Get the free Property - Insurance Claims Documents & Forms - Claims Pages

Show details

Property Insurance Claim Form

Send to claims@miramaruw.com.auinsuredpolicy numberPOLICY DETAILS

PERSONAL DETAILS first name last name telephone (day)telephone (evening)mobilefaxoccupation

INSURED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property - insurance claims

Edit your property - insurance claims form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property - insurance claims form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property - insurance claims online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit property - insurance claims. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property - insurance claims

How to fill out property - insurance claims

01

Start by documenting the incident thoroughly. Take photos, videos, or any other evidence that can support your claim.

02

Notify your insurance company as soon as possible. Provide them with all the necessary information, such as the date and time of the incident, description of the damage, and any supporting documents.

03

Complete the claim form accurately and honestly. Provide details about the property, the incident, and the estimated cost of repairs or replacement.

04

Attach any relevant documents, such as police reports, repair estimates, or medical reports, if applicable.

05

Keep a record of all communication with the insurance company. Note down the date, time, and details of each conversation or email exchange.

06

Cooperate with the insurance company's investigation if required. Answer their questions truthfully and provide any additional evidence they may request.

07

Follow up on the progress of your claim regularly. Keep track of any deadlines or requirements set by the insurance company.

08

Review the settlement offer carefully and negotiate if necessary. If you believe the offer does not adequately cover your losses, provide evidence to support your claim for a higher settlement.

09

Once a settlement is reached, carefully read and understand the terms before accepting it. Make sure you are fully aware of any conditions or restrictions mentioned in the settlement agreement.

10

If you encounter any difficulties or have concerns during the claims process, seek assistance from a professional insurance claim attorney or advisor.

Who needs property - insurance claims?

01

Anyone who owns or rents a property can potentially benefit from property insurance claims. This includes homeowners, tenants, landlords, and business owners who have insurance coverage for their properties.

02

People who have faced damage or loss to their property due to various reasons, such as natural disasters, accidents, theft, vandalism, or other covered perils, may need to file property insurance claims.

03

Property insurance claims are particularly important for individuals or businesses who cannot afford the financial burden of repairing or replacing their damaged property out of pocket.

04

Even those who have property insurance policies should still file claims to ensure they receive proper compensation for their losses and to avoid potential disputes with the insurance company.

05

It's essential to review your insurance policy to understand the specific coverage and exclusions related to property insurance claims.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my property - insurance claims directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your property - insurance claims and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I complete property - insurance claims online?

Completing and signing property - insurance claims online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit property - insurance claims on an iOS device?

You certainly can. You can quickly edit, distribute, and sign property - insurance claims on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

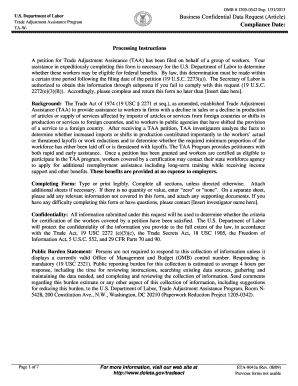

What is property - insurance claims?

Property insurance claims are formal requests made by homeowners or property owners to their insurance company for compensation due to loss or damage to property covered under an insurance policy.

Who is required to file property - insurance claims?

Property owners or policyholders are required to file property insurance claims when they experience loss or damage to their insured property.

How to fill out property - insurance claims?

To fill out property insurance claims, policyholders should gather all necessary documentation, including details of the incident, photographs of the damage, and relevant receipts, then complete the claim form provided by their insurance company accurately and submit it along with the supporting documents.

What is the purpose of property - insurance claims?

The purpose of property insurance claims is to allow policyholders to seek financial compensation for losses or damages to their property as covered under their insurance policy.

What information must be reported on property - insurance claims?

Information that must be reported includes the date of the incident, a detailed description of the damage, the estimated cost of repairs, and any police reports if applicable.

Fill out your property - insurance claims online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property - Insurance Claims is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.