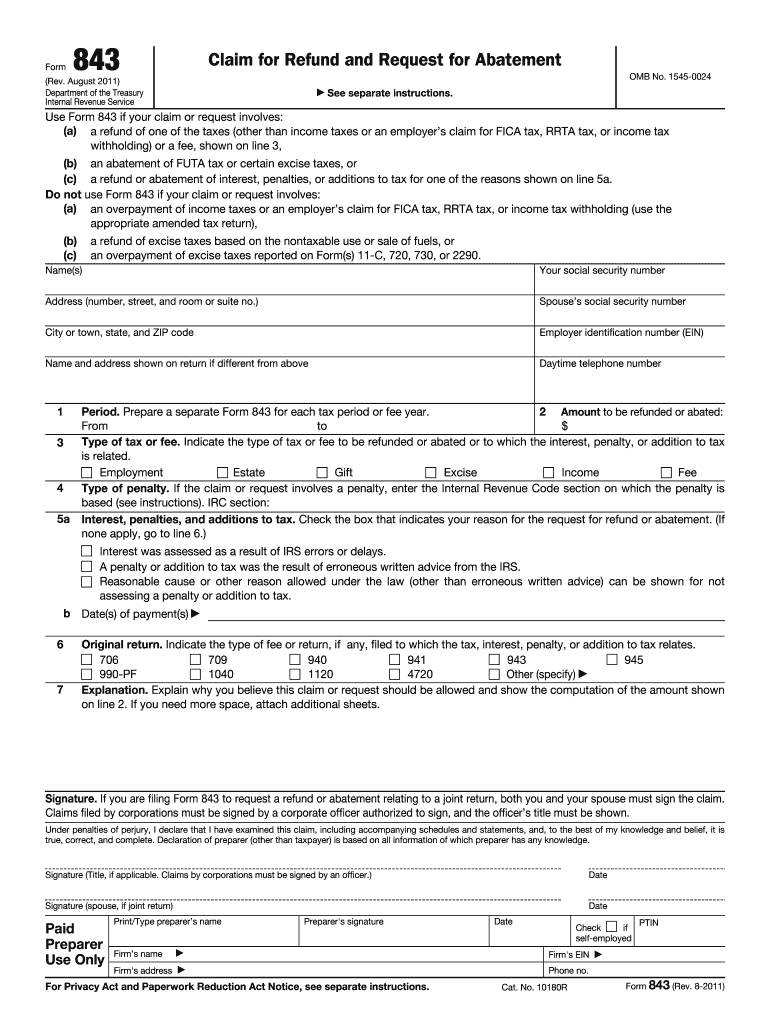

What is the IRS Form 843?

The IRS Form 843 is designed to claim a refund or request a reduction of certain taxes, interest, penalties, fees, and additions to tax. It requires precise specification of all the information needed for refunding, so read the information below attentively.

Who needs Form 843?

Form 843 is an IRS document that should be completed by individuals who believe some of their taxes, penalties, etc., have been overcharged or levied by the Internal Revenue Service in error. Please visit the IRS website or check the Form 843 Instructions in PDF format for more information.

Do other forms accompany the 843 Form?

Suppose a claimant decides to assign preparing the template to their authorized representative. In that case, there is a need to attach Form 2848 (Power of Attorney and Declaration of Representative) to your Form 843 Abatement Request.

If a penalty waiver or surcharge to tax is requested, the IRS filing package must also include:

- A written request for the IRS’s advice

- IRS’s response containing an erroneous advice

- Your report with faulty or excessive tax payments.

When is Form 843 due?

The submission of the 843 IRS Form doesn't have any provisions for its due date; however, it’s advisable to file your Claim for Refund and Request for Abatement as soon as you figure out the extra charge or get a notice from the Internal Revenue Service.

How do I fill out Form 843?

You can efficiently complete Form 843 in PDF format online using our fillable web template. To quickly complete your form with pdfFiller, please follow these steps:

- Click Get Form at the top of this web page

- Fill out all required fields following the tips provided.

- Add the date and your spouse's eSignature (if a joint return).

- Click Done to save the changes.

Now your claim is ready for filing. You can download it to your device, print it for mailing, or share it with your authorized representative if needed.

Keep in mind:

The completed document should clearly state:

- Claimant and their spouse (name and SSN)

- Address

- Tax period

- Amount requested to be refunded

- Identification of a tax/fee and a penalty

- Original return

- Explanation

- Signature and date

Where to mail Form 843

When completed and signed by the preparer, the request should be directed to the IRS office either on their response or to the tax service center where the most recent income tax returns were submitted. More detailed information you can find on page 3 of the IRS Form 843 Instructions.