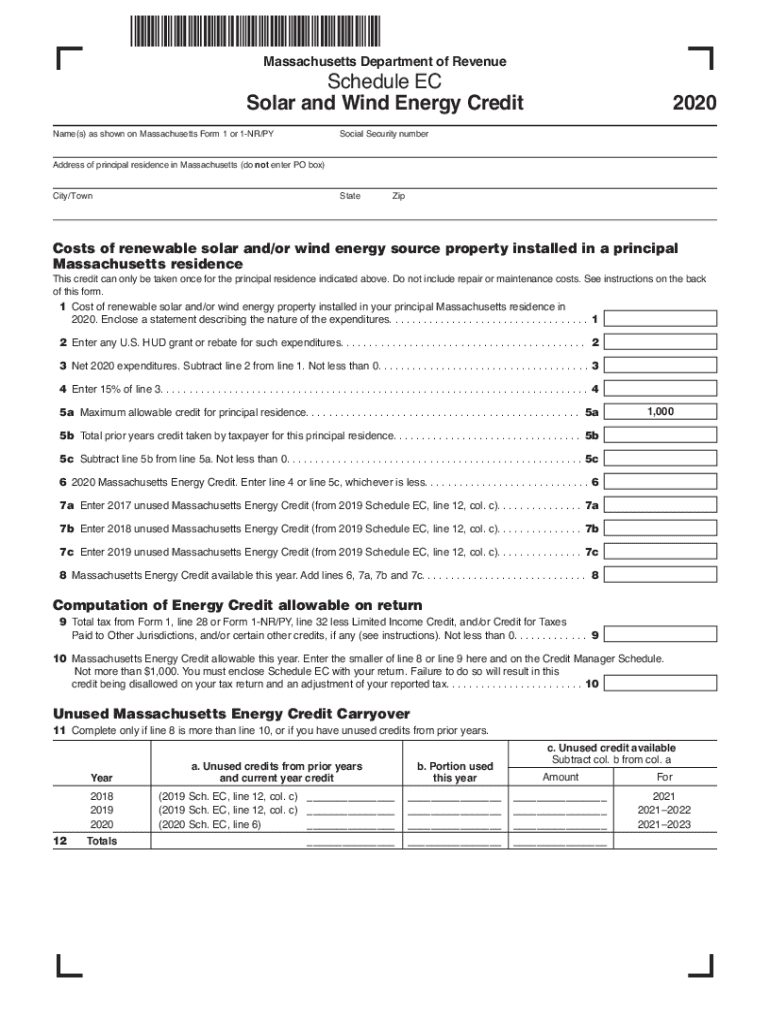

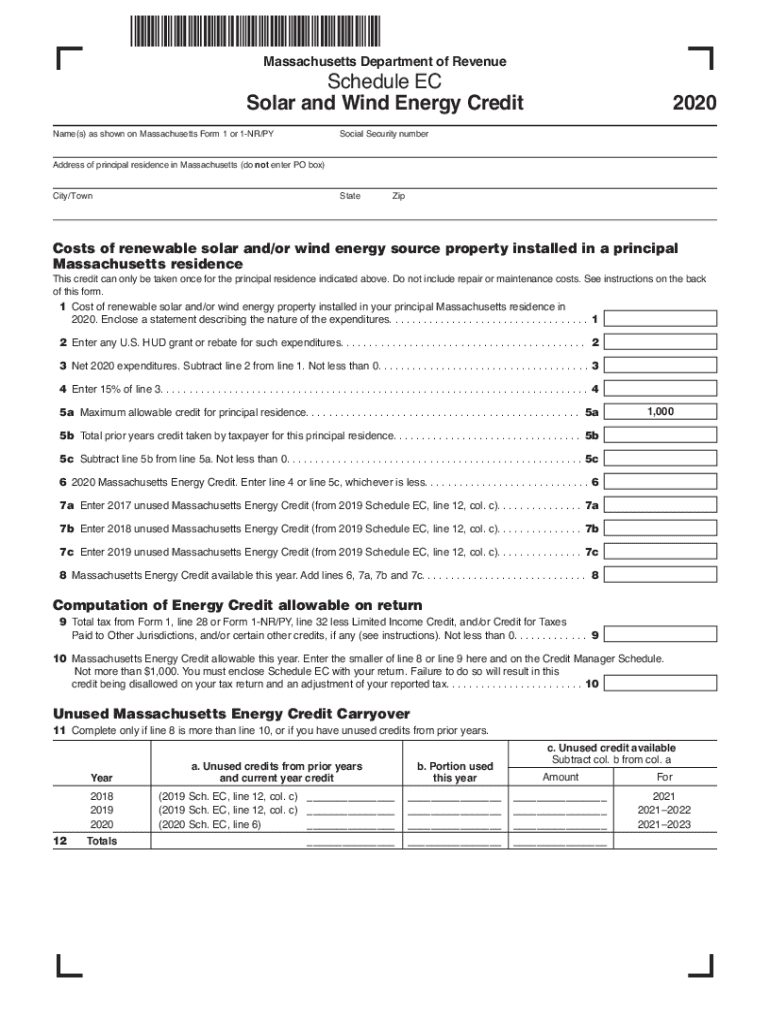

MA Schedule EC 2020 free printable template

Get, Create, Make and Sign ec form

How to edit ec form online

Uncompromising security for your PDF editing and eSignature needs

MA Schedule EC Form Versions

How to fill out ec form

How to fill out MA Schedule EC

Who needs MA Schedule EC?

Instructions and Help about ec form

Music hello everyone hope all of you are doing well so Lee I come again with a new topic in satisfactory and as you already see in the thermals today we are going to discuss specifically on what name calculation by our time sheet in success factor so lets check the steps how to configure that first and then well go into the system as usual and test the pencil configuration so first step of configuration we have to configure first time type so let me just tell you what the time type means, yet time test classifies the attendance type then the second point of configuration is time rule, so time to group is basically combining the time types as group of your working hours then we have to configure you know time text one is the regular walking term of hours and another is the overtime working hours then hardscape of this configuration is configured time evaluation, so time valuation is the object which will help us to segregate the regular working hours and the extra hours is over there when the food step in this configuration is time recording profile, so we have to assign these time valuation into what time recording profile and then in the last step we have to assign these time reporting profile to impress drop information so that the particular employee means this insanity of over in calculation my damn so now let's check today's a requirement on this particular copy so today's' requirement improve we just pick up on simple requirement to demonstrate this function and in the