Get the Tax Free Savings Account: Investment Application Form ...

Show details

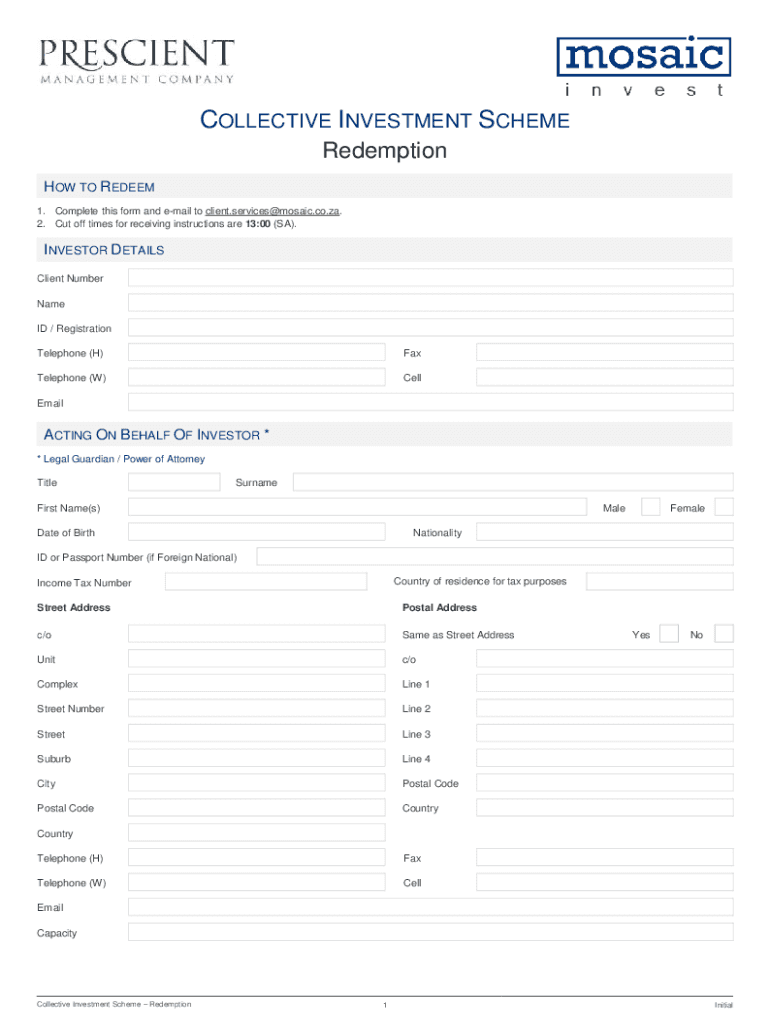

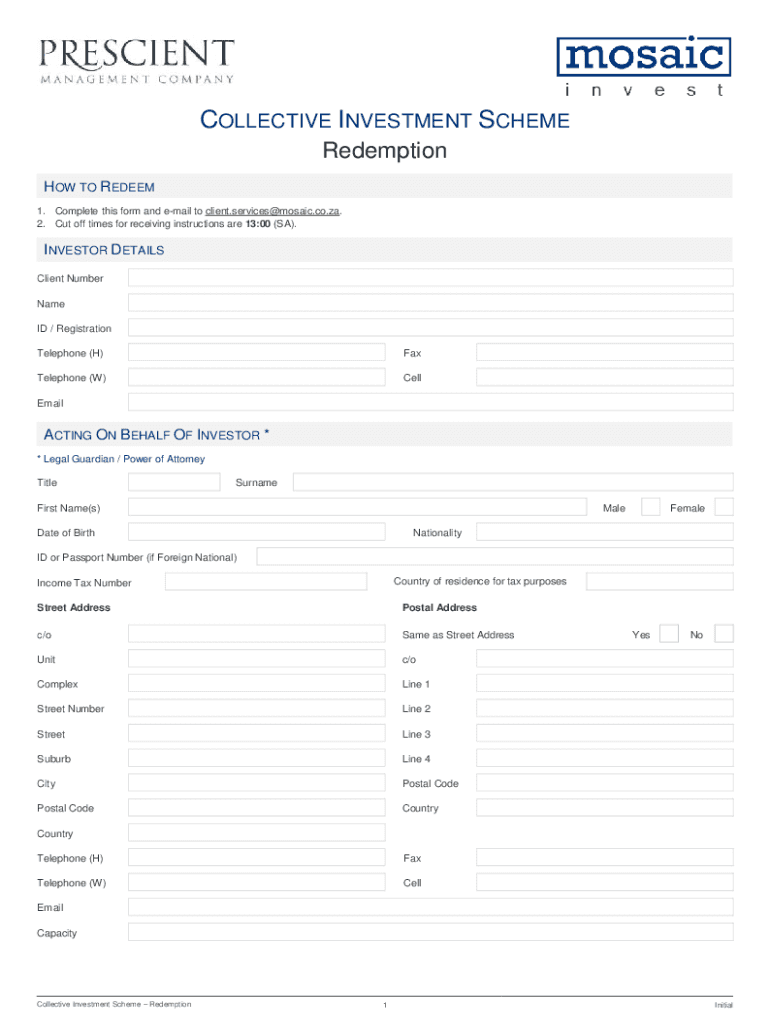

COLLECTIVE INVESTMENT SCHEME

Redemption

HOW TO REDEEM

1. Complete this form and email to client.services@mosaic.co.za.

2. Cut off times for receiving instructions are 13:00 (SA).INVESTOR DETAILS

Client

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax savings account investment

Edit your tax savings account investment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax savings account investment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax savings account investment online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax savings account investment. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax savings account investment

How to fill out tax savings account investment

01

To fill out a tax savings account investment, follow these steps:

02

Determine your eligibility: Check if you meet the criteria to open a tax savings account investment. Different countries may have different rules and requirements.

03

Research the benefits and limitations: Understand the advantages and limitations of investing in a tax savings account. This can include tax benefits, contribution limits, and withdrawal restrictions.

04

Choose the right account provider: Select a trustworthy financial institution or investment firm that offers tax savings account investments.

05

Gather required documents: Prepare the necessary identification and financial documents as per the account provider's requirements. This may include proof of identity, address, and income.

06

Complete the application: Fill out the application form provided by the account provider. Double-check the information entered to ensure accuracy.

07

Nominate a beneficiary (if applicable): If allowed, designate a beneficiary who will receive the funds in case of your demise.

08

Fund your account: Transfer funds into your tax savings account as per the minimum initial deposit requirement specified by the account provider.

09

Monitor and manage your investments: Regularly review your tax savings account's performance and make adjustments as needed to maximize returns.

10

Stay updated on tax regulations: Keep yourself informed about any changes in tax laws or regulations that may affect your tax savings account investment.

11

Seek professional advice if needed: Consult a financial advisor or tax expert for personalized guidance based on your financial goals and circumstances.

Who needs tax savings account investment?

01

Tax savings account investments are suitable for individuals who meet the following criteria:

02

Tax-conscious individuals: People who are focused on reducing their tax liabilities and maximizing tax savings.

