Get the free Donation of Stock and Other Securities : ConservationTools

Show details

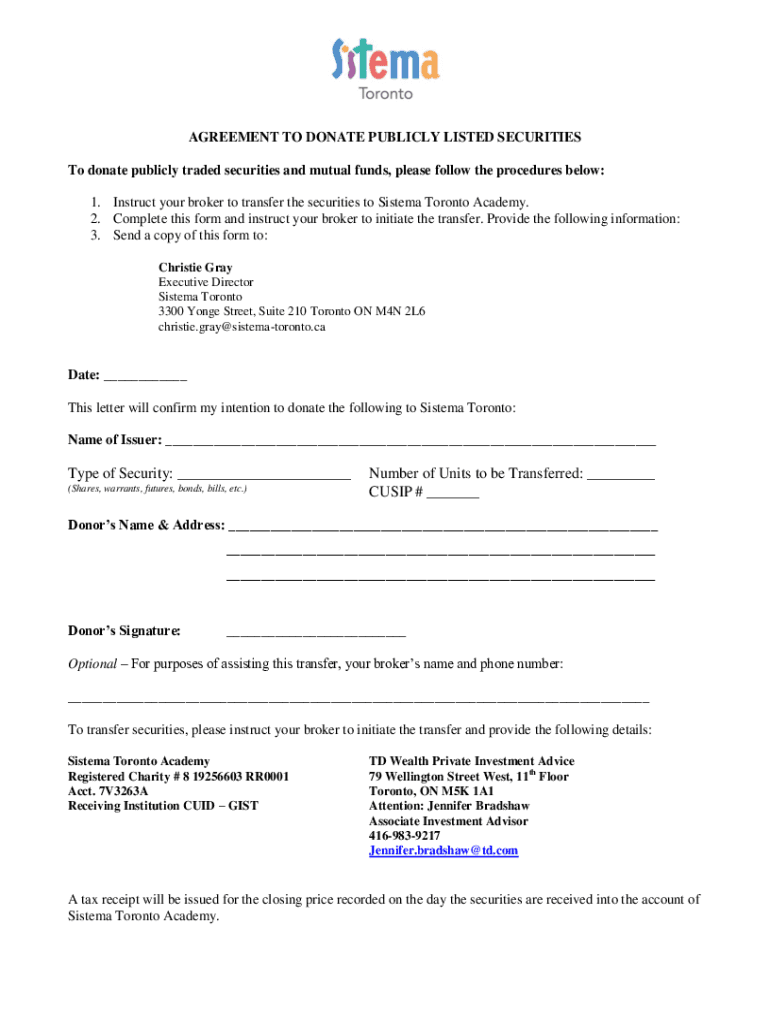

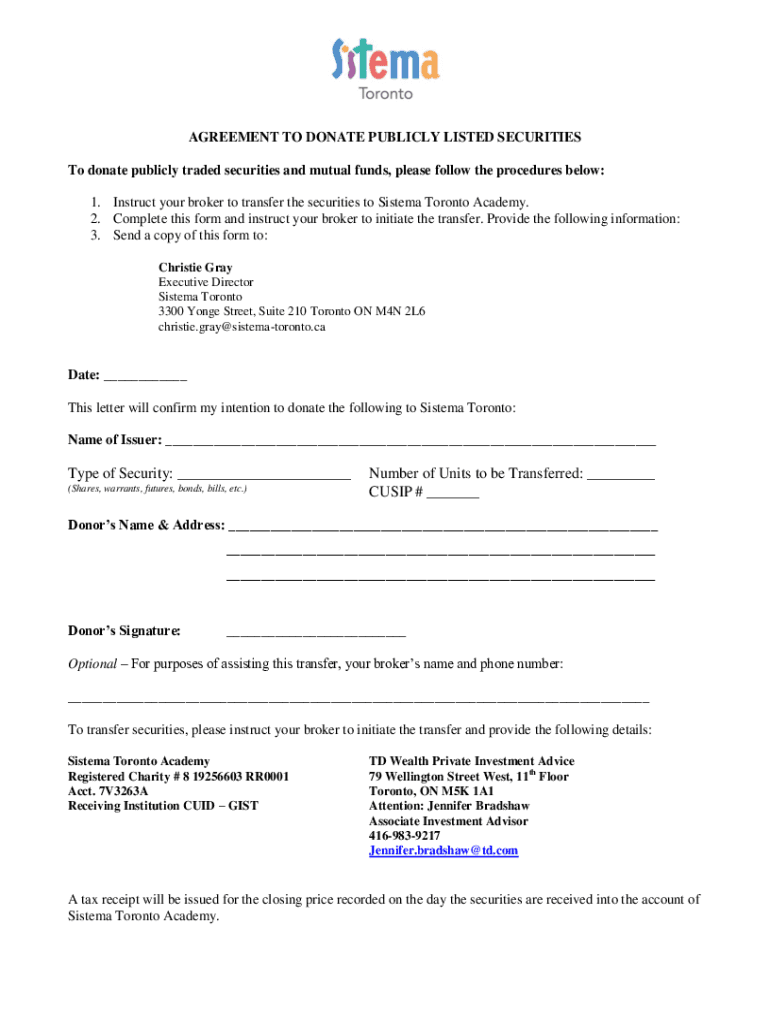

AGREEMENT TO DONATE PUBLICLY LISTED SECURITIES To donate publicly traded securities and mutual funds, please follow the procedures below: 1. Instruct your broker to transfer the securities to System

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donation of stock and

Edit your donation of stock and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donation of stock and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing donation of stock and online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit donation of stock and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donation of stock and

How to fill out donation of stock and

01

To fill out a donation of stock, follow these steps:

02

Contact the charity or organization you would like to donate the stock to. They will provide you with their brokerage account information.

03

Contact your own brokerage firm and inform them of your intention to donate stock. They will provide you with the necessary forms and instructions.

04

Fill out the forms provided by your brokerage firm. These will typically require information such as the name of the charity, the number of shares you wish to donate, and the stock's ticker symbol.

05

Provide any additional information required by your brokerage firm, such as the broker's contact information or the specific details of the stock you wish to donate.

06

Submit the completed forms to your brokerage firm. They will process the donation and transfer the stock to the charity's brokerage account.

07

Keep a record of the donation for your tax purposes. You may need to provide documentation of the donation when filing your taxes.

08

Consult with a tax professional to understand the potential tax benefits and implications of donating stock.

Who needs donation of stock and?

01

Donation of stock can be beneficial for various individuals or entities, including:

02

- Charitable organizations: Many non-profit organizations rely on donations to support their work. Donating stock to these organizations can provide them with financial resources to further their mission.

03

- Investors with appreciated stock: Donating appreciated stock can be a tax-efficient way to support a cause while potentially minimizing capital gains taxes. It allows investors to avoid paying capital gains tax on the stock's appreciation while still receiving a charitable deduction.

