Get the free MEDICAID COMPLIANT ANNUITY PLANNING INTAKE FORM MARRIED COUPLE

Show details

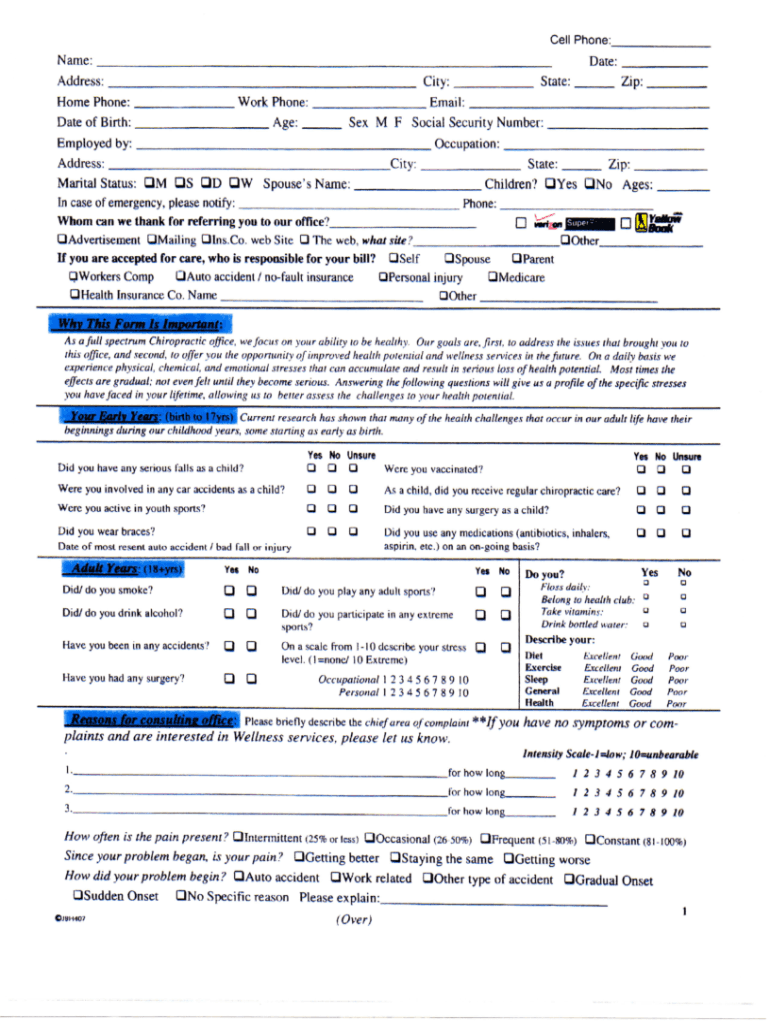

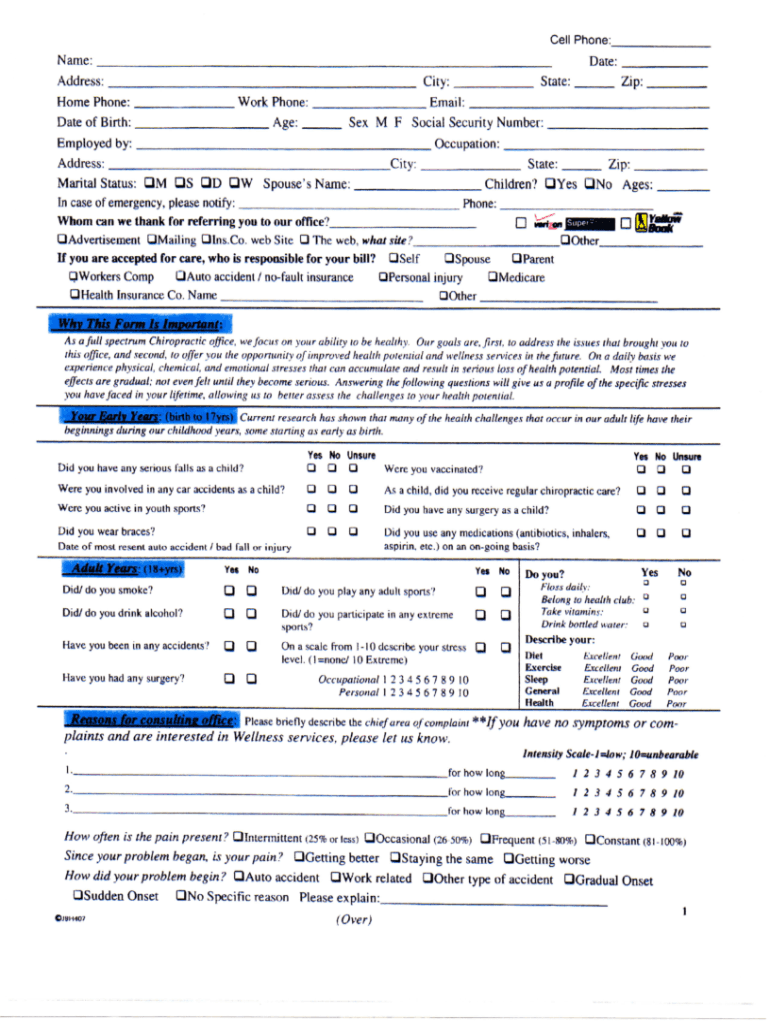

Cell Phone: Date:Name:Email:, Work Phone:Home Phone:. Age:Date of Birth:Zip:State:City:Address:Sex MF Social Security Number: Occupation: Employed by: Address:State:City:Marital Status: Q M O S Q

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign medicaid compliant annuity planning

Edit your medicaid compliant annuity planning form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your medicaid compliant annuity planning form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing medicaid compliant annuity planning online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit medicaid compliant annuity planning. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out medicaid compliant annuity planning

How to fill out medicaid compliant annuity planning

01

To fill out Medicaid compliant annuity planning, follow these steps:

02

Determine if you meet the eligibility requirements for Medicaid. These requirements may vary depending on your state.

03

Gather all the necessary documentation, such as financial statements, income records, and medical records.

04

Consult with a financial advisor or elder law attorney specializing in Medicaid planning to understand the rules and regulations specific to your situation.

05

Calculate your income and assets to determine if you qualify for Medicaid.

06

Consider purchasing a Medicaid compliant annuity if you have excess assets that would disqualify you from Medicaid eligibility.

07

Research and compare different annuity products to find one that meets the Medicaid requirements and aligns with your financial goals.

08

Fill out the necessary paperwork provided by the annuity provider with accurate and up-to-date information.

09

Submit the completed paperwork, along with any required supporting documents, to the annuity provider or your attorney.

10

Continuously review and update your annuity plan to ensure it remains compliant with Medicaid regulations.

11

Seek professional advice and guidance throughout the process to ensure you make informed decisions and comply with all legal requirements.

Who needs medicaid compliant annuity planning?

01

Medicaid compliant annuity planning is generally beneficial for individuals who:

02

- Have excess assets or income that might disqualify them from Medicaid eligibility.

03

- Wish to preserve assets for their beneficiaries while accessing Medicaid benefits for long-term care.