03

Long-term savers: Individuals with a long-term investment horizon who are willing to commit their funds for a specified period.

04

Financially stable individuals: Those who have sufficient income and financial stability to invest in a tax savings account.

05

Risk-tolerant investors: Individuals who understand and accept the risks associated with investment products.

06

Individuals with specific financial goals: Those who have financial goals such as saving for retirement, education, or purchasing a home.

07

It is important to evaluate your own financial situation and seek professional advice before investing in a tax savings account.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax savings account investment directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign tax savings account investment and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I fill out tax savings account investment using my mobile device?

Use the pdfFiller mobile app to fill out and sign tax savings account investment. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit tax savings account investment on an Android device?

You can make any changes to PDF files, such as tax savings account investment, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is tax savings account investment?

A tax savings account investment is a type of financial account that allows individuals to save money and earn interest without having to pay taxes on the earnings, provided the money is used for qualified expenses such as education or retirement.

Who is required to file tax savings account investment?

Individuals who have made contributions to a tax savings account investment and wish to claim tax deductions or benefits must file this investment. Additionally, those who have withdrawn funds from such accounts may also need to report it.

How to fill out tax savings account investment?

To fill out a tax savings account investment, gather the relevant financial information, complete the appropriate forms as outlined by the tax authority, and provide necessary documentation such as contribution statements and withdrawal records.

What is the purpose of tax savings account investment?

The purpose of a tax savings account investment is to provide individuals with a tax-advantaged way to save and invest money that can be used for specific approved purposes, thus encouraging savings for future expenses.

What information must be reported on tax savings account investment?

Individuals must report contributions made to the account, any withdrawals, the interest earned, and any distributions taken during the tax year.

Fill out your tax savings account investment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Savings Account Investment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.