Get the free Second charge mortgagesPOSITIVE LENDING

Show details

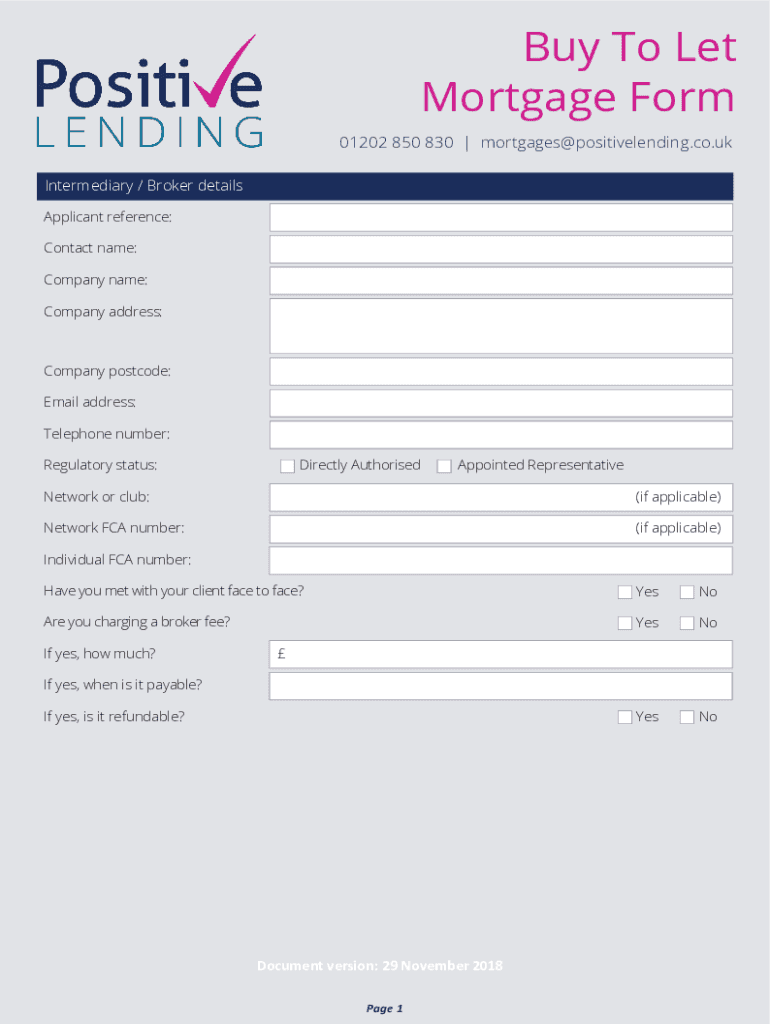

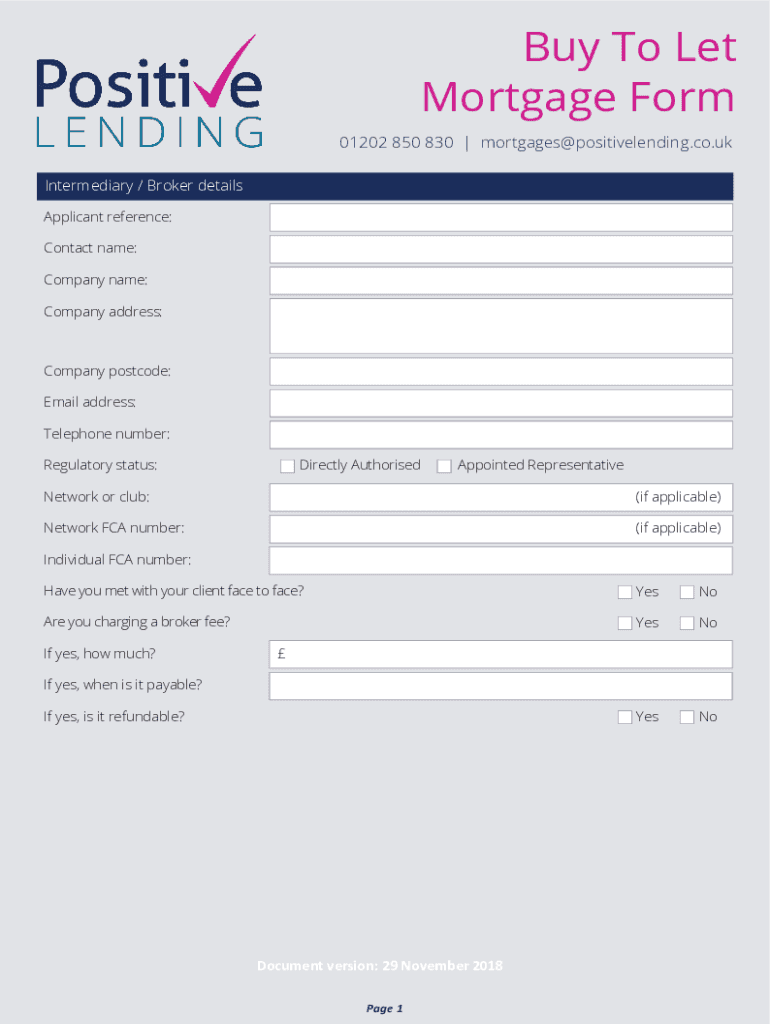

Buy To Let Mortgage Form 01202 850 830 mortgages positive lending.co.UK Intermediary / Broker details Applicant reference: Contact name: Company name: Company address:Company postcode: Email address:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign second charge mortgagespositive lending

Edit your second charge mortgagespositive lending form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your second charge mortgagespositive lending form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing second charge mortgagespositive lending online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit second charge mortgagespositive lending. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out second charge mortgagespositive lending

How to fill out second charge mortgagespositive lending

01

Gather all necessary documents such as proof of income, proof of identification, proof of address, and bank statements.

02

Research and compare different lenders and their second charge mortgage options to find the best fit for your situation.

03

Complete the application form provided by the chosen lender, providing accurate and detailed information.

04

Submit the application along with all the required documents to the lender for review.

05

Work closely with the lender to provide any additional information or clarification they may require.

06

Await the lender's decision on your application, which is usually communicated within a few weeks.

07

If the application is approved, carefully review the terms and conditions of the second charge mortgage before accepting the offer.

08

Sign the necessary paperwork and provide any requested documentation to finalize the process.

09

Make timely repayments on the loan to avoid any penalties or detrimental impact on your credit score.

Who needs second charge mortgagespositive lending?

01

Individuals who require additional funds for various purposes such as home improvements, debt consolidation, education expenses, or investment opportunities.

02

Borrowers who already have an existing mortgage but do not wish to remortgage and lose their current favorable terms.

03

Homeowners with low credit scores or adverse credit histories who may struggle to secure a traditional loan or remortgage.

04

