Get the free Self Managed Super Fund Application Form - Heritage Bank

Show details

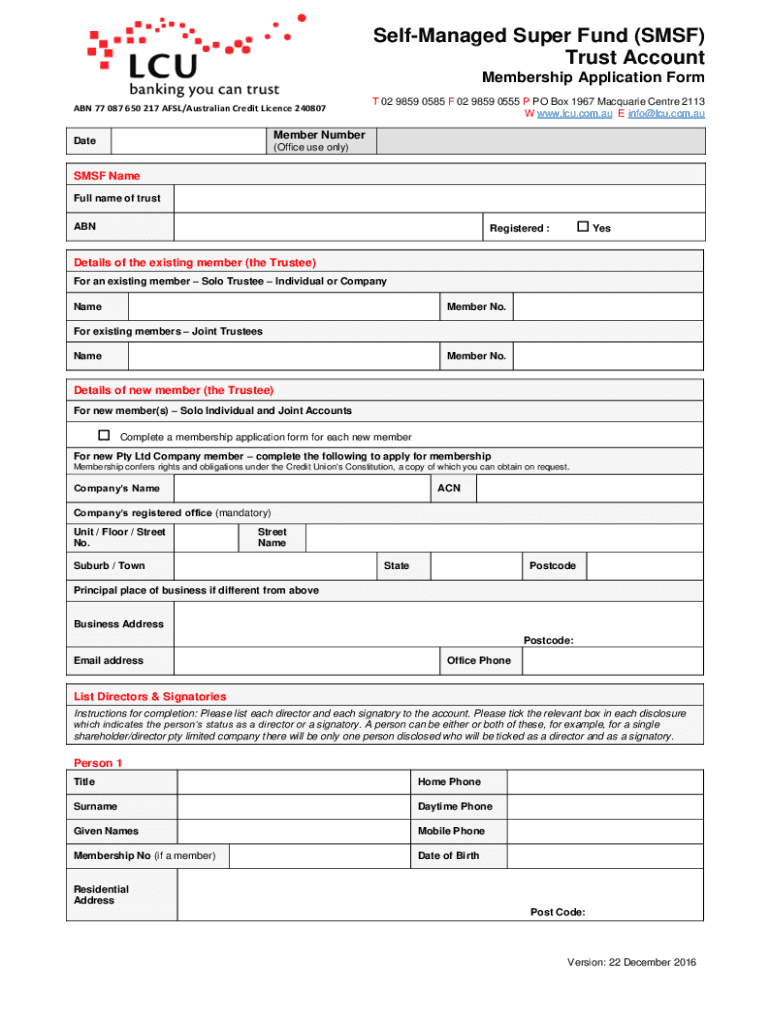

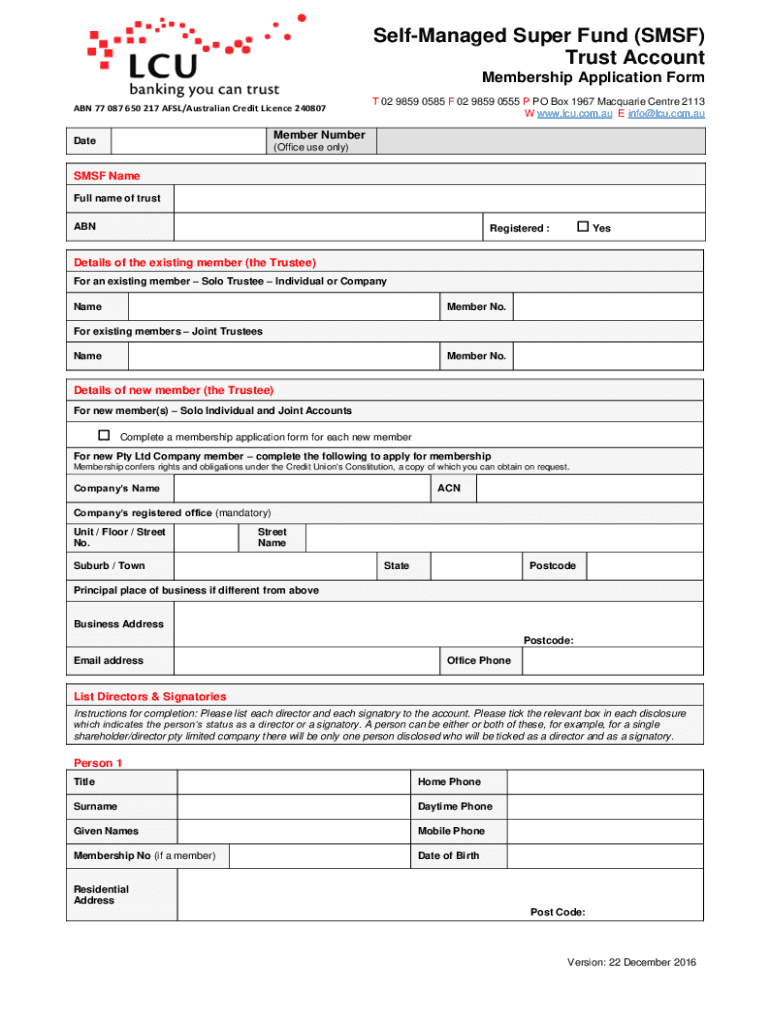

Self-managed Super Fund (SMS) Trust Account Membership Application Form ABN 77 087 650 217 ADSL/Australian Credit License 240807T 02 9859 0585 F 02 9859 0555 P PO Box 1967 Macquarie Center 2113 W

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self managed super fund

Edit your self managed super fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self managed super fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self managed super fund online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit self managed super fund. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self managed super fund

How to fill out self managed super fund

01

Step 1: Determine if you are eligible to set up a self managed super fund (SMSF). You must be over 18 years old, have less than 5 members in the fund, and be an Australian resident.

02

Step 2: Set up a trustee structure for your SMSF. You can choose an individual trustee structure where each member is also a trustee, or a corporate trustee structure where a separate company is the trustee.

03

Step 3: Register your SMSF with the Australian Taxation Office (ATO) and obtain a unique Australian Business Number (ABN) and Tax File Number (TFN).

04

Step 4: Develop an investment strategy for your SMSF. This should outline the objectives and investment guidelines of the fund, including the types of investments it can make.

05

Step 5: Roll over your existing superannuation funds into your SMSF, if applicable. You can also make contributions to your SMSF from your personal income or employer contributions.

06

Step 6: Manage and monitor your SMSF by keeping accurate records, lodging annual returns, and staying updated with changes in superannuation regulations.

07

Step 7: Consider seeking professional advice from a qualified financial advisor or SMSF specialist to ensure compliance with all legal and regulatory requirements.

Who needs self managed super fund?

01

Self managed super funds are suitable for individuals who want more control and flexibility over their retirement savings.

02

Business owners who want to include their business property as a part of their superannuation investment may also choose to establish an SMSF.

03

People with a higher level of financial literacy and investment knowledge may benefit from self managing their superannuation.

