars and Bars Annual Chapter ReportPeriod ending December 31, 20 Chapter Name No. City Commander Address City State Zip Phone Homeworkers Email Adjutant Address City State Zip

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign period ending december 31

Edit your period ending december 31 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your period ending december 31 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit period ending december 31 online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit period ending december 31. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out period ending december 31

How to fill out period ending december 31

01

Gather all financial documents for the period ending December 31, such as income statements, balance sheets, and cash flow statements.

02

Review the previous period's financial reports to understand any changes or trends.

03

Start with the income statement and record all revenue generated during the period, including sales, services, and other sources of income.

04

Deduct any expenses incurred during the period, such as cost of goods sold, operating expenses, and taxes.

05

Calculate the net income or loss by subtracting total expenses from total revenue.

06

Move on to the balance sheet and update the asset, liability, and shareholders' equity accounts using relevant transactions and balances.

07

Ensure that all transactions are properly classified and recorded according to accounting standards.

08

Prepare the cash flow statement by categorizing cash inflows and outflows into operating, investing, and financing activities.

09

Reconcile the ending cash balance with the beginning cash balance to ensure accuracy.

10

Perform a final review of all financial statements for any errors or inconsistencies.

11

Consider seeking professional advice or assistance if needed.

12

Once everything is verified, finalize the period ending December 31 financial reports for reporting or decision-making purposes.

Who needs period ending december 31?

01

Companies and businesses of all sizes and types need to prepare the period ending December 31 financial reports.

02

These reports are essential for internal purposes, such as monitoring financial performance, making strategic decisions, and assessing profitability.

03

External stakeholders, including investors, creditors, regulatory bodies, and tax authorities, also rely on these reports to evaluate a company's financial health and compliance with regulations.

04

In addition, period ending December 31 financial reports are necessary for filing annual tax returns and meeting reporting requirements. Therefore, nearly every organization needs to complete this process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get period ending december 31?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the period ending december 31 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete period ending december 31 online?

pdfFiller has made filling out and eSigning period ending december 31 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the period ending december 31 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your period ending december 31 in seconds.

What is period ending december 31?

The period ending December 31 refers to the financial year-end for many organizations and individuals, marking the conclusion of accounting and reporting for that fiscal year.

Who is required to file period ending december 31?

Typically, businesses, corporations, and individuals who are required to report their financial activities and tax obligations for the fiscal year are required to file reports or returns for the period ending December 31.

How to fill out period ending december 31?

To fill out the period ending December 31, one should gather all financial statements, summarize income and expenses, and complete the necessary forms or tax returns according to the regulations set by relevant taxation authorities.

What is the purpose of period ending december 31?

The purpose of the period ending December 31 is to provide a clear accounting of an entity's financial performance and position over the year, ensuring compliance with tax regulations and providing stakeholders with important financial information.

What information must be reported on period ending december 31?

Information that must be reported for the period ending December 31 typically includes revenues, expenses, net income or loss, assets, liabilities, and equity for businesses or income, deductions, and credits for individuals.

Fill out your period ending december 31 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Period Ending December 31 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.