People who have significant equity in their property and want to access it for financial purposes.

05

Individuals who are unable to obtain sufficient funds through unsecured loans or other forms of lending.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my second charge mortgagespositive lending directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your second charge mortgagespositive lending and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get second charge mortgagespositive lending?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the second charge mortgagespositive lending in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete second charge mortgagespositive lending online?

With pdfFiller, you may easily complete and sign second charge mortgagespositive lending online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is second charge mortgagespositive lending?

Second charge mortgagespositive lending refers to a type of loan secured against a property that already has a mortgage. It allows the homeowner to borrow additional funds while the original mortgage remains in place.

Who is required to file second charge mortgagespositive lending?

Lenders who provide second charge mortgages are required to file the necessary documentation with the relevant financial authorities to ensure compliance with regulations.

How to fill out second charge mortgagespositive lending?

To fill out second charge mortgagespositive lending, lenders need to complete specific forms detailing the loan amount, borrower information, property value, and terms of the loan, and may also require additional documentation as per regulatory standards.

What is the purpose of second charge mortgagespositive lending?

The purpose of second charge mortgagespositive lending is to provide homeowners with a means to access additional funds for various needs, such as home improvements, debt consolidation, or other significant expenses, while leveraging their property's equity.

What information must be reported on second charge mortgagespositive lending?

Reported information typically includes the borrower's financial status, the amount borrowed, the property value, loan terms, lender details, and any other relevant financial disclosures.

Fill out your second charge mortgagespositive lending online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Second Charge Mortgagespositive Lending is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.