Get the free Will my homeowners insurance cover a accidential shooting ...

Show details

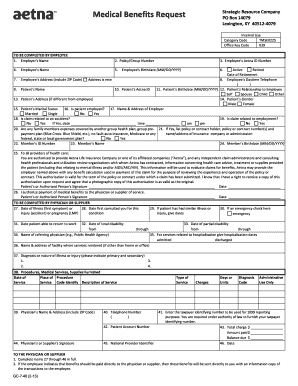

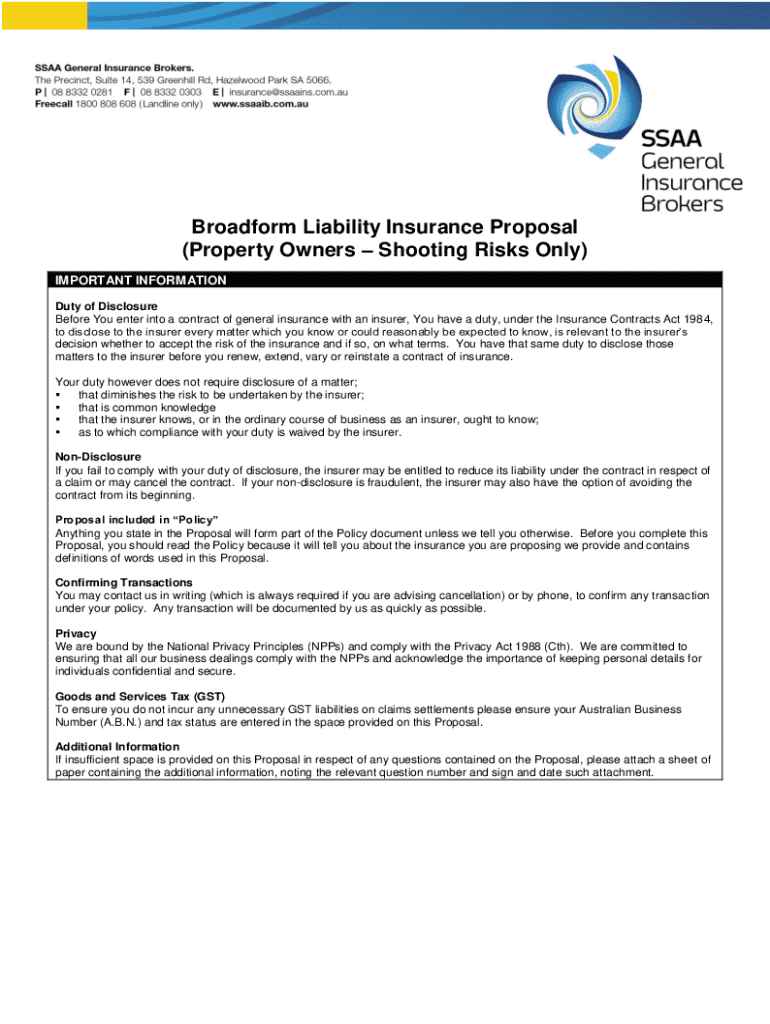

Broad form Liability Insurance Proposal (Property Owners Shooting Risks Only) IMPORTANT INFORMATION Duty of Disclosure Before You enter into a contract of general insurance with an insurer, You have

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign will my homeowners insurance

Edit your will my homeowners insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your will my homeowners insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing will my homeowners insurance online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit will my homeowners insurance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out will my homeowners insurance

How to fill out will my homeowners insurance

01

To fill out your homeowners insurance, follow these steps:

02

Gather all necessary documents, such as your policy information, personal identification, and property details.

03

Review your policy coverage and understand the scope of protection it offers.

04

Assess the value of your home and its contents, including any valuable assets that need additional coverage.

05

Provide accurate information about your home, such as its location, construction type, and safety features.

06

Indicate any desired endorsements or add-ons to tailor your policy to your specific needs.

07

Determine the coverage limits for different aspects, including dwelling, personal property, liability, and additional living expenses.

08

Fill in the details about any previous claims or losses you have experienced.

09

Consider any optional coverages, such as flood insurance or identity theft protection, and decide if you want to include them.

10

Double-check all the information you entered for accuracy and completeness.

11

Review the terms and conditions of your policy before submitting the application.

12

Submit the completed application and wait for your insurer to process it.

13

Keep a copy of the filled-out application for your records.

Who needs will my homeowners insurance?

01

Homeowners insurance is necessary for:

02

- Homeowners who want to protect their property against unexpected events, such as fire, theft, vandalism, or natural disasters.

03

- Homeowners who have a mortgage, as most lenders require insurance coverage to protect their investment.

04

- Homeowners who want liability protection in case someone gets injured on their property and decides to sue.

05

- Homeowners who want to secure coverage for their personal belongings, including furniture, appliances, electronics, and jewelry.

06

- Homeowners who want additional living expense coverage to help with temporary housing and living costs if their home becomes uninhabitable.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete will my homeowners insurance online?

Filling out and eSigning will my homeowners insurance is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my will my homeowners insurance in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your will my homeowners insurance right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit will my homeowners insurance on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share will my homeowners insurance from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is will my homeowners insurance?

Homeowners insurance is a type of property insurance that covers losses and damages to an individual's house and to assets in the home. It protects against various risks, such as theft, fire, and natural disasters.

Who is required to file will my homeowners insurance?

Typically, homeowners are not required to file a claim for homeowners insurance unless they experience a loss or damage that they wish to be compensated for. However, mortgage lenders usually require homeowners to have insurance coverage.

How to fill out will my homeowners insurance?

To fill out a homeowners insurance application, provide your personal information, details about the home (including location, size, and construction type), current insurance coverage, and any previous claims. It's best to consult with an insurance agent for guidance.

What is the purpose of will my homeowners insurance?

The purpose of homeowners insurance is to protect homeowners from financial loss due to damage or destruction of their home and belongings. It also provides liability coverage in case someone is injured on the property.

What information must be reported on will my homeowners insurance?

You must report your property details, personal details, information about the level of coverage desired, and any past claims when applying for homeowners insurance.

Fill out your will my homeowners insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Will My Homeowners Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.