Get the free Rev. Rul. 67-246 - Internal Revenue Service

Show details

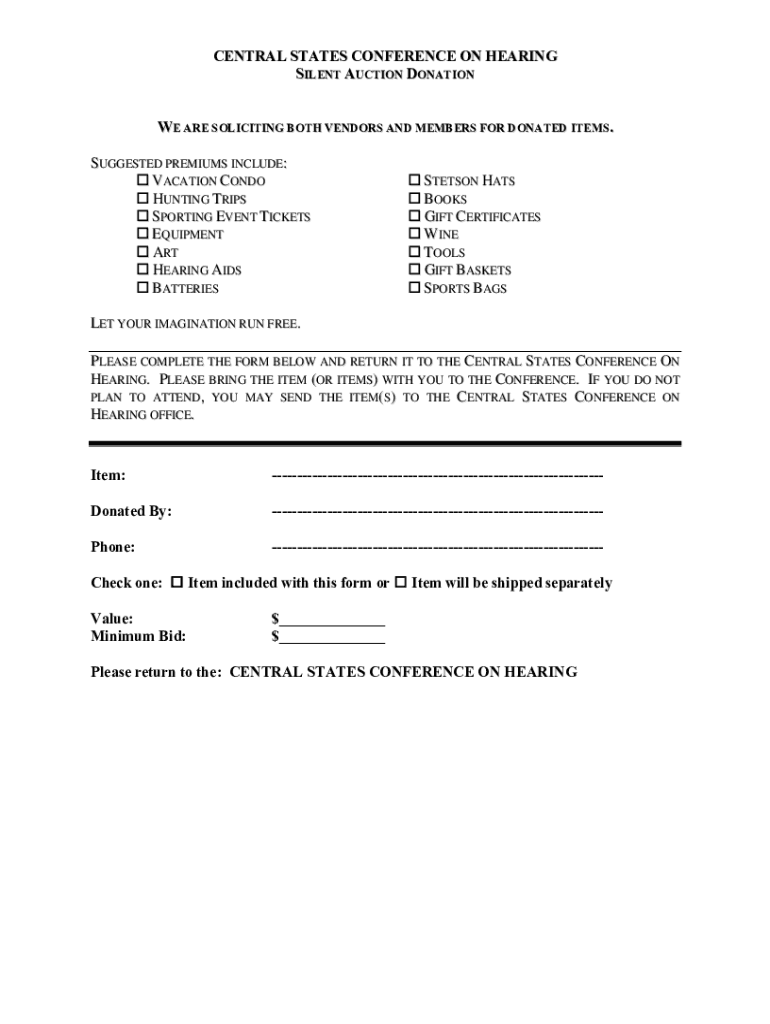

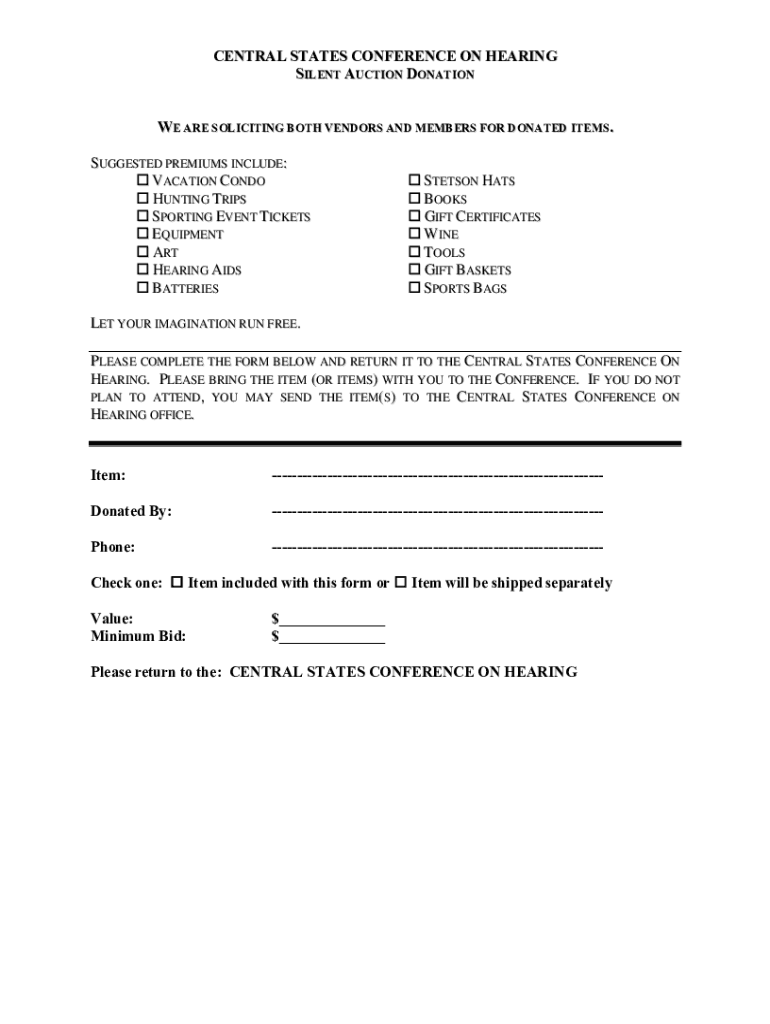

CENTRAL STATES CONFERENCE ON HEARING SILENT AUCTION DONATION WE ARE SOLICITING BOTH VENDORS AND MEMBERS FOR DONATED ITEMS. SUGGESTED PREMIUMS INCLUDE: VACATION CONDO HUNTING TRIPS SPORTING EVENT TICKETS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rev rul 67-246

Edit your rev rul 67-246 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev rul 67-246 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rev rul 67-246 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rev rul 67-246. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rev rul 67-246

How to fill out rev rul 67-246

01

To fill out rev rul 67-246, follow these steps:

02

Start by carefully reading and understanding the instructions provided with the form.

03

Gather all the required information and documents needed to complete the form.

04

Begin by entering your personal information such as your name, address, and contact details.

05

Follow the prompts on the form to provide the specific details requested.

06

Make sure to double-check all the information entered for accuracy and completeness.

07

If there are any additional sections or attachments required, ensure that you provide them as instructed.

08

Review the completed form one last time to ensure everything is answered properly.

09

Sign and date the form as required.

10

Submit the filled-out form according to the instructions provided, either online or by mail.

11

Keep a copy of the completed form for your records.

Who needs rev rul 67-246?

01

Rev rul 67-246 may be needed by tax professionals, attorneys, or individuals who are dealing with specific tax-related issues and need guidance or clarification on how the IRS interprets certain tax laws or regulations.

02

It is primarily used as a reference for understanding how the IRS applies certain tax provisions or handles specific tax situations.

