Get the free Pro Forma Financial Statements (with Templates and Examples ...

Show details

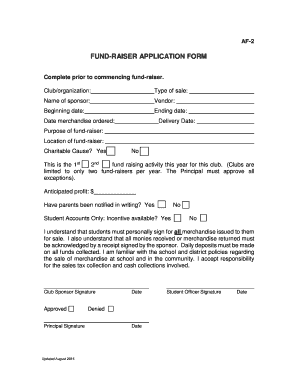

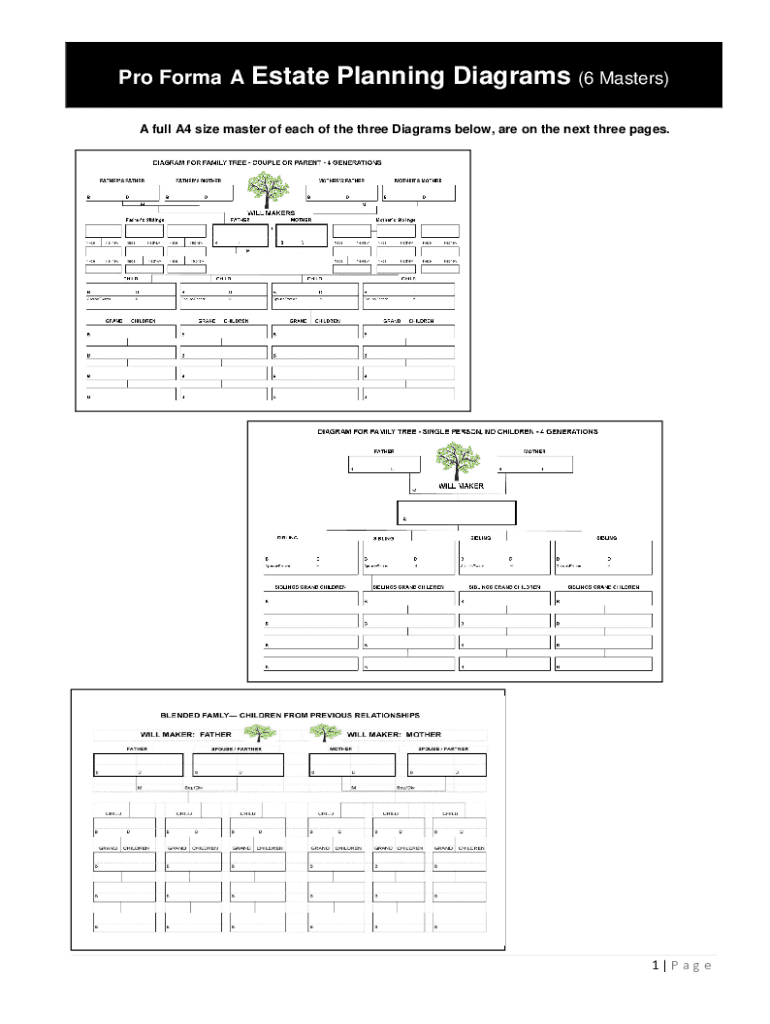

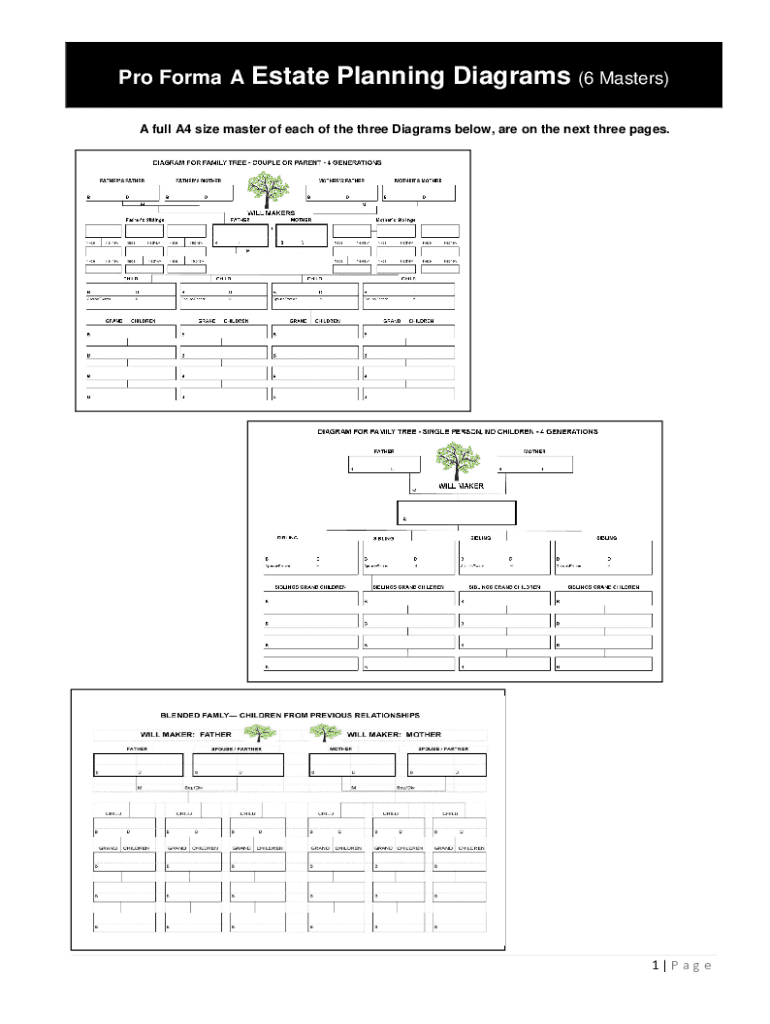

Pro Forma Estate Planning Diagrams (6 Masters)A full A4 size master of each of the three Diagrams below, are on the next three pages.1 PageDiagram for Family Tree Couple or Parent 4 Generations2 PageDiagram

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pro forma financial statements

Edit your pro forma financial statements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pro forma financial statements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pro forma financial statements online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pro forma financial statements. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pro forma financial statements

How to fill out pro forma financial statements

01

To fill out pro forma financial statements, follow these steps:

02

Start by gathering the necessary financial data for the pro forma statements, including past financial statements, sales projections, and expense forecasts.

03

Determine the time period for which the pro forma statements will cover, such as a month, quarter, or year.

04

Begin with the income statement. Enter the projected sales revenue for each period and subtract the estimated cost of goods sold to calculate the gross profit. Deduct operating expenses, interest expenses, and taxes to determine the net profit.

05

Move on to the balance sheet. List the projected assets, including cash, accounts receivable, inventory, and property. Deduct liabilities such as accounts payable and loans to calculate the projected equity.

06

Complete the cash flow statement. Enter the projected cash inflows and outflows for each period, including operating activities, investing activities, and financing activities. Calculate the net change in cash.

07

Review and analyze the pro forma financial statements for accuracy and coherence.

08

Make any necessary adjustments or revisions to ensure the statements reflect realistic financial projections.

09

Present the final pro forma financial statements to stakeholders or use them for financial planning and decision-making purposes.

Who needs pro forma financial statements?

01

Pro forma financial statements are needed by various individuals and organizations, including:

02

- Startups and entrepreneurs who are seeking funding or investment. Pro forma statements help demonstrate the financial viability and potential profitability of the business.

03

- Existing businesses planning for expansion, acquisitions, or mergers. Pro forma statements can assess the financial impact of these strategic decisions.