04

- Individuals looking to support a cause: Some individuals may choose to donate stock as a way to contribute to a cause they care about. It allows them to make a meaningful impact while potentially receiving tax benefits.

05

- Estate planning: Donating stock can be a component of estate planning, allowing individuals to leave a charitable legacy and potentially reduce estate taxes.

06

Ultimately, anyone who wishes to support a cause and has appreciated stock may consider donating it.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my donation of stock and directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your donation of stock and and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send donation of stock and for eSignature?

When you're ready to share your donation of stock and, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit donation of stock and on an iOS device?

Use the pdfFiller mobile app to create, edit, and share donation of stock and from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is donation of stock?

Donation of stock refers to the act of transferring ownership of shares from one individual or entity to another without receiving payment in return. This is often done for charitable purposes or as a gift.

Who is required to file donation of stock?

Individuals or organizations that donate stocks valued above a certain threshold, or those who receive stock donations, may be required to file specific tax forms detailing the donation for tax reporting purposes.

How to fill out donation of stock?

To fill out a donation of stock, one must typically complete a stock transfer form from the brokerage holding the stock, including details such as the number of shares, the stock's ticker symbol, and the recipient's information. Additionally, any required tax forms should be filled out accurately.

What is the purpose of donation of stock?

The purpose of donation of stock is to provide financial assistance to charitable organizations, reduce taxable income for the donor, and promote philanthropy by allowing individuals to contribute to causes they care about.

What information must be reported on donation of stock?

The information that must be reported includes the donor's and recipient's names and addresses, the stock's fair market value at the time of the donation, the number of shares donated, and any relevant dates.

Fill out your donation of stock and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donation Of Stock And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.