Get the free cp 575 a

Show details

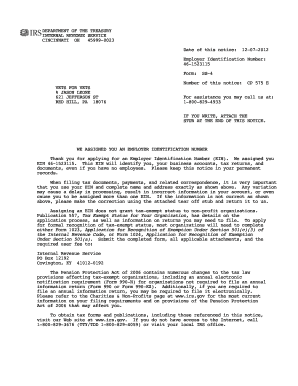

This document notifies the recipient of their assigned Employer Identification Number (EIN) and provides important instructions regarding tax filing and record-keeping.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign florida tax exempt form

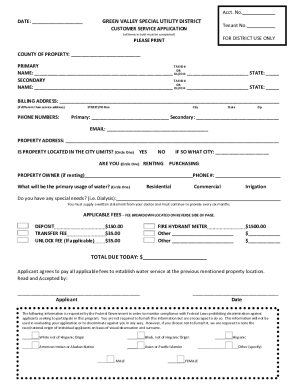

Edit your utility bill generator usa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs change address form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how to fill out a 1099 form online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ein confirmation letter pdf form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs ein letter pdf form

How to fill out cp 575 a

01

Visit the IRS website to download the CP 575 A form.

02

Review the instructions provided on the form carefully.

03

Fill out your business name and address in the designated fields.

04

Provide your Employer Identification Number (EIN) if you have one.

05

Indicate your business entity type (e.g., corporation, partnership, etc.).

06

Enter the date your business became active.

07

List the principal activity of your business.

08

Complete any additional required sections based on your business structure.

09

Review the completed form for accuracy.

10

Submit the form as instructed, either by mail or electronically.

Who needs cp 575 a?

01

Businesses that require an Employer Identification Number (EIN) from the IRS.

02

Newly established businesses forming partnerships, corporations, or other entities.

03

Any entity or organization that needs to report taxes or hire employees.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get my IRS EIN confirmation letter?

Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933. The hours of operation are 7:00 a.m. - 7:00 p.m. local time, Monday through Friday.

How do I download an EIN confirmation letter?

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email.

How do I get an EIN number confirmation letter?

How to Get an EIN Verification Letter From the IRS Call the IRS support at 800-829-4933. Provide the name of your business and other verification details like address and phone number to the support executive. Request the support executive for a 147c letter; placing such a request is free.

What is a confirmation letter from the IRS?

You receive an EIN Confirmation Letter once you have completed the Employer Identification Number (EIN) application on the IRS website. Upon completion, you will have the options for downloading and saving the Tax ID certificate.

Where can I download my EIN confirmation letter?

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email.

Can you print EIN confirmation letter online?

Unfortunately, you cannot get a copy of the IRS EIN confirmation letter online. The IRS will not email or fax the letter, they will send it via mail within eight to ten weeks of issuing your company a Federal Tax ID Number.

How do I print my EIN confirmation letter?

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email.

How do I get my EIN confirmation letter online?

Unfortunately, you cannot get a copy of the IRS EIN confirmation letter online. The IRS will not email or fax the letter, they will send it via mail within eight to ten weeks of issuing your company a Federal Tax ID Number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cp 575 a?

CP 575 A is a notice issued by the IRS confirming the assignment of an Employer Identification Number (EIN) to a business entity.

Who is required to file cp 575 a?

Any business entity that needs an Employer Identification Number (EIN) must file CP 575 A, including sole proprietors, corporations, partnerships, and non-profit organizations.

How to fill out cp 575 a?

To fill out CP 575 A, provide the required information about your business, including your entity type, legal name, trade name, address, and the reason for applying for an EIN. Follow the instructions provided by the IRS carefully.

What is the purpose of cp 575 a?

The purpose of CP 575 A is to notify businesses that their application for an Employer Identification Number (EIN) has been processed and to provide them with their assigned EIN for tax reporting and other purposes.

What information must be reported on cp 575 a?

CP 575 A must report information such as the entity's legal name, trade name, mailing address, type of entity, reason for applying for an EIN, and the EIN itself.

Fill out your cp 575 a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Policy Edit Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.