04

- Lenders and creditors who require detailed financial projections before extending credit or loans to a business.

05

- Investors and shareholders who want to evaluate the financial performance and growth prospects of a company.

06

- Financial analysts and consultants who provide financial advice and guidance to organizations.

07

- Government agencies and regulatory bodies that require financial projections for regulatory compliance or economic forecasting purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pro forma financial statements online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your pro forma financial statements to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit pro forma financial statements on an Android device?

The pdfFiller app for Android allows you to edit PDF files like pro forma financial statements. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I fill out pro forma financial statements on an Android device?

Use the pdfFiller Android app to finish your pro forma financial statements and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is pro forma financial statements?

Pro forma financial statements are financial reports that present a company's projected financial performance, often based on hypothetical scenarios or transactions. They are used to provide a clearer picture of potential earnings, cash flows, or other metrics.

Who is required to file pro forma financial statements?

Pro forma financial statements are typically filed by publicly traded companies, particularly during mergers or acquisitions, to help investors understand the potential financial impacts of these transactions.

How to fill out pro forma financial statements?

To fill out pro forma financial statements, a company must start with historical financial information, project future revenues and expenses, adjust for anticipated changes (like mergers or new product launches), and outline these figures in a structured format that reflects the expected outcomes.

What is the purpose of pro forma financial statements?

The purpose of pro forma financial statements is to provide stakeholders with an outlook of a company's financial performance under specific scenarios, aiding in decision-making for investments, acquisitions, or other financial activities.

What information must be reported on pro forma financial statements?

Pro forma financial statements typically report estimates of revenues, expenses, net income, and other significant financial metrics, as well as any assumptions made during the projections.

Fill out your pro forma financial statements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pro Forma Financial Statements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.