03

Those who are seeking authoritative guidance on specific tax matters related to sales, use, or excise taxes may find rev rul 67-246 helpful.

04

However, it is recommended to consult with a qualified tax advisor or attorney to determine if this ruling is applicable to your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit rev rul 67-246 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your rev rul 67-246 into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for signing my rev rul 67-246 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your rev rul 67-246 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit rev rul 67-246 on an Android device?

You can make any changes to PDF files, like rev rul 67-246, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is rev rul 67-246?

Rev Rul 67-246 is a revenue ruling issued by the IRS that provides guidance on the tax treatment of certain transactions, specifically addressing the deduction of interest paid on certain expenditures.

Who is required to file rev rul 67-246?

Taxpayers who engage in transactions covered by Rev Rul 67-246 and wish to comply with the IRS guidance regarding the deduction of interest must file.

How to fill out rev rul 67-246?

To fill out Rev Rul 67-246, taxpayers must provide specific details about the transactions in question, including amounts, dates, and the purpose of the expenditures, following the instructions provided by the IRS.

What is the purpose of rev rul 67-246?

The purpose of Rev Rul 67-246 is to clarify the tax implications of certain types of interest payments and expenditures, ensuring consistency and compliance with tax laws.

What information must be reported on rev rul 67-246?

The information required includes details of the expenditures, the amount of interest paid, the purpose of the expenditures, and any relevant supporting documentation.

Fill out your rev rul 67-246 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rev Rul 67-246 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.