04

Those who wish to diversify their investment portfolio and have specific investment preferences can also opt for an SMSF.

05

It is important to note that managing an SMSF requires time, effort, and a good understanding of superannuation laws, so it may not be suitable for everyone and professional advice is recommended.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute self managed super fund online?

pdfFiller has made it simple to fill out and eSign self managed super fund. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit self managed super fund straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing self managed super fund, you need to install and log in to the app.

How do I edit self managed super fund on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as self managed super fund. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is self managed super fund?

A self managed super fund (SMSF) is a type of superannuation fund that is managed by its members, providing them with greater control over their retirement savings. Members can make investment decisions and tailor their super fund according to their own financial goals.

Who is required to file self managed super fund?

All self managed super funds are required to lodge an annual return and comply with regulatory requirements set by the Australian Taxation Office (ATO). This includes trustees of the SMSF.

How to fill out self managed super fund?

To fill out an SMSF annual return, you need to provide information regarding the fund's income, expenses, member contributions, and asset values. This typically involves gathering documentation, completing the necessary forms, and submitting them to the ATO.

What is the purpose of self managed super fund?

The purpose of a self managed super fund is to provide individuals with a way to manage their own retirement savings by allowing them to choose their investments and strategies according to their personal preferences and circumstances.

What information must be reported on self managed super fund?

Information that must be reported on an SMSF includes income, expenses, member contributions, fund assets, and the investment strategy. Additional reports may be required depending on the fund's activities.

Fill out your self managed super fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Managed Super Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.