system and the requirement is employee to suppose one employee in an organization one employee can work in different time types means different attendance types so what are those attendance types we can classify first one is regular walking hours second one is knowledge transfer our phone is trying visit boat one is conference now suppose a spot that companies policy if employee walked more than four tiers in a week that means if we can is we think about daily basis then regular walking hours as what companies policy should be eight hours and if employee walk more than eight hours in daily basis or if we consider the weekly basis then more than forty hours five days in a week 40 hours in weekly basis then the extra hours should be paid to the employee fifty person moves and then the employees daily wages not clearance whatever it is so now to justify that suppose one employee walked in the doors Lidos then in the same day employee also walk in the knowledge transfer process two hours and the same day also they have climbed, so they've invested one over to the client is it as well so in that an employee in four years what he offers extra so for that three hours company will provide 50 move wages that employee, so this is up, and you know that how many hours employers walk moved we have to set up this overtime calculation so let's check in the system, so now we have are logged into the system as you see, and we have managed data section so here we need to configure first the...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in ec form without leaving Chrome?

How can I edit ec form on a smartphone?

How do I edit ec form on an iOS device?

What is MA Schedule EC?

Who is required to file MA Schedule EC?

How to fill out MA Schedule EC?

What is the purpose of MA Schedule EC?

What information must be reported on MA Schedule EC?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.