04

- Want to protect their financial security and prevent their assets from being depleted by healthcare costs.

05

- Require long-term care services and need assistance in managing their financial resources.

06

- Must navigate the complex Medicaid rules and regulations to maximize their eligibility and financial protection.

07

- Desire a structured and legally compliant strategy to qualify for Medicaid while ensuring their assets are appropriately managed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify medicaid compliant annuity planning without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including medicaid compliant annuity planning. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make changes in medicaid compliant annuity planning?

With pdfFiller, the editing process is straightforward. Open your medicaid compliant annuity planning in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit medicaid compliant annuity planning on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as medicaid compliant annuity planning. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is medicaid compliant annuity planning?

Medicaid compliant annuity planning refers to the strategy of purchasing an annuity that meets specific legal criteria set by Medicaid to convert resources into an income stream while preserving eligibility for benefits.

Who is required to file medicaid compliant annuity planning?

Individuals seeking Medicaid benefits who have excess assets but want to qualify for coverage, typically elderly or disabled individuals requiring long-term care.

How to fill out medicaid compliant annuity planning?

Filling out Medicaid compliant annuity planning involves completing state-specific forms, providing relevant financial disclosures, and ensuring the annuity terms align with Medicaid regulations.

What is the purpose of medicaid compliant annuity planning?

The purpose is to allow individuals to protect their assets while still qualifying for Medicaid long-term care benefits, ensuring they have income after spending down their savings.

What information must be reported on medicaid compliant annuity planning?

Key information includes the type of annuity, funding sources, payout terms, beneficiary designations, and compliance with state Medicaid requirements.

Fill out your medicaid compliant annuity planning online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Medicaid Compliant Annuity Planning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.